Moncler (BIT:MONC) Seems To Use Debt Rather Sparingly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Moncler S.p.A. (BIT:MONC) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Moncler

What Is Moncler's Debt?

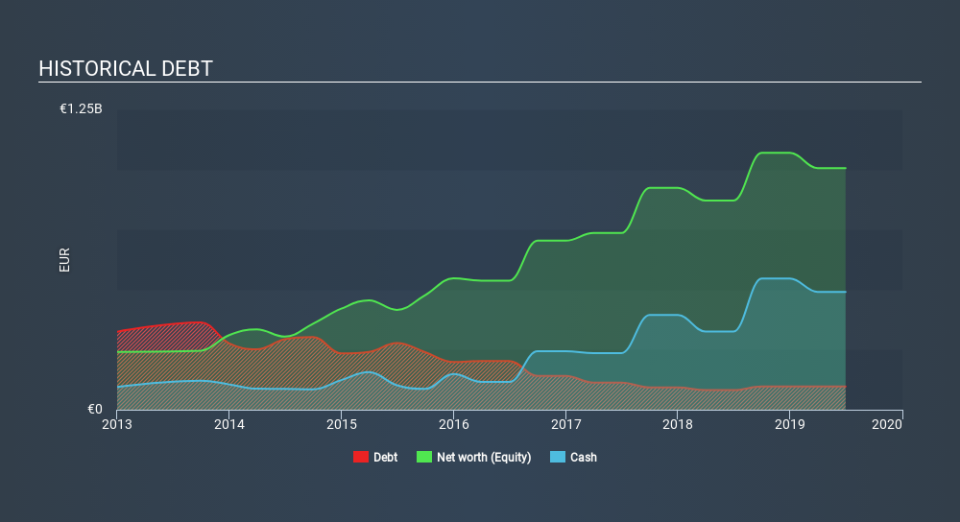

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Moncler had €96.9m of debt, an increase on €81.5m, over one year. However, it does have €490.5m in cash offsetting this, leading to net cash of €393.7m.

How Healthy Is Moncler's Balance Sheet?

We can see from the most recent balance sheet that Moncler had liabilities of €476.1m falling due within a year, and liabilities of €633.6m due beyond that. On the other hand, it had cash of €490.5m and €102.9m worth of receivables due within a year. So its liabilities total €516.4m more than the combination of its cash and short-term receivables.

Of course, Moncler has a titanic market capitalization of €10.2b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Moncler boasts net cash, so it's fair to say it does not have a heavy debt load!

And we also note warmly that Moncler grew its EBIT by 19% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Moncler can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Moncler has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Moncler generated free cash flow amounting to a very robust 85% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Moncler has €393.7m in net cash. And it impressed us with free cash flow of €430m, being 85% of its EBIT. So we don't think Moncler's use of debt is risky. Over time, share prices tend to follow earnings per share, so if you're interested in Moncler, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance