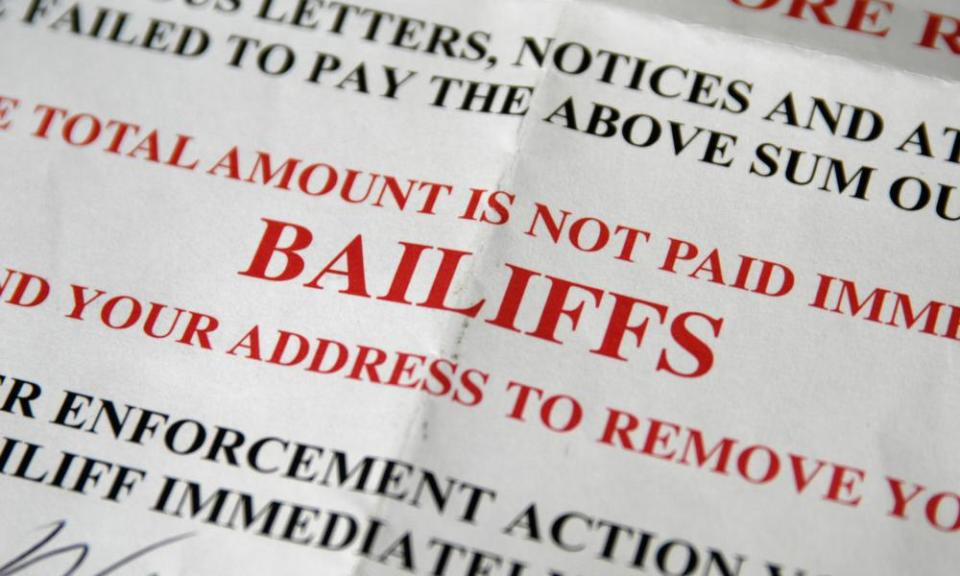

Most of the 2m people in UK contacted by bailiffs report intimidating behaviour

More than 2 million people have been contacted by bailiffs during the cost of living crisis, according to Citizens Advice, with a majority of those who came into contact with a debt collector reporting they felt harassed or intimidated.

The charity estimates that bailiffs added £250m in fees to people’s debts in the past 18 months, driving people deeper into financial hardship.

More than a third of people who came into contact with a bailiff were subjected to behaviour that broke Ministry of Justice rules, Citizens Advice said. These included bailiffs forcing their way into homes, not taking into account vulnerabilities such as disability or illness, or taking goods needed for work reasons.

Nearly 60% experienced harassment or intimidation through doorstep visits, the misrepresentation of powers or even threats to break into the property.

Dame Clare Moriarty, chief executive of Citizens Advice, said that bailiffs were “a law unto themselves” and called for more regulation.

“Rogue behaviour is making things far worse for people in really difficult situations – sometimes pushing them further into debt,” she said.

“Rules are in place to try and ensure bailiffs act fairly to recover debt, but our advisers are hearing from people every day who are being intimidated and harassed by bailiffs.

John, not his real name, who lives with his partner and children in a rural area and have a child who is disabled, said he was woken one morning before Christmas at about 6am by a call from a bailiff who was outside his home.

John had a £90 debt for a missed council tax payment and was put on to a repayment plan. The bailiff demanded nearly £500 in extra fees for their visit and threatened to take his car, which they’d already clamped. John was forced to borrow money to pay the bailiff as the family are reliant on their car.

“I missed a payment on my debt repayment plan because my child had been taken to hospital. Yet the council still passed my debt over to a bailiff.

“After receiving the call from the bailiff, I went outside and he was in his car. He wouldn’t get out to speak to me but was being really aggressive and said I had to pay or he’d call for my car to be removed.

“I told him that I have a disabled child and he basically said he didn’t care. In the end, I got someone to come down with a bank card to pay the bailiff through his car window. Once it was paid he got out of his car and removed the clamp.”

John experiences post-traumatic stress disorder and said his anxiety “kicked in”.

Almost three in four people (72%) who came into contact with a bailiff said it affected their mental health – many were left feeling unsafe in their home, afraid to answer the door and even not wanting to leave their house.

Half (49%) said they experienced long-term financial consequences – such as debts becoming harder to manage, needing to take out more credit and not being able to pay other bills because of bailiff fees.

Bailiffs are not allowed to threaten or harass those they approach. They cannot try to break into your home without a warrant, try to charge you incorrect fees, take goods belonging to someone else or take essential items, including things you need for work.

However, the industry has little regulation and the current Enforcement Conduct Board only provides independent oversight of bailiff firms that choose to be accredited.

Citizens Advice believes that with more people falling into debt, and potentially exposed to bailiff action, a voluntary, self-regulation model is no longer able to meet the scale of the issue. Instead, the charity wants the regulation of bailiff firms to be put on statutory footing.

The survey found that one in four people (27%) have fallen into debt and are now potentially exposed to heavy-handed bailiffs in the near future.

A Ministry of Justice Spokesperson said: “It is vital that vulnerable people in debt are protected and not harassed by rogue bailiffs which is why we have announced plans to make body worn video cameras compulsory and backed the recently established Enforcement Conduct Board to better hold private bailiffs to account.

“We will review whether the Board requires a statutory footing after it has been running for two years.”

Citizens Advice polled 6,000 adults over a month, and the figures were weighted.

Yahoo Finance

Yahoo Finance