Molson Coors (TAP) to Report Q1 Earnings: What's in Store?

Molson Coors Beverage Company TAP is expected to register top-line growth when it reports first-quarter 2023 earnings on May 2. The Zacks Consensus Estimate for the company’s first-quarter revenues is pegged at $2.23 billion, suggesting 0.7% growth from the prior-year period’s reported figure.

The consensus mark for earnings has moved down by a penny in the past 30 days to 26 cents per share. It suggests decline of 10.3% from the year-ago reported figure.

We expect total revenues to be up 0.4% year over year to $2,652.9 million and the bottom line to decrease 22.7% to 22 cents a share in the first quarter of 2023.

In the last reported quarter, this leading alcohol company delivered a positive earnings surprise of 22.6%. The company recorded an earnings surprise of 20.4%, on average, in the trailing four quarters.

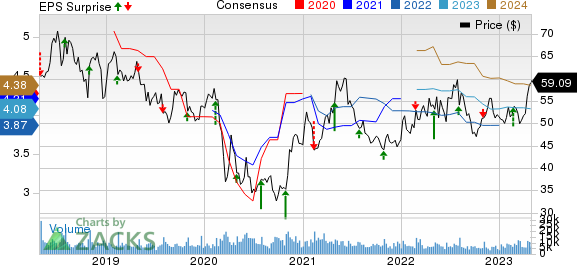

Molson Coors Beverage Company Price, Consensus and EPS Surprise

Molson Coors Beverage Company price-consensus-eps-surprise-chart | Molson Coors Beverage Company Quote

Key Factors to Note

Molson Coors has been benefiting from aggressive pricing actions, a revitalization plan and the premiumization of its global portfolio. Strength in its Coors Light and Miller Lite brands bodes well. The company has been on track with increased investments toward core brands and innovations. These elements are anticipated to have improved Molson Coors' first-quarter performance.

Positive pricing and favorable brand and channel mix, stemming from portfolio premiumization and fewer on-premise channel restrictions, are expected to have aided the company’s first-quarter earnings.

TAP has been witnessing strong market share gains, driven by its innovation and premiumization efforts. In a bid to accelerate portfolio premiumization, it has been aggressively growing its above-premium portfolio in the past few years. The continued strength of the U.S. hard seltzer portfolio, particularly the successful launch of Simply Spiked Lemonade and strength in Blue Moon and Peroni’s, bodes well. This is likely to have boosted sales of the company’s above-premium beer category in the to-be-reported quarter.

The company’s revitalization plan has been aiming to achieve sustainable top-line growth by streamlining the organization and reinvesting resources into its brands and capabilities. As part of this plan, it has been investing in iconic brands and growth opportunities in the above-premium beer space, expanding in adjacencies and beyond beer, and creating digital competencies for commercial functions, supply-chain-related system capabilities and employees. These investments are expected to get reflected in Molson Coors’ first-quarter top line. Also, the company’s cost-saving program has been one of the key growth drivers.

For 2023, management expects net sales growth in the low-single digits in constant currency. Underlying EBIT is likely to increase in the low-single digits in constant currency.

However, management expects higher marketing investments in core brands for 2023 from the year-ago period. Also, inflationary pressures related to higher transportation costs are expected to have led to higher cost of goods sold in the quarter under review. Apart from these, global supply-chain disruptions and higher freight costs are likely to have been concerning.

Molson Coors has been witnessing weakened consumer demand across the beer industry in its Central and Eastern European regions. This is mainly due to soft industry pressure and pricing actions taken. On the last reported quarter’s earnings call, management expected global inflationary pressures to be a headwind. Also, it expected the impacts of the Russia-Ukraine conflict to affect its performance. These factors are likely to affect the company’s bottom line in the first quarter.

Zacks Model

Our proven model predicts an earnings beat for Molson Coors this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Molson Coors has an Earnings ESP of +5.65% and a Zacks Rank #3 at present.

Other Stocks With Favorable Combination

Here are some other companies you may want to consider, as our model shows that the companies have the right combination of elements to deliver an earnings beat.

Post Holdings POST has an Earnings ESP of +2.94% and a Zacks Rank #1 at present. The company is expected to report second-quarter fiscal 2023 results on May 4. The Zacks Consensus Estimate for its quarterly revenues is pegged at $1.6 billion, which suggests growth of 10.5% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ quarterly earnings has inched up 3% in the past 30 days to 68 cents per share, suggesting growth of 183.3% from the year-ago quarter’s reported number. POST has a trailing four-quarter earnings surprise of 34.8%, on average.

The J. M. Smucker Co. SJM currently has an Earnings ESP of +1.78% and a Zacks Rank #2. SJM is likely to register top-line growth when it reports the fourth-quarter fiscal 2023 numbers on Jun 6. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.2 billion, which suggests growth of 7.6% from the figure reported in the prior-year quarter.

However, the Zacks Consensus Estimate for J. M. Smucker's quarterly earnings has moved up 1 cent in the past 30 days to $2.42 per share, suggesting growth of 8.5% from the year-ago quarter’s reported number. SJM has delivered an earnings beat of 16.4%, on average, in the trailing four quarters.

TreeHouse Foods THS has an Earnings ESP of +19.75% and a Zacks Rank #3 at present. The company is slated to report first-quarter 2023 results on May 8. The Zacks Consensus Estimate for its quarterly revenues is pegged at $849.03 million, which suggests a decline of 25.6% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for TreeHouse Foods’ quarterly earnings has moved up 5.4% in the past 30 days at 39 cents per share, suggesting growth of 360% from the year-ago quarter’s reported number. THS has a trailing four-quarter earnings surprise of 48.8%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance