MoneyGram (MGI) Down 3.1% Since Q1 Earnings & Sales Miss

Shares of MoneyGram International, Inc. MGI have slipped 3.1% since it reported weaker-than-expected first-quarter 2022 results on May 6, 2022. A strengthening dollar value against the Euro and Pound Sterling hurt MGI’s results. The negatives were partially offset by a decrease in operating expenses while MGI’s strong digital business performance increased its cross-border transactions and fees.

Let’s delve deeper into the March-quarter results.

MoneyGram reported first-quarter 2022 adjusted earnings per share of 9 cents, which missed the Zacks Consensus Estimate of 11 cents. However, the bottom line rebounded from the year-ago loss of 6 cents per share.

Revenues of $307.6 million were down from $310.1 million a year ago and missed the Zacks Consensus Estimate of $316 million.

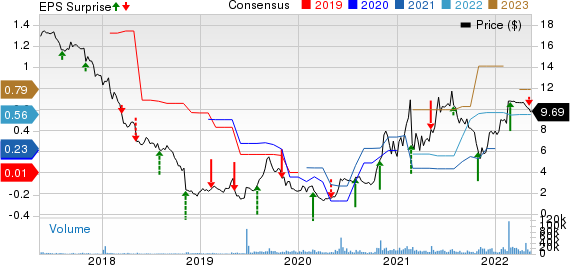

MoneyGram International Inc. Price, Consensus and EPS Surprise

MoneyGram International Inc. price-consensus-eps-surprise-chart | MoneyGram International Inc. Quote

Quarterly Operational Update

Total operating expenses of $128.3 million decreased from $136.4 million a year ago, primarily due to lower compensation and benefits plus occupancy, equipment and supplies costs. Interest expense dropped to $10.9 million in the first quarter from $22.3 million in the year-ago period.

Adjusted EBITDA of $49 million fell from $49.9 million a year ago due to strengthening dollar value against the Euro and Pound Sterling. Adjusted EBITDA margin contracted 20 basis points (bps) year over year to 15.9%.

Segments in Detail

Global Funds Transfer

Total revenues logged $293.6 million, decreasing from $296.2 million a year ago due to lower money transfer and bill-payment revenues caused by strengthening dollar value.

The Money Transfer business of MoneyGram continued to perform well in the quarter, attributable to a 22% year-over-year surge in cross-border transactions of MoneyGram Online (MGO). Cross-border customer growth jumped 19% from the year-ago period’s level.

In the first quarter, digital transactions rose 33% year over year. Digital transactions now constitute 40% of MoneyGram’s money transfer operations. Digital revenues climbed 36% year over year, attaining a record figure of $83 million. The segment reported a gross profit of $132.6 million for the first quarter, up from $131.1 million a year ago.

Financial Paper Products

Total revenues increased to $14 million from $13.9 million a year ago. While money order revenues of $10.5 million inched up from $10.4 million a year ago, official check revenues were flat year over year. The segment reported a gross profit of $13.6 million for the first quarter, down from $13.7 million a year ago.

Financial Position (as of Mar 31, 2022)

Cash and cash equivalents were $103.7 million, down from $155.2 million at 2021 end. MGI’s payment service obligations as of Mar 31, 2022, were $3,587.4 million, sequentially down from $3,591.4 million. Net debt was recorded at $786 million, down from the 2021-end level of $786.7 million.

MGI generated an adjusted free cash flow of $4.1 million in the first quarter, which plunged from $16.5 million a year ago.

Capital expenditures were $10.3 million, reflecting a decrease of $0.9 million from the first-quarter 2021 level.

Acquisition Update

MoneyGram is expected to be acquired by Chicago-based private equity firm Madison Dearborn Partners, LLC for $1.8 billion. The deal is likely to close in the December quarter of 2022.

Zacks Rank & Key Picks

MoneyGram currently has a Zacks Rank #3 (Hold). Some better-ranked players in the Finance space are Alerus Financial Corporation ALRS, Burford Capital Limited BUR and Columbia Financial, Inc. CLBK, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Based in Grand Forks, ND, Alerus Financial’s bottom line for 2022 is pegged at $2.48 per share. The stock has witnessed three upward estimates in the past 30 days and no movement in the opposite direction. ALRS beat on earnings in each of the last four quarters, the average being26.8%.

Burford Capital, based in Saint Peter Port, Guernsey, is expected to witness a 372.7% increase in bottom line this year. The earnings estimate has been stable over the past month. Further, BUR’s revenues are expected to increase 19.9% from the year-ago reported figure to $428 million.

Headquartered in Fair Lawn, NJ, Columbia Financial has witnessed one northbound earnings estimate revision against none in the southward direction. The consensus estimate for CLBK’s top line indicates a 7.7% increase this year from the prior-year reported number. CLBK beat on earnings in three of the last four quarters and missed on the metric just once, with an average surprise of 12.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MoneyGram International Inc. (MGI) : Free Stock Analysis Report

Burford Capital Limited (BUR) : Free Stock Analysis Report

Columbia Financial (CLBK) : Free Stock Analysis Report

Alerus Financial (ALRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance