MorphoSys (ETR:MOR) Shareholders Have Enjoyed An Impressive 116% Share Price Gain

MorphoSys AG (ETR:MOR) shareholders might be concerned after seeing the share price drop 10% in the last quarter. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In fact, the share price is up a full 116% compared to three years ago. To some, the recent share price pullback wouldn't be surprising after such a good run. Only time will tell if there is still too much optimism currently reflected in the share price.

See our latest analysis for MorphoSys

Because MorphoSys is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

MorphoSys's revenue trended up 25% each year over three years. That's well above most pre-profit companies. Meanwhile, the share price performance has been pretty solid at 29% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

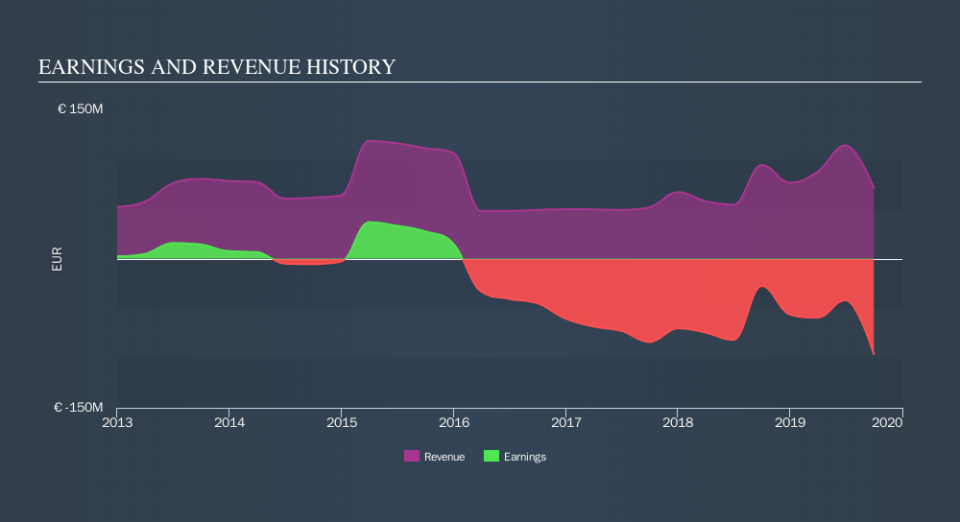

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

MorphoSys is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for MorphoSys in this interactive graph of future profit estimates.

A Different Perspective

Investors in MorphoSys had a tough year, with a total loss of 1.5%, against a market gain of about 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 4.3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like MorphoSys better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance