'Money has started to flow back into Britain - the Brexit deal is unequivocally positive'

Last year was tough for investors in British stocks as successive lockdowns and Brexit uncertainty wreaked havoc on the economy. But many are now cautiously optimistic that the vaccine rollout, coupled with a Brexit deal, may breathe new life into both the economy and their portfolios.

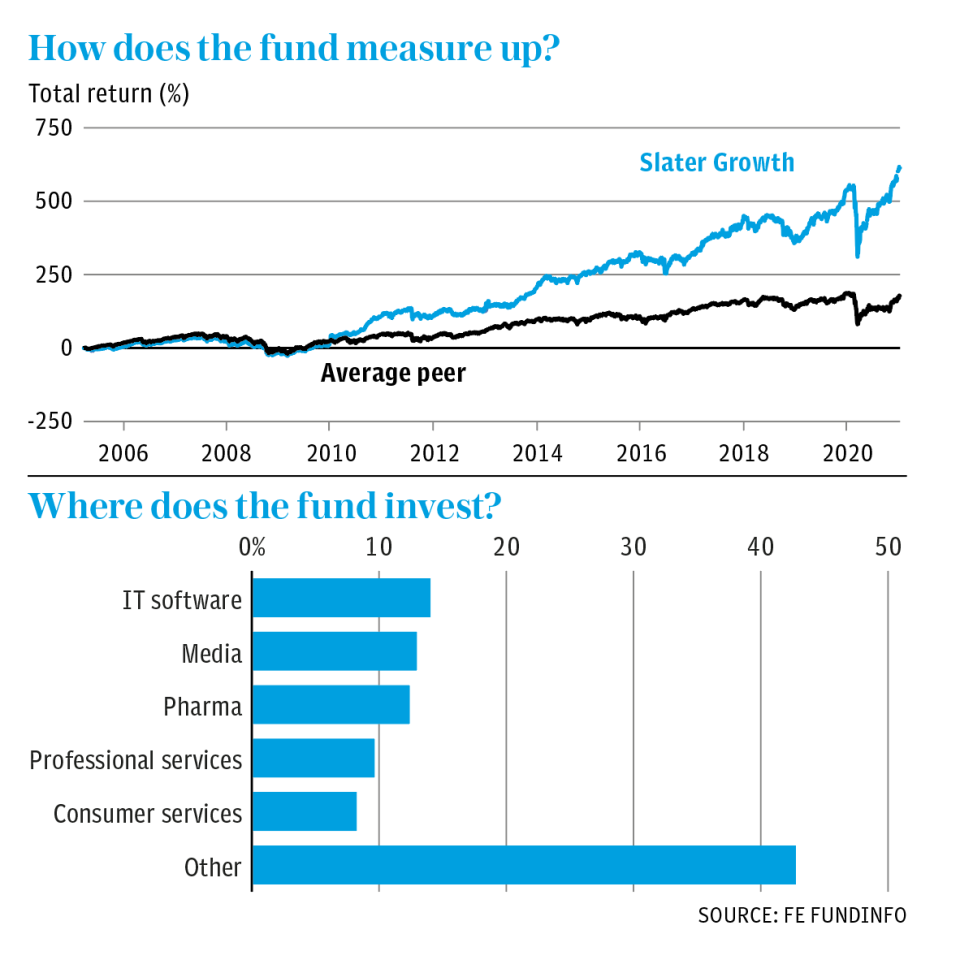

Mark Slater, who manages the £827m Slater Growth fund, is one of those investors. He tells Telegraph Money that a rise in mergers and acquisitions makes him optimistic for the year ahead and that he believes now is the right time to back British stocks.

Who is the fund for?

The fund is aimed at anyone who is interested in capital growth. “Growth” means different things to different people in the same way that “value” does.

In my view, it doesn’t mean chasing stocks that have momentum behind them – we have no interest in that. Our focus is on dynamic growth businesses, but we also apply aggressive value filters.

How do you pick stocks?

We screen the whole of the UK stock market, including the Alternative Investment Market, to look for businesses that are growing their earnings at double-digit rates and that we can buy cheaply.

We’re also on the lookout for companies that generate cash as well as accounting profits. After doing this, we’re left with a relatively manageable shortlist of businesses to work with. Our work from then on is trying to understand the degree to which their growth is sustainable and reliable. A lot of that work is subjective.

How will the Brexit deal affect your strategy?

I think it’s positive. For the past few years the British market has been deeply out of favour. You can see that in the fund flow data – a lot of money has left the UK, from both international and domestic investors.

Initially that was because of concerns over Brexit, then from 2017 onwards it was due to fears over the risks of a Marxist government. Both of those risks have now been dealt with.

Money started to flow back into Britain last year and that will continue and probably accelerate. So it’s unequivocally positive. The other place we see it is in mergers and acquisitions. I think the UK is on sale – a lot of these buyers are from overseas. We’re going to see a lot of activity in the UK market because it’s been left behind.

What does the Covid vaccine mean for your stocks?

It’s good news. Last year roughly half of our investments weren’t really affected by Covid, while one or two even benefited. Of the half that were hit, maybe a quarter were severely affected – for example, businesses that were shut down by the Government.

Those kinds of business will benefit massively from the vaccine. Even with new strains of the virus, most investors are taking the view that life will go back to some form of normality relatively soon, whether that be in three months’ or six months’ time. People are clearly looking ahead rather than panicking.

Are there any sectors you try to avoid?

We’re happy to look across the board. We occasionally get surprises in sectors that we hadn’t previously considered and we’ll look with an open mind.

What’s been your best investment?

A company called Hutchison China MediTech, which is quoted on Aim and is up about 25 times on what we paid for it in 2010.

And your worst?

A peat supply business called William Sinclair, which went to zero some years back. It was a small holding.

Do you have your own money invested in the fund?

Yes I do. I’m a very substantial investor in all of our funds.

How are you paid?

I’m paid a salary and a bonus, plus dividends from the business.

What would you have done if you weren’t a fund manager?

Before I became a fund manager I was a financial journalist for about two years, which I enjoyed. I’d always been interested in finance and it was brilliant training – you got to meet four or five companies every day, you had to cover their results and you got to write tips each week.

It was a very good immersion into the UK market. I’ve always liked the financial world, so I’m sure I would have done something that would have touched on it in some way or another.

Yahoo Finance

Yahoo Finance