Motorola (MSI) Focuses on Holistic Growth to Boost Margins

On Jun 11, we issued an updated research report on Motorola Solutions, Inc. MSI, one of the leading communications equipment manufacturers in the United States.

Motorola focuses on continued innovation in voice and data solutions spanning 12,500 systems across the world. These systems drive demand for additional device sales, software upgrades, infrastructure refresh and expansion, as well as additional services to maintain, monitor, and manage these complex networks and solutions. The comprehensive suite of services ensures continuity and reduces risks for continued critical communications operations.

The company remains focused on inorganic growth strategy to broaden its product portfolio. During first-quarter 2018, Motorola completed the acquisition of Plant Holdings from Airbus SE EADSY to boost its command center software and enterprise portfolio. It also completed the buyout of Canadian firm Avigilon, in an all-cash transaction, to extend its mission-critical communications technologies portfolio.

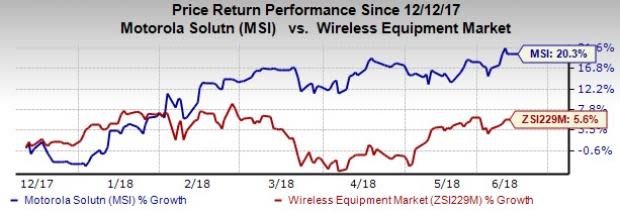

Motorola is poised to gain from robust organic growth, disciplined capital deployment and a favorable global macroeconomic environment. With solid quarterly results and continued strength in order trajectory, management has raised the earlier guidance for 2018. Full-year adjusted earnings are currently anticipated to lie within the $6.70-$6.85 per share range, up from $6.50-$6.65 expected earlier on revenue growth of 14%, higher than the prior expectations of 10-11% rise. Driven by a diligent execution of operational plans, Motorola has outperformed the industry in the past six months with an average return of 20.3% compared with a rally of 5.6% for the latter.

However, headwinds in currency translation could add to the woes as Motorola generates significant revenues outside the United States. Presently, when the economy of Europe is highly unpredictable post Brexit, it becomes difficult for the company to increase revenues and reduce costs. In addition, Motorola is likely to be stifled by the renegotiated deals and restrictions imposed on trade with other European Union members. Brexit could further result in higher tariff and non-tariff barriers to trade between the U.K. and the European Union, lowering productivity of the company. All these are likely to undermine its growth potential to some extent.

Nevertheless, we remain impressed with the inherent growth potential of this Zacks Rank #2 (Buy) stock. Some other stocks in the industry worth mentioning are Ubiquiti Networks, Inc. UBNT and AudioCodes Ltd. AUDC, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ubiquiti Networks has a long-term earnings growth expectation of 18.6%. It topped estimates thrice in the trailing four quarters with an average positive earnings surprise of 8.9%.

AudioCodes topped estimates thrice in the trailing four quarters with an average positive earnings surprise of 16.2%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Ubiquiti Networks, Inc. (UBNT) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance