Mondelez (MDLZ) Beats Earnings & Revenue Estimates in Q1

Mondelez International, Inc. MDLZ reported first-quarter 2018 results, with the earnings and revenues beating the consensus mark. The company posted impressive results on the back of strong performance in Asia, Middle East & Africa and Europe. Notably, shares inched up 1.6% in after-hours trading on May 1.

Adjusted earnings of 62 cents per share beat the Zacks Consensus Estimate of 61 cents. Adjusted earnings grew 9.6%, primarily driven by favorability on interest and less number of shares outstanding.

Sales Details

Net revenues increased 5.5 % year over year to $6.77 billion driven by currency tailwinds. Emerging markets’ net revenues rose 7.6%, while Power Brands witnessed 8.2% increase in revenues.

Regionally, Asia, Middle East & Africa and Europe registered an increase of 3.4% and 14.4% in revenues, respectively. However, revenues in the North America and Latin America declined 1.3% and 2.1%, respectively.

Reported total revenues surpassed the Zacks Consensus Estimate of $6.65 billion.

Organic revenues increased 2.4% and were flat year over year. The improvement was primarily driven by Power Brands as well as strong performance in Europe and Asia, Middle East & Africa.

Pricing increased 0.7 percentage points (pp), down from 2.1 pp in the last reported quarter. Volume/Mix had a positive impact of 1.7 pp to the revenues. It was 0.3 pp in the last reported quarter.

Margins

Adjusted gross margin was 39.4%, down 110 basis points (bps) owing to unfavorable mix, higher commodity costs and freight inflation.

However, adjusted operating margin expanded 20 bps year over year to 16.7% on the back of lower selling, general & administrative costs and supply chain productivity savings.

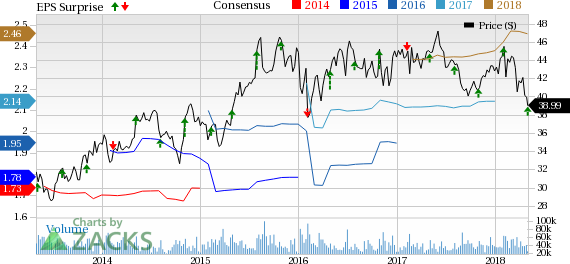

Mondelez International, Inc. Price, Consensus and EPS Surprise

Mondelez International, Inc. Price, Consensus and EPS Surprise | Mondelez International, Inc. Quote

Financials

Mondelez reported cash and cash equivalents of $1,130 million as of Mar 31, 2018, down from $761 million at the end of 2017.

The company repurchased approximately $500 million of its common stock and paid approximately $300 million in cash dividends.

Guidance

Organic net revenues are expected to increase between 1% and 2%. Adjusted operating margin is expected to be 17%.

Management continues to expect adjusted earnings to grow by double-digit on a constant-currency basis.

The company now expects currency translation to boost net revenues by approximately 2% (from previous estimate of 4%) and adjusted EPS by approximately 6 cents (from prior projection of 12.3 cents).

The company continues to expect Free Cash Flow of approximately $2.8 billion.

Zacks Rank

Mondelez has a Zacks Rank #4 (Sell).

Upcoming Peer Releases

Monster Beverage Corp. MNST, B&G Foods, Inc. BGS and Kellogg Company K are expected to report quarterly results on May 3.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

B&G Foods, Inc. (BGS) : Free Stock Analysis Report

Kellogg Company (K) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance