Mortgage warning: two-year deals 'dangerous' as house prices weaken and rates rise

Looming interest-rate rises and a stagnant housing market mean first-time buyers with large mortgages are at risk of becoming "loan prisoners" where in future years they will be trapped paying some of the highest rates, mortgage experts have warned.

The most popular mortgage deals involve fixing rates for just two years. But a cooling housing market coupled with a background of rising borrowing costs could mean that at the end of those deals borrowers will not be able to re-finance to a new, fixed rate. Instead they could be forced to pay their existing lender's highest "standard variable rate" or SVR, likely to be as much as twice the rate of their starting loan.

Those most at risk are borrowers setting out today with small deposits.

House price data published last month showed the first annual decline in London house prices in eight years - as the average value fell by 0.6pc. Hints from the Bank of England also suggest interest rates could rise next month for the first time in a decade.

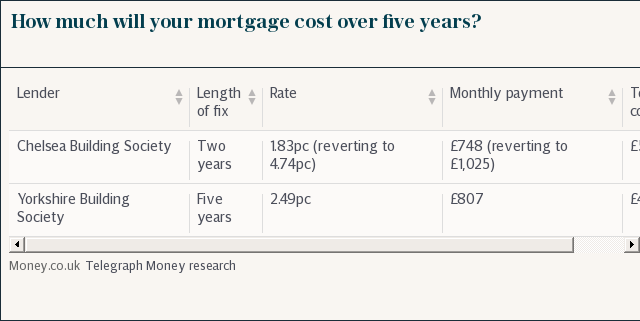

Calculations by Telegraph Money reveal the dangers of becoming a “mortgage prisoner”. Chelsea Building Society currently offers a two-year fixed mortgage for a buyer with a 10pc deposit at a rate of 1.83pc.

Reader Service: Telegraph Remortgage Service is fee free, we help you find and secure the best deal for your remortgage requirements. Find out more

A borrower taking out a loan of £180,000 on a £200,000 property would make monthly payments of £748. However, if they found themselves unable to refinance and were forced to pay Chelsea’s SVR of 4.74pc, their monthly payments would jump by almost £300 to £1,025.

Provided they have equity in their property of at least 10pc - and provided the mortgage market is similarly competitive as today - they could remortgage elsewhere to another, better rate. But if the value of their home has fallen and thus their equity is reduced, they may be stuck on the higher SVR.

Ray Boulger, of brokers John Charcol, said for some buyers this means they should consider fixing their deal for five or even 10 years.

Mr Boulger said: “The potential problem [with a short-term fix] is that house prices fall - in which case you don’t have the equity to refinance. The other problem is that your personal circumstances might change so you can’t get a mortgage, that’s the risk.”

The buyer in the case above would pay significantly less over five years on a fixed deal than if they reverted to an SVR after year two. The rate on a five-year deal with Yorkshire Building Society is currently 2.49pc - meaning monthly payments of £807.

This means, over five years, the buyer would pay a total of £48,420. If they fixed for two years with Chelsea and then paid the SVR they would pay £54,852 - around £6,000 more.

Mr Boulger said someone borrowing 90pc equity may be better off with the certainty of a longer fixed deal. “There are some people who will put a lot of value on certainty, even if the rate is higher,” he explained. He added these people may want to consider a 10-year fix.

Longer-term fixes reduce the likelihood of property prices falling before the borrower needs to remortgage. But there are other risks: if the property is too small or unsuitable, a fixed rate mortgage may limit owners' ability to move.

For first-time buyers moving from rented accommodation into their own property, their is also the need to weigh up likely future mortgage costs against their current rent. Rents in some parts of the country are higher than mortgage costs even where standard variable rates of 4.7pc or more are applied.

Rates available for those with 10pc equity are far better than rates available for those with 5pc, Mr Boulger points out, which is another factor borrowers should be aware of.

Reader service:Get remortgage advice with The Telegraph's Money Comparison Service, in association with London & Country

How fast will rates rise? No-one knows for certain, but the underlying cost to mortgage lenders of their funds is increasing rapidly. The"swap rates" which indicate indicate banks' cost of capital have approximately doubled in the 15 months since the Brexit referendum. Competition between lenders, however, has so far prevented this from being fully passed on to borrowers in the form of higher rates.

Yahoo Finance

Yahoo Finance