Moderna (MRNA) Q1 Earnings & Sales Top Estimates, Stock Up 2%

Moderna MRNA reported earnings of 19 cents per share for the first quarter of 2023, beating the Zacks Consensus Estimate and our model estimate of a loss of $1.77 and $2.09, respectively. Earnings declined 98% in the quarter. The year-over-year decline in the bottom line was due to lower revenues and higher operating expenses incurred during the first quarter.

Revenues in the quarter were $1.86 billion, beating the Zacks Consensus Estimate and our estimate of $1.16 billion and $1.05 billion, respectively. Total revenues declined 69% year over year due to lower COVID-19 vaccine sales during the quarter.

Moderna’s shares were up 2.3% in pre-market trading on May 4, likely due to the better-than-expected earnings reported by the company. Investors were expecting the company to report a loss in the first quarter. However, the company’s positive earnings in the quarter took the investor community by surprise. The better-than-expected earnings performance was driven by higher-than expected revenues generated by the company from its COVID-19 vaccine product sales.

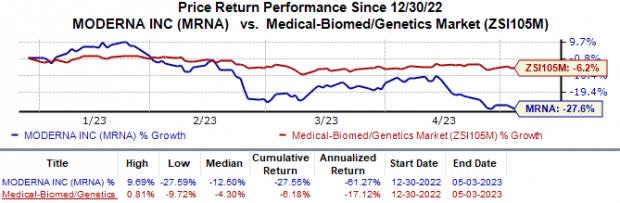

In the year so far, the stock has declined 27.6% compared with the industry’s 6.2% fall.

Image Source: Zacks Investment Research

Quarter in Detail

Product sales, entirely from the sale of COVID-19 vaccines, were down 69% year over year to $1.83 billion due to lower sales volume compared with the year-ago period’s levels. Per management, the figure represents majority of the deferred 2022 revenues worth $2.0 billion, expected in first-half 2023.

Grant and collaboration revenues were $34 million compared with $141 million in the year-ago quarter. The company earns collaboration revenues from agreements with several big pharma/biotech companies, including Merck MRK and Vertex Pharmaceuticals.

Selling, general and administrative expenses were $305 million, up 14% year over year. The upside can be attributed to increased spending in commercialization activities to support the company’s marketed products and expansion.

Research & development expenses were $1.1 billion, up 104% from the year-ago period’s levels. The significant increase was primarily attributable to higher clinical costs and personnel-related expenses.

2023 Guidance

Moderna reiterated its product revenue guidance for 2023. Management expects to record a minimum of around $5.0 billion from COVID vaccine sales in 2023, based on confirmed advance purchase agreements and contract deferrals. Management also reported that this figure does not include product sales in the United States or new contracts with Europe, Japan and other key markets. The company expects to record approximately $2.0 billion in product sales in first-half 2023, indicating product revenues in second-quarter 2023 between $0.2-$0.3 billion.

The company maintained combined R&D and SG&A expenses to be approximately $6.0 billion in 2023, with nearly $4.5 billion in R&D. It expects capital expenditures to be around $1.0 billion.

Pipeline Updates

Moderna has 48 mRNA-based investigational candidates with 36 candidates in clinical development stage. The company has three late-stage candidates — mRNA-1647, mRNA-1345 and mRNA-1010 — in its pipeline, which are being developed as cytomegalovirus (CMV) vaccine, respiratory syncytial virus (RSV) vaccine and influenza vaccine, respectively.

Management is on track to file a regulatory application with the FDA seeking approval for its RSV vaccine candidate, mRNA-1345, before the end of second-quarter 2023. The company also reported that it has completed more than 50% of the enrolment in the pivotal phase III study, evaluating its CMV vaccine candidate mRNA-1647.

Since the onset of 2023, Moderna faced two major setbacks in late-stage clinical studies evaluating its influenza vaccine mRNA-1010. This February, Moderna announced mixed results from a late-stage study (P301), evaluating mRNA-1010 conducted in the Southern Hemisphere. While the vaccine showed promise against the influenza A virus, it did not show any improvement against the influenza B virus. Last month, management provided the first interim analysis from a phase III efficacy study (P302) evaluating mRNA-1010 conducted in the Northern Hemisphere. The P302 study failed to meet the statistical threshold needed to declare early success.

Based on these analyses of data, management announced that it initiated a phase III immunogenicity study (P303) to test an updated formulation of mRNA-1010, which is expected to improved immune responses against influenza B strain. The P303 study will also allow the company to seek accelerated approval for the vaccine.

Last month, Moderna and Merck announced detailed results from the phase IIb KEYNOTE-942 study, evaluating their personalized cancer vaccine (PCV) candidate mRNA-4157 in melanoma patients. The companies revealed that after a follow-up period of around two years, 22.4% of patients treated with mRNA-4157 plus Merck’s blockbuster drug Keytruda reported disease recurrence/death compared with 40% in the control arm. Moderna and Merck are currently discussing these results with regulatory authorities. The companies intend to start a phase III study in melanoma patients later this year and also intend to expand the PCV vaccine to other cancer indications, including non-small cell lung cancer.

Moderna, Inc. Price

Moderna, Inc. price | Moderna, Inc. Quote

Zacks Rank & Stocks to Consider

Moderna currently has a Zacks Rank #3 (Hold). A couple of better-ranked stock in the same sector include Lisata Therapeutics LSTA and Spero Therapeutics SPRO, which sport a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Lisata Therapeutics’ 2023 loss per share estimates have narrowed from $3.81 to $3.58. During the same period, the loss estimates per share for 2024 have improved from $4.01 to $3.12. Shares of Lisata Therapeutics have gained 28.5% in the year-to-date period.

Earnings of Lisata beat estimates in two of the last four quarters, while missing the mark on the other two occasions. On average, the company’s earnings witnessed a negative surprise of 5.63%. In the last reported quarter, Lisata’s earnings beat estimates by 20.83%.

Spero Therapeutics’ stock has risen 4.6% in the year-to-date period. SPRO’s loss estimates for 2023 have narrowed from $1.45 to $1.02 per share in the past 60 days. During the same period, the loss estimates per share for 2024 have improved from $2.45 to 95 cents.

Spero Therapeutics beat earnings estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed an earnings surprise of 56.37%. In the last reported quarter, SPRO delivered an earnings surprise of 237.50%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

Spero Therapeutics, Inc. (SPRO) : Free Stock Analysis Report

Lisata Therapeutics, Inc. (LSTA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance