How to move your money to America – and escape high-tax Britain

Speculation has been rife that Rishi Sunak could jet off to sunny California after losing the election.

The former prime minister has previously shot down rumours he would leave the country if ousted, describing them as “simply not true”. In May he committed to staying in the UK and keeping his seat for many years should the Tories lose the election.

But he has undeniably close ties to the United States. He earned his Master of Business Administration degree from Stanford University, where he also met his future wife Akshata Murty.

They own a penthouse apartment on Ocean Avenue in Santa Monica and at one point, Mr Sunak obtained a green card, granting him permanent residence in the US. However, he gave this up in 2021 after becoming chancellor.

The couple also made a $3m donation to pay for a new computer lab at Claremont McKenna, the California college where Ms Murty completed her undergraduate degree.

Mr Sunak would hardly be the first politician to cross the Atlantic after leaving office. Former Liberal Democrat leader Nick Clegg moved to Silicon Valley for a job at Facebook owner Meta in 2017 after losing his seat in the general election.

Around 20,000 British residents move to the US every year, drawn by the higher wages and lower tax burden.

Here, Telegraph Money explains what a move to the US can mean for your money.

How easy is it to move to the US?

The US is an increasingly popular destination for wealthy people looking to escape from high-tax Britain. But setting up permanent residence in the country can be difficult, says Phyllis Guillory, of law firm Womble Bond Dickinson.

“Firstly, you’ll need a solid connection to the US: employment, investments or family ties are all areas in which you can base the visa application. Despite this, even if you qualify for a visa, approval times may be significant.”

Luckily for Mr Sunak, finding employment is unlikely to be a problem. His experience as prime minister – plus previous roles at investment bank Goldman Sachs and various hedge funds – put him in good stead for top positions in the investment world or technology sector.

If he left for the US, there is no denying that Mr Sunak’s earning potential would shoot up. As prime minister and an MP, Mr Sunak earned £139,000 in 2022-23. Executive jobs in Silicon Valley can pay more than 10 times this.

On the other hand, the average salary in California is not quite so generous at $73,220 (£57,403). However, this is far more than what a worker can typically expect to earn in Britain – and it is ultimately one of the best states in the US for a high salary.

But you will have to factor in the cost of health insurance, which is obligatory for Americans.

Most get health insurance through their employer, which usually covers some of the costs. For family coverage, a worker will typically contribute $6,106, or about $509 per month, or $1,327 for a single policy.

The other thing to bear in mind is tax. Unfortunately, for those whose hearts are set on the Golden State, it has one of the biggest tax burdens in the country.

Tax in California

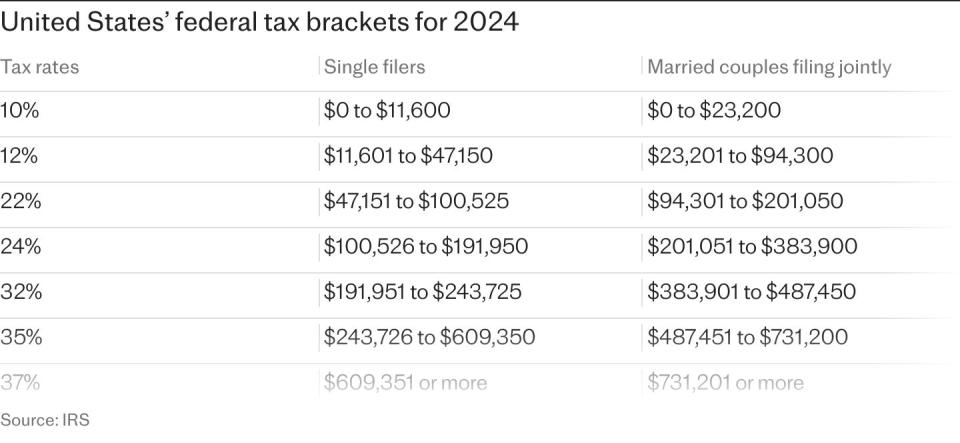

The US levies federal taxes. There are seven tax brackets. The top rate is 37pc, due on earnings over $609,351 in 2024.

However, some states also have their own income tax regime. Federal taxes go to the federal government through the International Revenue Service (IRS), while state income tax funds state budgets.

California is known for having the highest income tax burden in the US, with a top rate of 13.3pc in 2024. In total, there are nine income tax rates, starting at 1pc.

For those with an income of over $1m, there is an additional 1pc tax to help fund mental health services.

How to pay less tax

Taxpayers can deduct $5,000 of state taxes on their federal tax return – or $10,000 if filing as a couple – to reduce their taxable income.

High-tax states like California generally see the highest take-up of the so-called Salt (state and local tax) deduction. However, this is set to expire after 2025.

You could save money by relocating to states with no income tax, such as Texas, Florida or Nevada. But if you do this, then there is a risk that you may still find yourself paying California taxes.

Ms Guillory said: “While federal income tax applies uniformly across the US, state income tax varies significantly from state to state. Put simply, even if you’re not a resident of a state, you might still owe state income tax on income earned there.”

With the rise of remote working, more Californians have moved to lower-tax states, only to be caught out by the state’s complex tax rules.

California’s tax authority – the Franchise Tax Board (FTB) – has the power to conduct residency audits and unlike the IRS, which can only conduct audits going back three or six years, the FTB can look into your residency at any time.

If you are in California for more than nine months, then you are considered a resident, in which case you must pay state income tax.

However, for the FTB to consider you a non-resident, it is not quite as straightforward as leaving the state for a certain period of time.

As an example, the FTB states that if you took up a 15-month employment contract elsewhere, but remained registered to vote with a house in California, then you would still be considered a resident.

Non-residents pay state tax only on Californian income, while part-year residents pay tax on all income earned while a resident and only on Californian income while a non-resident.

So if you want to escape California’s tax system, you should sever ties by registering to vote in your new state, giving up your home in California and so on.

Will you still have to pay inheritance tax?

The UK plans to abolish its “non-dom regime” in April 2025. Under proposals for a “residence-based” scheme launching in its place, expats may exit the UK inheritance tax regime once they have been out of the country for 10 years or more.

This is subject to consultation. UK expats would still have to pay the 40pc charge on their UK assets – just not their worldwide assets.

They would however, move into the US’ inheritance tax system.

James Radcliffe, of Womble Bond Dickinson, said: “Moving to the US will usually open the individual up to exposure under the US estate and gift tax system, so it’s important that the individual coordinates their US and UK estate plan.”

There is no inheritance tax in California. US citizens are charged a federal estate tax which ranges from 18pc to 40pc but this generally only applies to assets over $13.6m in 2024.

Other states to consider

If California does not sound so appealing now, there are plenty of lower-tax options out there. Eight states have no income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Of these, Florida is a popular destination for UK expats in search of fairer weather. It also has no capital gains or inheritance tax. Average salaries are around $35,216.

For those who crave the great outdoors, Alaska is another potential option and has relatively low property taxes depending on the local municipality. For example, Nightmute’s residents paid on average just $7 each in property and sales taxes during 2022, according to official figures.

Yahoo Finance

Yahoo Finance