Monster Beverage Hits the Brakes

During the 2000s, Monster Beverage (NASDAQ: MNST) took a huge bite out of the beverage industry establishment. Starting from humble beginnings with its former name of Hansen's Natural, Monster initially specialized in natural sodas that offered higher-quality ingredients than higher-profile competition. Yet the advent of energy drinks transformed Monster's business. Now, as consumer preferences continue to shift, Monster has had to plot a course to keep up with changing times.

Coming into Wednesday's fourth-quarter financial report, Monster Beverage investors wanted to see solid gains in sales and earnings. Monster's results were mixed, but a substantial deceleration in sales growth came as somewhat of a shock to shareholders hoping for a better finish to 2017. Let's take a closer look at Monster Beverage and what its most recent numbers say about what's coming down the road.

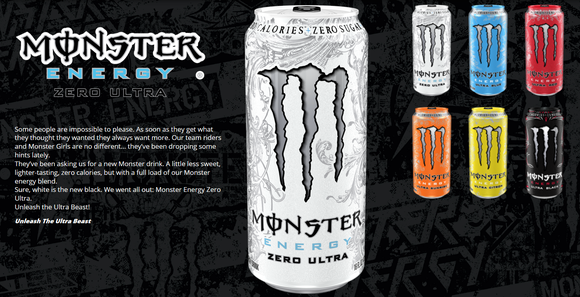

Image source: Monster Beverage.

Monster Beverage needs a pick-me-up

Monster Beverage's fourth-quarter results didn't sustain positive momentum that the company generated last quarter. Net sales were up just 7.5% to $810.4 million, falling well short of the consensus forecast among those following the stock for $843 million on the top line. Net income rose 16% to $201.3 million, but earnings of $0.35 per share fell short of the $0.37 per share that most investors were looking to see.

Tax reform didn't have a huge impact on Monster's numbers. The company posted a $39.8 million charge due to revaluation of deferred tax assets, and mandatory repatriation of overseas earnings cost the company a minimal $2.1 million.

Growth was relatively uniform across Monster's business. The Monster Energy drinks segment had a 7.6% growth rate, while the energy drink brands that Monster acquired from Coca-Cola (NYSE: KO) as part of their exchange of energy and non-energy products saw sales rise 7.8%. Only the American Fruits & Flavors business struggled, and even it managed to keep revenue flat year over year. Domestic business weighed on Monster's overall results, but growth internationally was stronger. The drink company reported a nearly 9% rise in sales to customers outside the U.S. market. Overall, Monster sold more than 86.5 million cases, up 11%, but per-case sales figures fell $0.30 to $9.31 per case.

What saved Monster's bottom line was strong cost discipline. Operating expenses were down 4%, largely because the company didn't have recurring charges related to terminating distribution agreements. After adjusting for those items, overhead expenses were slightly higher as a percentage of sales from the previous year, but favorable tax treatment helped boost Monster's earnings.

Can Monster Beverage get its growth back?

CEO Rodney Sacks once again focused on operations. "Our strategic alignment with Coca-Cola system bottlers continues to progress," Sacks said, and the CEO pointed to new releases of Monster products in several countries that haven't seen them before.

Further product launches are already taking place. In 2018, Sacks expects to make Monster Energy available in areas like Argentina and Belarus, while relaunching the brand in India. Meanwhile, the U.S. market should see an energy coffee product as well as a protein-infused beverage labeled Muscle Monster.

Yet the big question is whether Monster can produce more growth from its new product launches. Greater penetration into overseas markets is fine, and trying to capture new niches domestically is also a smart strategic move. But in the end, investors seem to be coming to terms with the fact that Monster can't grow at a lightning-fast rate indefinitely.

Monster Beverage shareholders seemed to focus on the short-term missed expectations in its fourth-quarter results, and the stock sank 6% in after-hours trading following the announcement. To get back its momentum, Monster will need to accelerate its growth, drawing success from strategic initiatives and new product launches to get back the energy it had throughout the 2000s.

More From The Motley Fool

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Monster Beverage. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance