Motorola (MSI) Beats Q1 Earnings Estimates on Solid Demand

Motorola Solutions, Inc. MSI reported strong first-quarter 2022 results, driven by diligent execution of operational plans and healthy growth dynamics backed by solid order trends. Adjusted earnings in the reported quarter surpassed the Zacks Consensus Estimate. In addition, Motorola achieved record first-quarter sales and ending backlog despite supply chain headwinds, which further exemplified the strength of its product portfolio.

Net Earnings

On a GAAP basis, net earnings in first-quarter 2022 were $267 million or $1.54 per share compared with $244 million or $1.41 per share in the year-earlier quarter. The year-over-year improvement was primarily attributable to top-line growth and income tax benefit in the reported quarter.

Excluding non-recurring items, non-GAAP earnings in the quarter were $1.70 per share compared with $1.87 in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 12 cents.

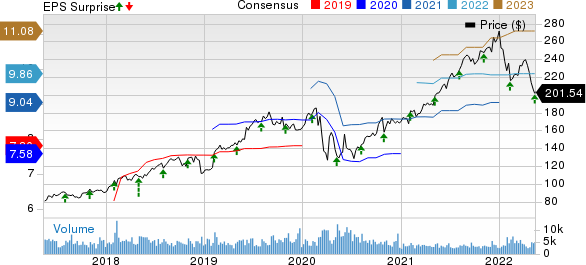

Motorola Solutions, Inc. Price, Consensus and EPS Surprise

Motorola Solutions, Inc. price-consensus-eps-surprise-chart | Motorola Solutions, Inc. Quote

Revenues

Quarterly net sales were $1,892 million, up 6.7% year over year due to growth in North America driven by the strength of its business model and the value of its mission-critical integrated ecosystem. The company witnessed strong demand for video security, command center software and LMR (land mobile radio) services. The top line beat the consensus estimate of $1,832 million.

Region-wise, quarterly revenues were up 10.1% in North America to $1,305 million due to growth in LMR and video security products. International revenues were flat at $587 million as growth in video security products and command center software were offset by a decline in LMR owing to adverse foreign currency effect.

Segmental Performance

Net sales from Products and Systems Integration increased to $1,103 million from $1,015 million in the year-ago quarter, driven by higher demand for LMR and video security solutions. The segment’s backlog was up $852 million to $4.1 billion, primarily due to high LMR demand in North America and the International markets.

Net sales from Software and Services were up 4.1% to $789 million, with solid performance across command center software and video security services. The segment’s backlog increased $1.3 billion to $9.3 billion, primarily due to multi-year software and service agreements in the Americas and the extension of the Airwave contract.

Other Quarterly Details

GAAP operating earnings decreased to $239 million from $298 million in the prior-year quarter, while non-GAAP operating earnings were down to $374 million from $411 million a year ago. The company ended the quarter with a record first-quarter backlog of $13.4 billion, up $2.1 billion year over year.

Overall GAAP operating margin was 12.6%, down from 16.8%, while non-GAAP operating margin was 19.8% compared with 23.2% in the year-ago quarter. The decrease in both GAAP and non-GAAP operating margins was due to higher operating expenses owing to inflated direct material costs and acquisitions, partially offset by higher sales.

Non-GAAP operating earnings for Products and Systems Integration were down 26.7% to $96 million for a margin of 8.7%. Non-GAAP operating earnings for Software and Services were $278 million, down 0.7% year over year, for an operating margin of 35.2% for the segment, declining from 36.9%.

Cash Flow and Liquidity

Motorola generated a record $152 million of cash from operating activities in the quarter compared with $370 million a year ago. Free cash flow at quarter-end was $98 million, significantly down from $318 million in the prior year. The company repurchased $493 million worth of stock during the first quarter. As of Mar 31, 2022, the company had $878 million of cash and cash equivalents with $5,689 million of long-term debt.

Guidance

With solid quarterly results and robust demand patterns, the company reiterated its earlier guidance for 2022. Non-GAAP earnings for 2022 are expected in the $9.80-$9.95 per share range on year-over-year revenue improvement of 7%, with a rise in both segments on higher demand.

For second-quarter 2022, non-GAAP earnings are expected in the $1.83-$1.88 per share range on year-over-year revenue improvement of 4-5% on healthy demand trends.

Moving Forward

Motorola is poised to gain from disciplined capital deployment and a strong balance sheet position. The company expects to witness strong demand across LMR products, the video security portfolio, services and software while benefiting from a solid foundation.

Motorola currently has a Zacks Rank #3 (Hold).

Clearfield, Inc. CLFD, sporting a Zacks Rank #1 (Strong Buy), is a solid pick for investors. You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered an earnings surprise of 37.5%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 114.7% since May 2021. Over the past year, Clearfield has gained a solid 47.5%.

InterDigital, Inc. IDCC also sports a Zacks Rank #1. It has a long-term earnings growth expectation of 15% and delivered a stellar earnings surprise of 141.1%, on average, in the trailing four quarters. Earnings estimates for the current year have moved up 88.5% since May 2021.

InterDigital is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics markets. The company aims to become a leading designer and developer of technology solutions and innovation for the mobile industry, IoT and allied technology areas. InterDigital’s global footprint, diversified product portfolio and the ability to penetrate different markets are impressive.

Spirent Communications plc SPMYY carries a Zacks Rank #2. Earnings estimates for the current year for the stock have moved up 9.2% since May 2021, while that for the next year is up 10.3%.

Founded in 1936 and headquartered in Crawley, the United Kingdom, Spirent offers a comprehensive, end-to-end solution that validates forwarding performance, latency and functional capabilities in an integrated approach that reduces cost of ownership. It is a leading provider of Ethernet validation solutions in the market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Spirent Communications PLC (SPMYY) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance