MORGAN STANLEY: Argentina's stock market could rocket as much as 258% in 5 years

Mario Tama/Getty Images

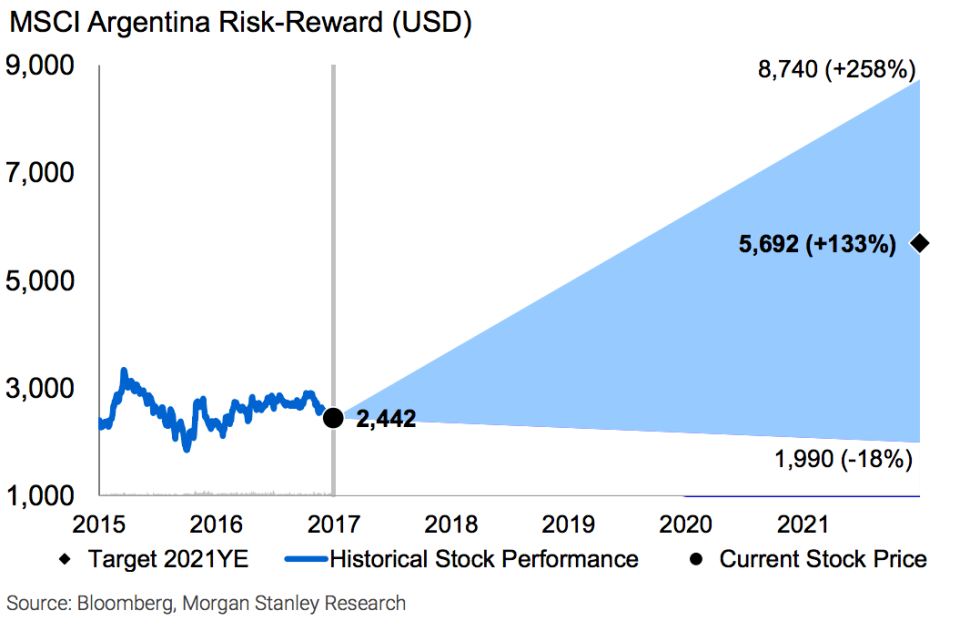

Investors betting on Argentina's stock market could make a return of 258% in five years, according to analysts at Morgan Stanley.

The country is returning to economic and political normality after years in the capital markets wilderness following its 2002 debt default and financial collapse, Morgan Stanley said in a note to clients on Friday.

While a 258% return on Argentinian stock investments is the best-case scenario, the investment bank said a 133% return is the most likely.

"We believe the deepening of Argentina’s capital market will trigger roughly $230 billion (~8% of GDP p.a.) in net financing and foreign direct investment over the next five years, and we expect Argentina’s role and prominence in fixed income and equity investment portfolios to grow," the analysts said.

"The journey has just begun and it is not too late to buy Argentina: In our base case scenario, we forecast MSCI Argentina should reach circa 5,700 points by 2021YE (+133% in USD; +18% CAGR)."

The analysts said that returns could top 250% if economic reforms are implemented quickly: "In an optimistic scenario, the economy quickly normalizes and the government is able to implement far reaching structural reforms that lift potential real GDP growth to +4.0% per year."

"This backdrop would be extremely supportive for equities and we project MSCI Argentina to close to 8,800 points after 5 years (+258% in USD; +29% CAGR)," Morgan Stanley said.

If things do not go to plan, the most Morgan Stanley sees investors losing over that period is 18%, making the risk worth the potential reward.

Here is the chart:

Mario Tama/Getty Images

Argentina's change of leadership and return to global capital markets has been a boon to fund managers betting on revival. Brevan Howard, which manages around $18 billion in assets, made an 18% return on its Argentina investments last year.

The firm profited after offering a special purpose vehicle to clients in January 2015 "in order to take advantage of anticipated political change and a subsequent resolution of the bond hold out dispute."

The country has travelled a long road back to being accepted by global financial players.

Fifteen years years after defaulting on more than $90 billion of sovereign debt, Argentina returned to the bond market in April last year. The country raised around $15 billion from its bond sale, but attracted orders worth $65 billion.

While former President Cristina Fernandez de Kirchner struck a combative tone in her dealings with bondholders, new President Mauricio Macri made finalising negotiations with creditors and issuing new debt a policy priority.

In February 2016, Argentina reached a $4.7 billion agreement with hold-out creditors, paving the way to the new bond issue.

NOW WATCH: This is what Bernie Madoff's life is like in prison

See Also:

Stocks tumble into the red then rebound during Trump's press conference

One of the biggest market leaders is flashing a warning sign

SEE ALSO: Investors can't get enough of Argentina's first bonds in 15 years

Yahoo Finance

Yahoo Finance