Monzo heads to £3 billion valuation, despite losses

MONZO is in talks with shareholders to raise another £300 million to fund expansion plans.

The digital based lender, founded in 2015, is one of the best known of the new breed of “challenger” bank, aimed at shaking-up the sector.

According to Sky News, the fund raiser would value the business at £3 billion, a fairly extraordinary price for a business that lost £130 million in the year to February. That came atop £114 million of losses the year before. It aims to make a profit next year. The fundraising was first reported by Business Insider. A spokesperson for Monzo declined to comment.

Monzo was last valued at £1.1 billion when it raised cash from investors earlier this year.

Monzo claims it is “banking made easy”. Customer numbers, it says, are up 23% to five million.

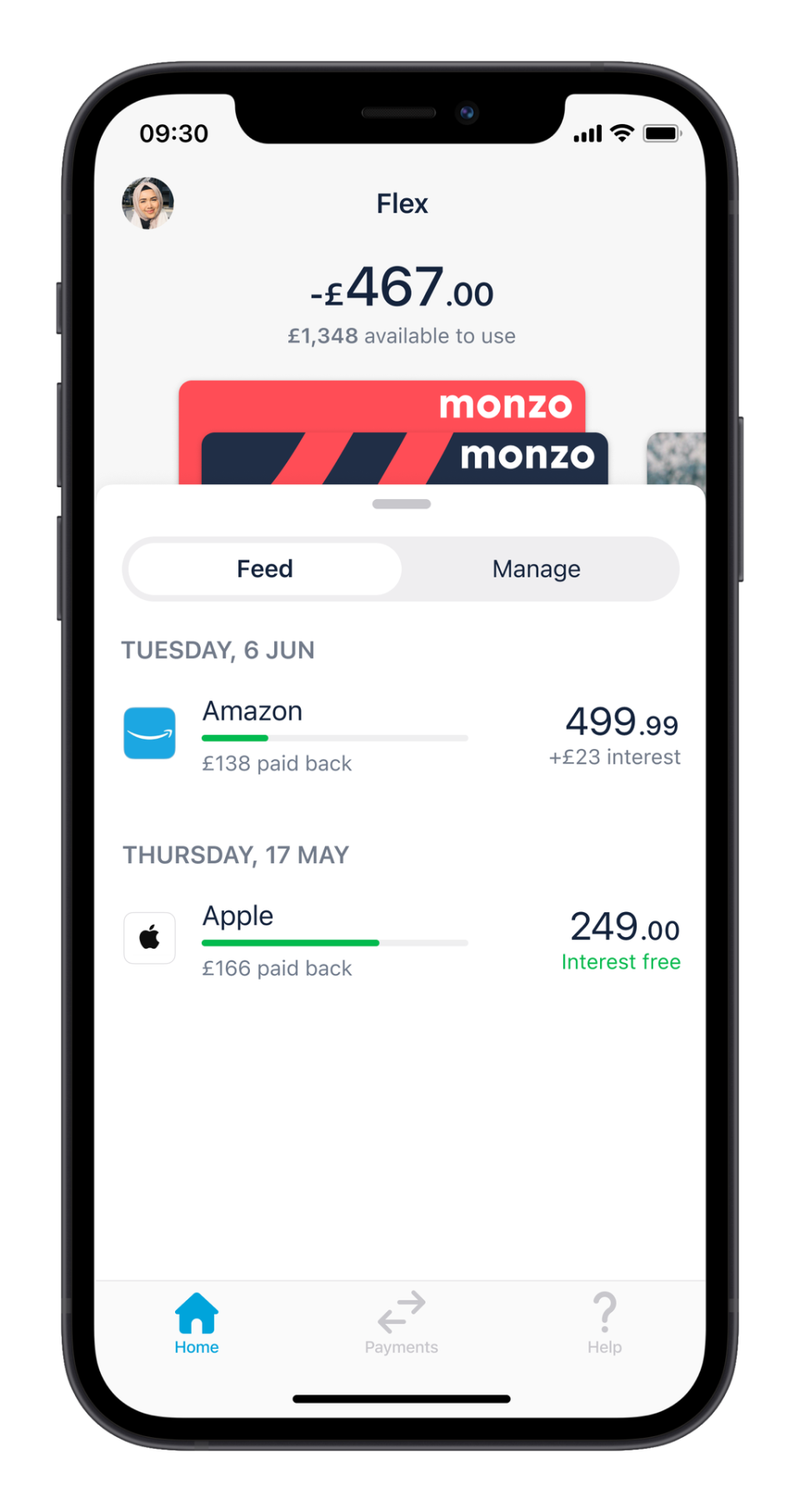

The company began as a free app but has lately been pushing into paid for accounts such as Monzo Plus.

Monzo declined to say what its revenues are presently.

To date it has raised more than £500 million in funding from investors including General Catalyst, Y Combinator, Goodwater, Accel, Stripe and Passion Capital.

Three weeks ago Monzo withdrew its application for a US banking licence after some difficulty with the regulator, the Office of the Comptroller of the Currency.

It has lately moved into the controversial “buy now, pay later” sector, an industry that is beginning to trouble regulators and MPs.

CEO Tom Blomfield, the co-founder, left the bank last year citing pressures heightened by the pandemic.

Read More

‘Money spoils children’: Revolut’s $7bn CEO Nik Storonsky on inheritance, growth plans, and IPO

Monzo taps ex-Purplebricks CFO James Davies to lead finances as recovery continues

Yahoo Finance

Yahoo Finance