Former Carillion finance director thought pension contributions a 'waste of money', trustee chairman says

One of Carillion's former finance directors thought funding the pension scheme was a "waste of money", according to the chairman of the company's pension trustees.

Minutes from a meeting in July 2013 between the trustees and The Pensions Regulator (TPR), which were made public today, showed Robin Ellison had accused then finance director Richard Adams of focusing on the preservation of cash over pension contributions.

At the time, Mr Ellison told TPR that the trustees did not believe they were "being offered contributions reflecting the company’s maximum affordability".

The trustees also believed there was a "disconnect" between what Carillion directors were telling the trustees and what they was telling the City, employing tactics such as holding back payments at reporting times to inflate its balance sheet.

The minutes were released as part of an inquiry into Carillion's collapse by the joint pensions and business select committee, which on Thursday heard evidence from TPR and auditors from KPMG and Deloitte.

In a tense session, Lesley Titcomb, chief executive of TPR, said she thought the regulator needed to be “clearer, quicker and tougher” in using its powers to force companies to pay more into their schemes.

She was quizzed over the regulator’s involvement with Carillion and its pension trustees in 2010 and 2013.

She said she felt that, in hindsight, the organisation should have done more to extract higher pension contributions from Carillion’s management. “We would not have continued so long in that negotiation situation,” she said. Carillion's pension deficit is understood to run to almost £1bn.

Ms Titcomb also came under fire as MPs accused the body of being ineffectual in its monitoring of around 6,000 pension schemes. She said she did not know how many schemes had plans to pay off deficits which were longer than 10 years.

The Pensions Protection Fund warned last year that the length of plans put in place to repair pension deficits was a “significant” risk.

TPR’s director of case management, Mike Birch, said the regulator had threatened to use its power to impose higher contributions on Carillion, which had meant the company increased its payments by £85m over a 15 year period. Pension trustees had initially called for an extra £30m each year for the scheme.

MP Frank Field said: “They were shovelling money out to themselves, they were shovelling it out to investors. Why didn’t you get them to shovel it out to the pensioners?”

Union Unite on Thursday called for an investigation into “disappearing” pension contributions, having claimed that Carillion workers last paid their pension contributions in December, but the money had not been received by the statutory pension schemes.

It is also unclear exactly when the company last paid contributions into the required schemes for its workforce, Unite said.

Wednesday’s select committee session also heard evidence from representatives from KPMG and Deloitte who were responsible for auditing Carillion’s accounts.

Peter Meehan, the audit partner at KPMG, cast doubt on Carillion management’s statement that it was outstanding payments from a contract in Qatar which sunk the company. “I can't see how that was the cause in itself at all,” he said.

He also said he had not independently checked that the money Carillion’s former chief executive said he was owed by Qatari company Mshreireb Properties was actually outstanding, telling the committee that it was not normal for auditors to contact its clients’ customers.

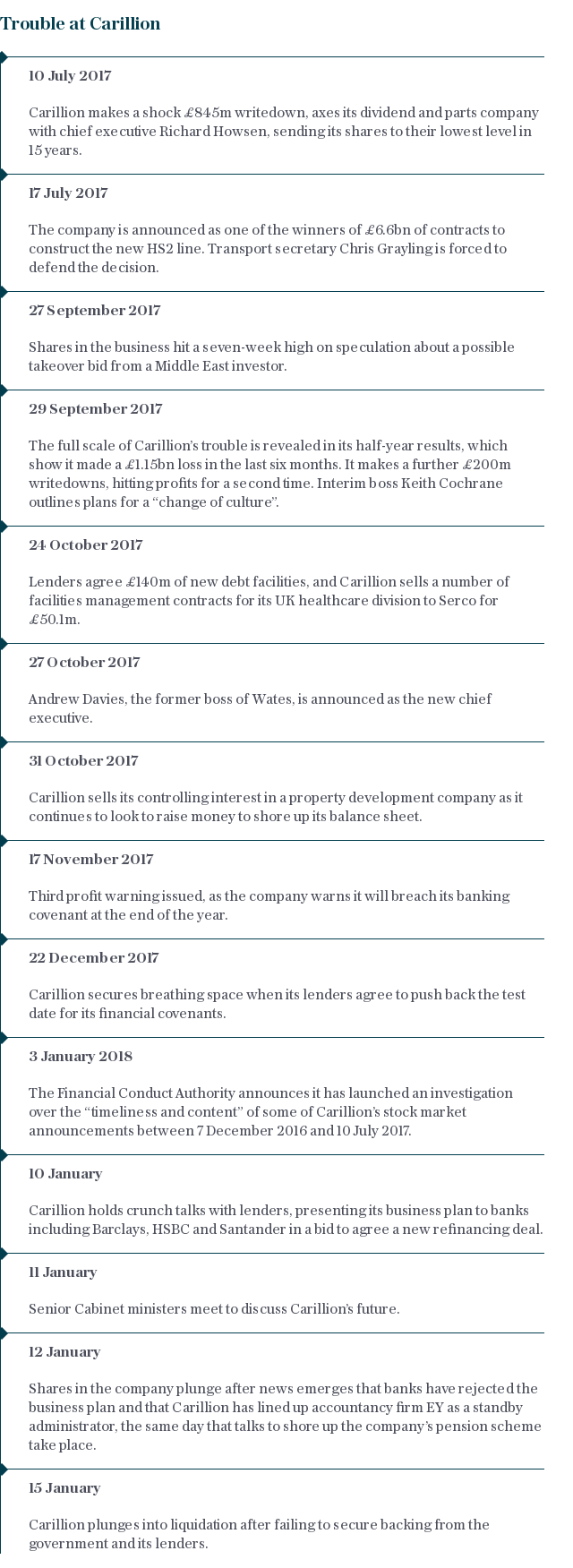

He said he stood by his decision to sign off the company’s 2016 accounts in March 2017, four months before the company issued a shock £845m writedown.

"People knew it had challenges, but the company also had the reserves to deal with those challenges," he said.

Rachel Reeves, chair of the business select committee, criticised KPMG, telling those giving evidence that she would “not hire you to audit the contents of my fridge”.

Yahoo Finance

Yahoo Finance