Is MJ Gleeson plc (LON:GLE) A Smart Choice For Dividend Investors?

Is MJ Gleeson plc (LON:GLE) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

In this case, MJ Gleeson likely looks attractive to dividend investors, given its 4.4% dividend yield and eight-year payment history. It sure looks interesting on these metrics - but there's always more to the story . There are a few simple ways to reduce the risks of buying MJ Gleeson for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on MJ Gleeson!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 56% of MJ Gleeson's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. MJ Gleeson paid out 280% of its free cash flow last year, which we think is concerning if cash flows do not improve. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. While MJ Gleeson's dividends were covered by the company's reported profits, free cash flow is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were MJ Gleeson to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

With a strong net cash balance, MJ Gleeson investors may not have much to worry about in the near term from a dividend perspective.

We update our data on MJ Gleeson every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

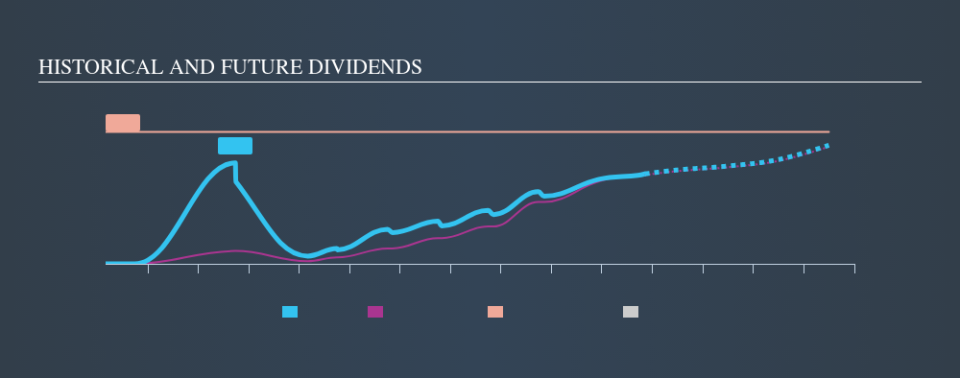

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The first recorded dividend for MJ Gleeson, in the last decade, was eight years ago. It's good to see that MJ Gleeson has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past eight-year period, the first annual payment was UK£0.05 in 2011, compared to UK£0.34 last year. This works out to be a compound annual growth rate (CAGR) of approximately 27% a year over that time. The dividends haven't grown at precisely 27% every year, but this is a useful way to average out the historical rate of growth.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's good to see MJ Gleeson has been growing its earnings per share at 13% a year over the past five years. Earnings per share have been growing rapidly, but given that it is paying out more than half of its earnings as dividends, we wonder how MJ Gleeson will keep funding its growth projects in the future.

Conclusion

To summarise, shareholders should always check that MJ Gleeson's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think MJ Gleeson has an acceptable payout ratio, although its dividend was not well covered by cashflow. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than MJ Gleeson out there.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 5 analysts we track are forecasting for MJ Gleeson for free with public analyst estimates for the company.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance