Molson Coors (TAP) Banks on Revitalization Plan for Growth

Molson Coors Beverage Company TAP is well positioned for top- and bottom-line growth courtesy of its revitalization plan. The impact of the same was seen in the fourth quarter of 2022 wherein both revenues and earnings increased year over year. The company is also benefiting from its commitment toward innovation and premiumization.

Let’s Delve Deeper

Molson Coors is keeping on track with its revitalization plan. The plan is focused on achieving sustainable top- and bottom-line growth by streamlining the organization and reinvesting resources into its brands and capabilities.

The company intends to invest in iconic brands and growth opportunities in the above-premium beer space. It also plans to develop digital competencies for employees, supply-chain-related system capabilities and commercial functions.

In the second quarter of 2022, Molson Coors increased dollar share in the United States for the first time in more than 10 years, achieving its goal of revitalizing the company globally. Coors Light, Miller Lite and Coors Banquet's combined strength led to an increase in the industry share in the United States, which was fueled by better branding and marketing. National champion brands, including Molson Canadian and Carling beer in UK saw sizable market share gains.

Molson Coors, one of the largest brewers in the world, is committed to grow its market shares through innovation and premiumization. The firm has been rapidly expanding its above premium portfolio over the past few years in an effort to accelerate portfolio premiumization.

The company emphasized that it is working to reshape its product portfolio and grow in emerging markets. Sales of its U.S. above-premium portfolio outperformed those of its U.S. economy portfolio due to the hard seltzer category's rapid expansion, Simply Spiked Lemonade's successful launch and the continued strength of Blue Moon and Peroni's.

The company’s fourth-quarter results gained from strength in the core brands, particularly Coors Light and Miller Lite as well as the above premium portfolio and contributions from its Revitalization Plan. In the said period, the company’s bottom line surpassed the Zacks Consensus Estimate, while the top line missed the same. However, both metrics improved year over year.

The company’s adjusted earnings of $1.30 per share surged 61% year over year. Net sales inched up 0.4% to $2,629.5 million. On a constant-currency basis, net sales rose 3.8% due to positive pricing and a favorable sales mix stemming from portfolio premiumization.

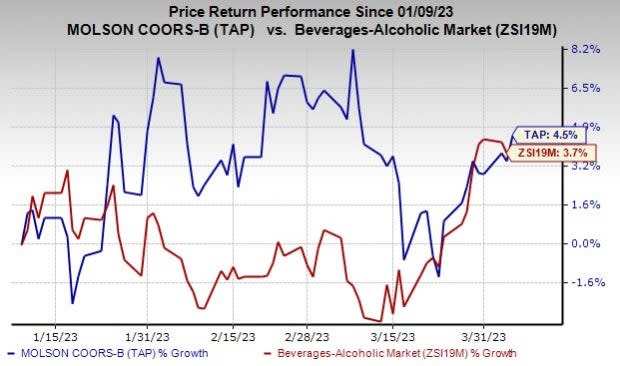

Image Source: Zacks Investment Research

Wrapping Up

Molson Coors continues to experience lower brand and financial volume as well as ongoing inflationary pressures. In addition, sluggishness in the beer industry as a result of pricing actions and inflationary pressures acts as a deterrent. Rising cost of goods is also a concern for the company.

Nonetheless, the benefits mentioned above will most likely assist Molson Coors in overcoming such obstacles.

Shares of this Zacks Rank #3 (Hold) company have rallied 4.5% in the past three months compared with the industry’s growth of 3.7%.

Key Picks

Some better-ranked stocks that investors may consider are Inter Parfums IPAR, General Mills GIS and KimberlyClark KMB.

IPAR has an expected long-term earnings growth rate of 15% and a trailing four-quarter earnings surprise of 36.2%, on average. Inter Parfums currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial year sales and earnings suggests growth of 10.5% and 0.8%, respectively, from the year-ago reported numbers.

General Mills is a major designer, marketer and distributor of premium lifestyle products. It currently carries a Zacks Rank of 2 (Buy). GIS has a trailing four-quarter earnings surprise of 8.1%, on average.

The Zacks Consensus Estimate for General Mills’ current financial year sales and earnings suggests growth of 5.9% and 7.1%, respectively, from the year-ago reported numbers.

KimberlyClark is engaged in the manufacture and marketing of a wide range of consumer products around the world. It currently carries a Zacks Rank of 2. KMB has a trailing four-quarter earnings surprise of 1.4%, on average.

The Zacks Consensus Estimate for KimberlyClark’s current financial year sales and earnings suggests growth of 2% and 5.2%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance