Money Makeover: ‘I’m 63 – is £370k enough to retire on?’

Steve Mack, 63, is hoping to retire in three years’ time but is unsure how long his current savings will last if he does.

Based in Brighton, he is a foreman for a construction company that works on football stadiums, such as Manchester United’s ground, Old Trafford. He earns around £66,000 a year. “I’ve got a small workplace pension but only started paying in a few years ago so most of my income will come from my investments,” Mr Mack said.

He has £164,142 in a stocks and shares Isa and £5,838 in a fund and share account. He also has a self-invested personal pension, currently worth £66,657, into which he adds £1,000 each month.

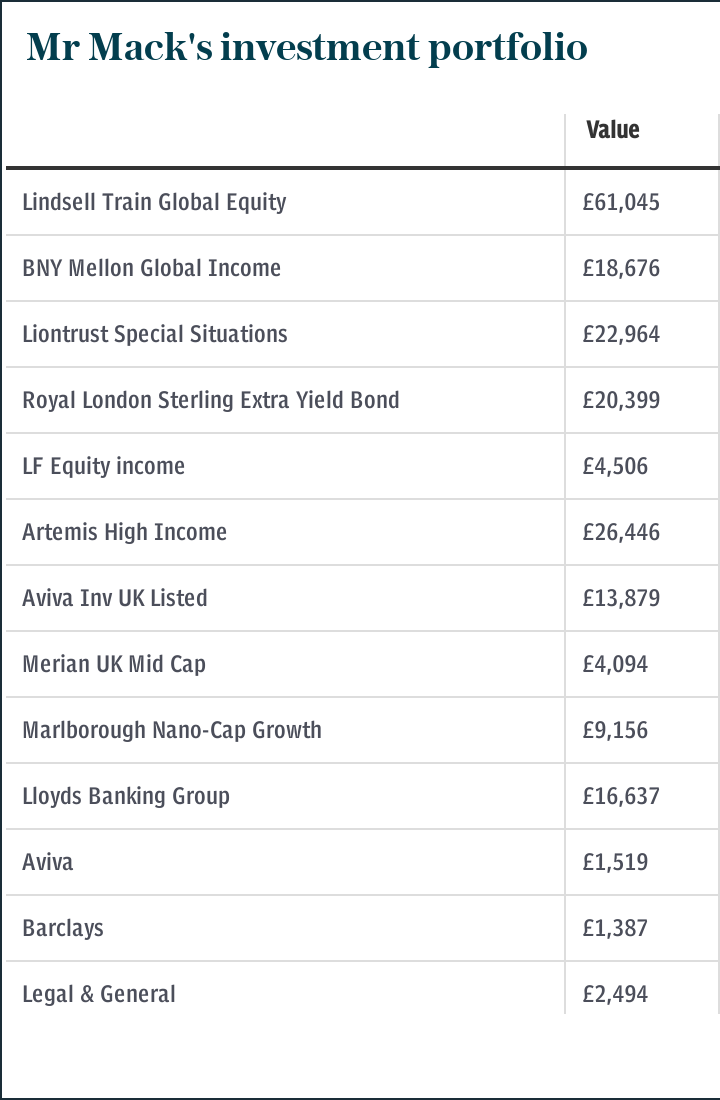

These are all held with Hargreaves Lansdown, a broker, in a mix of funds and individual stocks. His largest fund holdings are £61,045 in Lindsell Train Global Equity, £26,446 in Artemis High Income, £22,964 in Liontrust Special Situations and £20,399 in Royal London Sterling Extra Yield Bond.

He owns seven other funds, including Jupiter Asian Income, Merian UK Mid Cap, Marlborough Nano-Cap Growth and LF Equity Income, which used to be run by disgraced manager Neil Woodford.

“During the market dip this spring I bought some shares in companies that were hit particularly hard, expecting they’d bounce back. Actually they’ve gone on to fall even further,” Mr Mack said. He now has £16,638 in Lloyds shares, £1,519 in Aviva, £1,387 in Barclays and £2,494 in Legal & General.

He has paid off the mortgage on his £425,000 home and has about £93,000 in cash and £41,000 in NS&I Premium Bonds. “I’m not a big spender and live off around £400 a month. I don’t expect that to change much in retirement,” Mr Mack said. “Anything left over once I pass away will go to my son.”

Keir Ashman, financial planner at Bancroft Wealth:

Mr Mack has a low requirement for retirement income, which would be met by his state pension alone – assuming he has a full National Insurance record. He can check this at Gov.uk.

In total, he has £236,637 in investments and £134,000 in savings, which would only be required if he chose to splash out, for example on holidays, or if he needed to pay for care.

However, his portfolio is not well diversified. He has too much invested in British stocks and very little exposure to America, Japan, Europe, Asia and emerging markets. He could consider investing in a global exchange-traded fund – these are passive funds which track an index in a cost-effective manner. The iShares Core MSCI World ETF has global exposure and ongoing charges of just 0.2pc.

He also has very limited exposure to bonds. He is invested in a British bond fund, so should consider a global one. Marlborough Global Bond is a good one-stop shop for cautious investors. It holds almost 500 different bonds around the world and aims to make gains when markets rise while protecting investors’ money when they drop.

The portfolio would benefit from regular reviews. For example, the former Neil Woodford fund Mr Mack holds had been removed from most actively managed portfolios before it was suspended.

The shares Mr Mack bought early on in the pandemic have fallen in value. He should stick to funds, which provide far greater diversification, unless he is confident in his own stock picking abilities and has the time to invest in research.

Whether he should sell the shares now and move the money into funds is a difficult call. The domestically-focused companies he holds are likely to perform well once Britain emerges from recession and has left the European Union – but this could take a while.

Mr Mack should also consider moving his investments to a new broker. Hargreaves Lansdown is relatively expensive, with an annual management charge of 0.45pc on up to £250,000, and a cost of around £12 on each share purchase or sale. Interactive Investor has an annual flat fee of £120 for a Sipp and customers get one free trade per month.

Assuming he traded once a month, Mr Mack could save almost £1,000 a year by switching.

Rob Burgeman, investment manager at Brewin Dolphin:

Mr Mack looks well on track to meet his goals. However, having £61,000 invested in one fund – more than a third of his “non-pension” investments – is too great a concentration of risk.

He should try to buy direct exposure to American stocks. The Baillie Gifford American Growth Fund invests in companies such as Amazon and Tesla which are transforming the world we live in as well as some of the newer disruptors such as Shopify.

This could be mixed with some passive funds, such as the Vanguard S&P 500 index ETF which charges just 0.07pc. Mr Mack should also consider the Invesco Nasdaq 100 ETF which tracks the Nasdaq index, which is more focused on technology and healthcare stocks. It is a little more expensive at 0.3pc. The Fidelity US Quality Income ETF would be a good choice if he is set on getting an income.

A similar process could be followed across the major geographical regions. Given his age, it is important not simply to buy income funds. He could be investing for another 20 years or more. With that in mind, he would be sensible to diversify away from the Artemis High Income Fund and the Jupiter Asian Income Fund in favour of some that aim to grow his money.

Mr Mack should also consider investing in other asset classes such as property and gold, which can provide protection when stock markets fall. The Schroder Global Cities Fund or 3i Infrastructure, a London-listed fund investing in bridges, tunnels, ports and utilities, would be sensible options.

He should check how much his current funds overlap. Often buying four different British income funds can simply give you the same basic portfolio four times over. Look at the underlying holdings and management style to find funds that are different but complement one another.

As for his shares, both banks and insurance companies will struggle in the current economic climate. He could wait and hope prices recover or move his money out of the shares and invest it somewhere that may offer better returns. Personally, I would favour the latter.

Reader Service: Get a free and impartial recommendation on whether you can improve your pensions. Capital at risk.

Yahoo Finance

Yahoo Finance