Is There More Growth In Store For Preformed Line Products' (NASDAQ:PLPC) Returns On Capital?

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at Preformed Line Products (NASDAQ:PLPC) and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Preformed Line Products:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = US$36m ÷ (US$413m - US$74m) (Based on the trailing twelve months to March 2020).

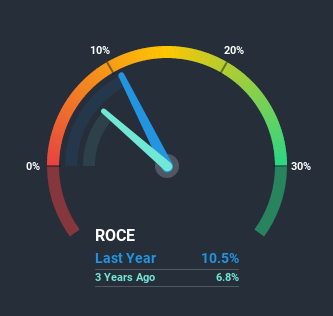

Thus, Preformed Line Products has an ROCE of 11%. That's a relatively normal return on capital, and it's around the 10% generated by the Electrical industry.

View our latest analysis for Preformed Line Products

Historical performance is a great place to start when researching a stock so above you can see the gauge for Preformed Line Products' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Preformed Line Products, check out these free graphs here.

What Does the ROCE Trend For Preformed Line Products Tell Us?

Preformed Line Products has not disappointed with their ROCE growth. More specifically, while the company has kept capital employed relatively flat over the last five years, the ROCE has climbed 62% in that same time. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

The Bottom Line On Preformed Line Products' ROCE

To bring it all together, Preformed Line Products has done well to increase the returns it's generating from its capital employed. And with a respectable 64% awarded to those who held the stock over the last five years, you could argue that these trends are starting to get the attention they deserve. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

While Preformed Line Products looks impressive, no company is worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether PLPC is currently trading for a fair price.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance