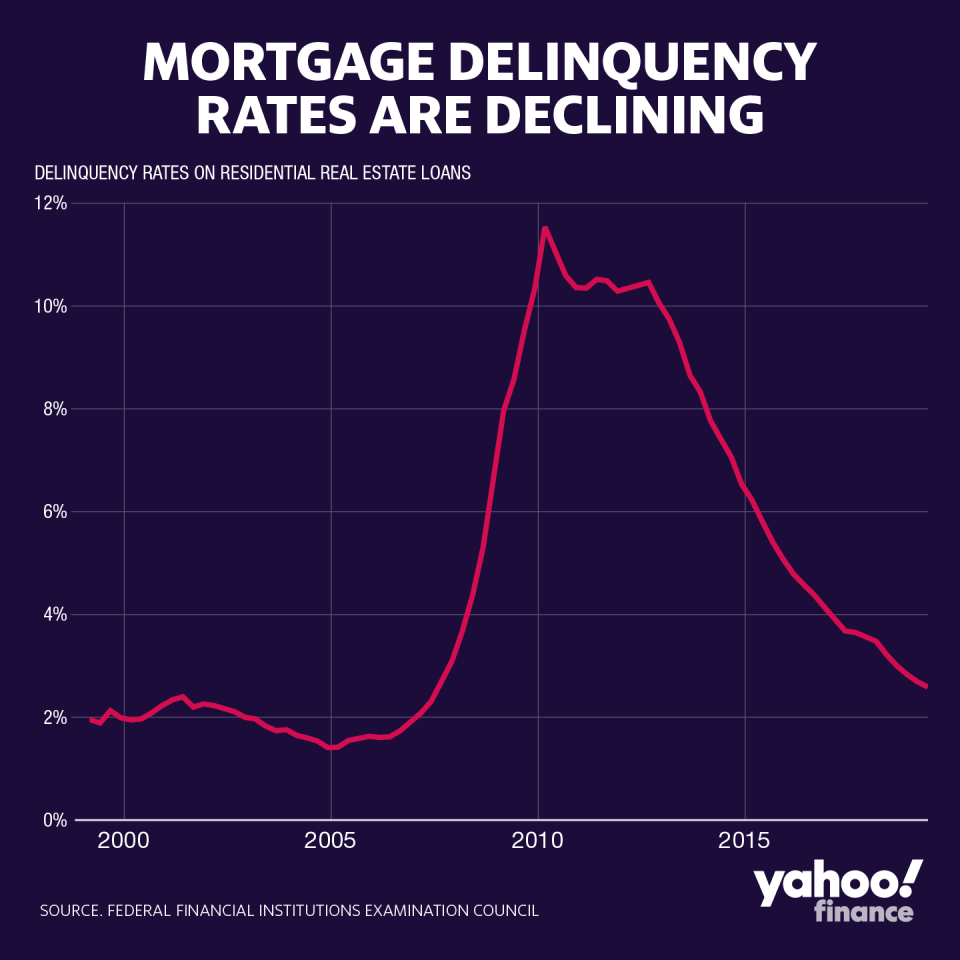

Why mortgage delinquencies are at a 12-year low

There’s a lot of talk about a looming recession in the U.S. economy. But according to one data point, the economy looks pretty healthy.

Mortgage delinquency rates, for single- to four-family properties, have been declining since the Great Recession. At 2.59% in second quarter of this year, according to the Federal Reserve, the rate is at its lowest level since 2007.

“Mortgage delinquencies are not waving a red flag, at least not yet,” said Stifel Chief Economist Lindsey Piegza.

It’s only natural for delinquency rates to be so low with unemployment at 3.5% and the household savings rate ticking up to 8%.

“It’s worth noting that, post-crisis, mortgage debt has been highly constrained, producing an upward shift in mortgage credit quality — the current median FICO score of mortgage originations is over 750 versus ~700 pre-crisis,” wrote Morgan Stanley in a recent research note. “Unsurprisingly, delinquencies are low when lending in the largest segment of consumer debt [mortgages constitute 70% of consumer debt] is limited to high quality-borrowers.”

Additionally, there are not as many homeowners as there used to be. Homeownership rates fell to 64.1% currently from 69.2% during the pre-crisis high, according to Morgan Stanley. It also helps that those individuals who own are more educated and conservative when it comes to a home purchase.

“Our data suggest younger households who buy homes commit lower share of income, being more conservative in terms of financial commitment which will serve them well,” said Doug Duncan, Fannie Mae chief economist, adding that lenders also have learned from the housing bust and have a better idea of how to help people stay in their homes and get loan modifications.

“We’ve made huge changes on the underwriting side and servicing, how we assess the ability for a borrower to pay for a mortgage” by leveraging big data, said Kevin Palmer, senior vice president of single family portfolio management at Freddie Mac. He added that a downturn can’t be prevented but we can prepare by making “the consumer and borrower more resilient to hiccups or downturns in the market.”

But the low mortgage delinquency rates don’t necessarily mean that we’re not headed for a recession. It’s just that this time around, the housing market is unlikely to be at the root and center of the crash.

Keep an eye on the unemployment rate

“We have to retrain ourselves to what a recession looks like,” said Piegza. She added that in 2007 when the economy fell off a cliff there was a housing bubble and in 2001 when the market crashed there was a tech bubble. Today, we are “losing momentum in key sectors. It’s a slow bleed over the past year,” she said, referring to manufacturing activity slowing down and business investment declining. Retail sales unexpectedly declined in September to a seven-month low and Piegza noted that the report “solidifies concerns of the consumer’s inability to perpetually support the economy alone."

“It will not be a traditional recession, it won’t dig deep in negative territory,” she said. “It will be a slow drag.”

Duncan notes that this time if a recession hits, he would expect mortgage delinquency rates to rise several months after unemployment starts to rise, depending on the length of the recession and that’s “a more traditional cyclical behavior.”

The reason we experienced such a run up in mortgage delinquency rates before the Great Recession was because of poor underwriting and speculative lending activity. Around 2007 everyone bought, whether they could afford it or not.

That doesn’t seem to be the case this time around. And while we’re facing a student debt crisis and starting to see auto loan delinquencies creep up, ultimately, experts say, the home is the last thing consumers stop paying for.

Amanda Fung is an editor at Yahoo Finance.

US home price growth unchanged after 15-month slowdown

Low interest rates are giving the housing market a boost

Here are 10 U.S. cities where homebuyers have an advantage over sellers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance