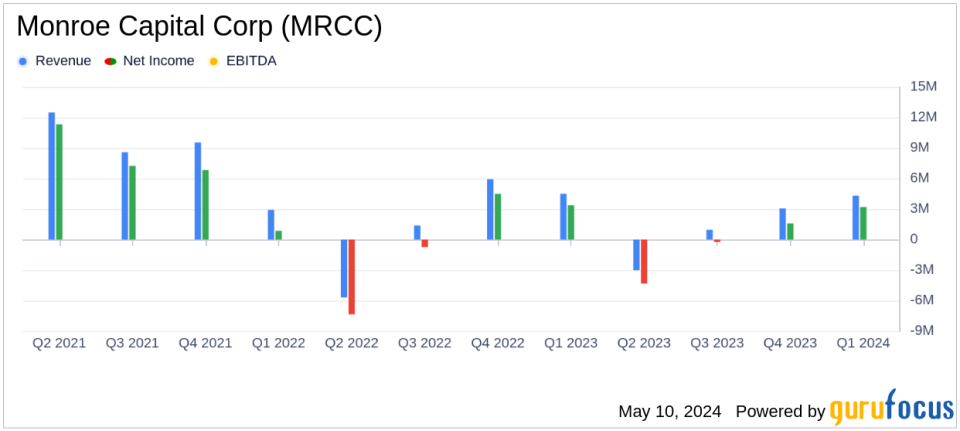

Monroe Capital Corp (MRCC) Q1 2024 Earnings: Aligns with Analyst EPS Projections

Net Investment Income: Reported at $5.5 million or $0.25 per share, meeting the estimated earnings per share of $0.25.

Revenue: Totalled $15.2 million for the quarter, slightly below the estimated revenue of $15.21 million.

Net Asset Value (NAV): Decreased slightly to $201.5 million, or $9.30 per share, from $203.7 million or $9.40 per share in the previous quarter.

Quarterly Dividend: Maintained at $0.25 per share, with an annual cash dividend yield to shareholders of approximately 13.8%.

Portfolio Expansion: Increased the fair value of investments to $500.9 million from $488.4 million, reflecting growth in the portfolio.

Leverage Ratio: Debt-to-equity ratio rose to 1.60 times from 1.49 times, indicating higher leverage as of the end of the quarter.

Investment Performance: Net increase in net assets resulting from operations stood at $3.2 million or $0.15 per share, showing improvement from the previous quarter's $1.6 million or $0.07 per share.

On May 8, 2024, Monroe Capital Corp (NASDAQ:MRCC) disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The specialty finance company, known for its financing solutions to lower middle-market companies in the U.S. and Canada, reported a net investment income of $5.5 million, or $0.25 per share, perfectly aligning with analyst expectations of $0.25 earnings per share.

Financial Highlights and Performance Analysis

The reported net investment income matches the estimated earnings per share, showcasing a stable financial performance amidst fluctuating market conditions. Monroe Capital also declared a net increase in net assets resulting from operations at $3.2 million, or $0.15 per share, and maintained a consistent quarterly dividend of $0.25 per share. The company's net asset value (NAV) per share saw a slight decrease from $9.40 to $9.30.

CEO Theodore L. Koenig highlighted the coverage of the dividend for the 16th consecutive quarter and emphasized the company's strategic focus on credit quality and leveraging market dynamics to enhance returns. This approach reflects Monroe's commitment to maintaining robust financial health and delivering shareholder value.

Portfolio and Operational Metrics

Monroe Capital's investment portfolio experienced a modest growth, with the total fair value of investments increasing to $500.9 million from $488.4 million in the previous quarter. The portfolio primarily comprises first lien loans, which account for 81.9% of the total portfolio. Despite a slight uptick in investments on non-accrual status, from 1.5% to 2.1%, the overall portfolio performance remains strong, supported by a weighted average yield of 11.9%.

The company's leverage ratio increased slightly, with debt-to-equity rising from 1.49 to 1.60 times, driven by new investment purchases and additional borrowings. This strategic use of leverage is a critical aspect of Monroe's financial structure, aimed at optimizing returns on equity.

Liquidity and Outlook

As of March 31, 2024, Monroe Capital reported having $4.9 million in cash and cash equivalents. The company's liquidity position is further supported by $63.3 million available for additional borrowings under its revolving credit facility, ensuring ample flexibility to manage operations and pursue growth opportunities.

The company's joint venture, MRCC Senior Loan Fund, continues to perform well, contributing dividend income and maintaining a stable valuation. This partnership underscores Monroe's strategic approach to diversify income sources and enhance its investment portfolio's resilience.

Strategic Initiatives and Market Position

Monroe Capital remains focused on maintaining a strong market position by capitalizing on its expertise in direct lending and private credit investments. The company's strategic initiatives are geared towards sustaining high credit quality and optimizing its investment portfolio to deliver consistent returns to shareholders.

As Monroe Capital continues to navigate the complexities of the financial markets, its alignment with analyst expectations in Q1 2024 and strategic focus on credit quality and portfolio optimization position it well for sustained growth and profitability.

Conclusion

Monroe Capital Corp's Q1 2024 results demonstrate a robust financial position and strategic resilience. The company's consistent performance, aligned with analyst projections, and strategic focus on high-quality credit investments provide a solid foundation for future growth and continued shareholder value creation.

For further details on Monroe Capital Corp's financial results, including the upcoming webcast and conference call on May 9, 2024, please visit the Investor Relations section of the company's website.

Explore the complete 8-K earnings release (here) from Monroe Capital Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance