Monster Beverage Corp (MNST) Q1 2024 Earnings: Aligns with EPS Projections Amidst Robust Sales ...

Net Sales: Reached $1.90 billion, up 11.8% year-over-year, slightly below the estimate of $1.901 billion.

Net Income: Increased 11.2% to $442.0 million, falling short of the estimated $451.27 million.

Earnings Per Share (EPS): Reported at $0.42, below the estimated $0.43.

Gross Profit Margin: Improved to 54.1% from 52.8% in the previous year.

Operating Expenses: Rose to $485.1 million, representing 25.5% of net sales, up from 24.3% last year.

International Sales: Grew by 19.5% to $744.1 million, comprising 39% of total net sales.

Stock Repurchase: Announced intent to commence a tender offer to repurchase up to $3.0 billion of common stock.

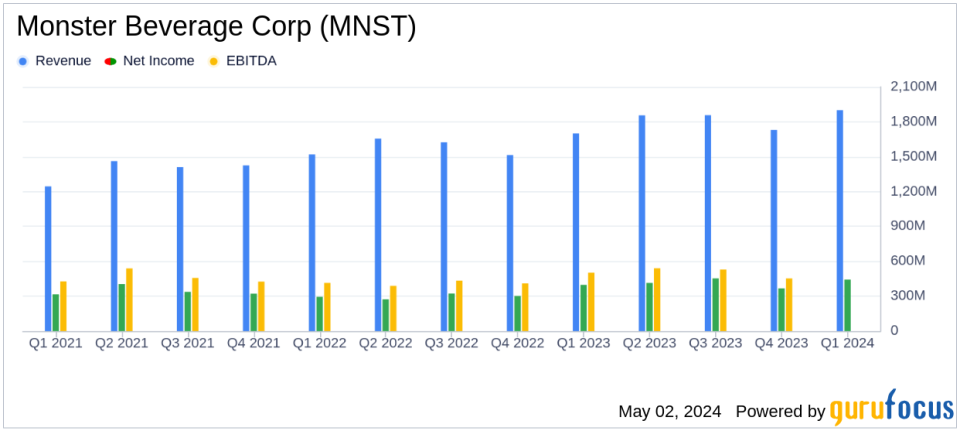

On May 2, 2024, Monster Beverage Corp (NASDAQ:MNST) announced its financial results for the first quarter ended March 31, 2024, revealing a performance that aligns closely with analyst expectations for earnings per share while showcasing significant revenue growth. The detailed earnings report can be accessed through the company's 8-K filing.

Financial Performance Overview

Monster Beverage Corp reported a notable increase in net sales, which rose by 11.8% to $1.90 billion from $1.70 billion in the comparable period last year. This growth exceeds the estimated revenue of $1901.39 million slightly. The net income for the quarter was $442.0 million, an 11.2% increase year-over-year, although it slightly missed the estimated net income of $451.27 million. Earnings per share for the quarter were $0.42, aligning with the estimated earnings per share of $0.43.

The company's gross profit margin improved to 54.1% from 52.8% in the previous year, primarily due to decreased freight-in costs, pricing actions in certain markets, and lower input costs. However, operating expenses as a percentage of net sales increased to 25.5% from 24.3% due to higher distribution, selling, and general administrative expenses.

Segment Performance and Strategic Initiatives

Monster Energy Drinks segment, the company's largest, grew by 10.7% to $1.73 billion. The Strategic Brands segment saw a remarkable increase of 25.6% to $108.4 million, and the Alcohol Brands segment grew by 21.1% to $56.1 million. Sales outside the United States increased by 19.5%, representing 39% of total net sales, up from 37% in the previous year.

Monster Beverage continues to innovate, launching new products like Monster Energy Ultra Fantasy Ruby Red and expanding the distribution of The Beast Unleashed. The company also announced its intention to commence a tender offer to repurchase up to $3.0 billion of its common stock, highlighting confidence in its financial health and future prospects.

Market Position and Future Outlook

As a leader in the energy drink market, Monster Beverage's strategic relationships, such as its extensive commercial arrangements with The Coca-Cola Company, and its continual product innovation play crucial roles in its sustained growth. The company's ability to adapt to market demands and expand its product portfolio across various segments supports its competitive edge in the rapidly evolving beverage industry.

Looking ahead, Monster Beverage's management remains focused on expanding its market share and enhancing shareholder value through strategic initiatives and effective capital allocation. The planned stock repurchase program and ongoing product and market expansion efforts are expected to continue driving growth and profitability.

Investor and Analyst Perspectives

During the investor conference call, Co-CEOs highlighted the impact of unfavorable foreign exchange rates and expressed optimism about the company's robust innovation pipeline. Analysts are likely to focus on the company's strategies for managing operational costs and its ability to maintain profit margins in the face of potential economic fluctuations and competitive pressures.

Overall, Monster Beverage Corp's first quarter of 2024 reflects a solid performance with strategic expansions and improved profitability metrics that align with market expectations, positioning the company well for sustained growth in the competitive non-alcoholic beverage market.

Explore the complete 8-K earnings release (here) from Monster Beverage Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance