M&S is finally doubling down on the one area it's doing well

Marks & Spencer (MKS.L) is finally doubling down on the one area that has consistently shown growth for the massive retailer — food.

While M&S’s food offerings are a hit with customers, its line of food products was not “in front of enough customers,” M&S said in a letter to suppliers.

“This must change, and it will,” the letter added. “The full range will go online with Ocado (OCDO.L) and we are starting a store renewal programme that will get more products in front of more customers with bigger, better M&S Food Halls in new and existing sites.”

The move to get more food in front of customers is aimed at boosting consumer confidence that they will be able to do their weekly shop at an M&S store. Currently, M&S consumers spend an average of just £13 on each shop and only around 12 of its stores offer all 6,500 of its food products.

The letter is the latest in a line of steps M&S has taken to double down on food.

READ MORE: Why the new £1.5bn Ocado-Marks & Spencer tie-up makes sense

Last month, M&S and online retailer Ocado confirmed plans to set up a joint venture. M&S will pay up to £750m ($995m) for 50% of Ocado’s UK retail operation under the deal. M&S is planning to raise £600m through a rights issue to finance the deal. M&S’s range will replace Waitrose on Ocado.com when the current Waitrose contract ends in 2020.

At the moment, on average, customers spend £100 on Ocado per shop.

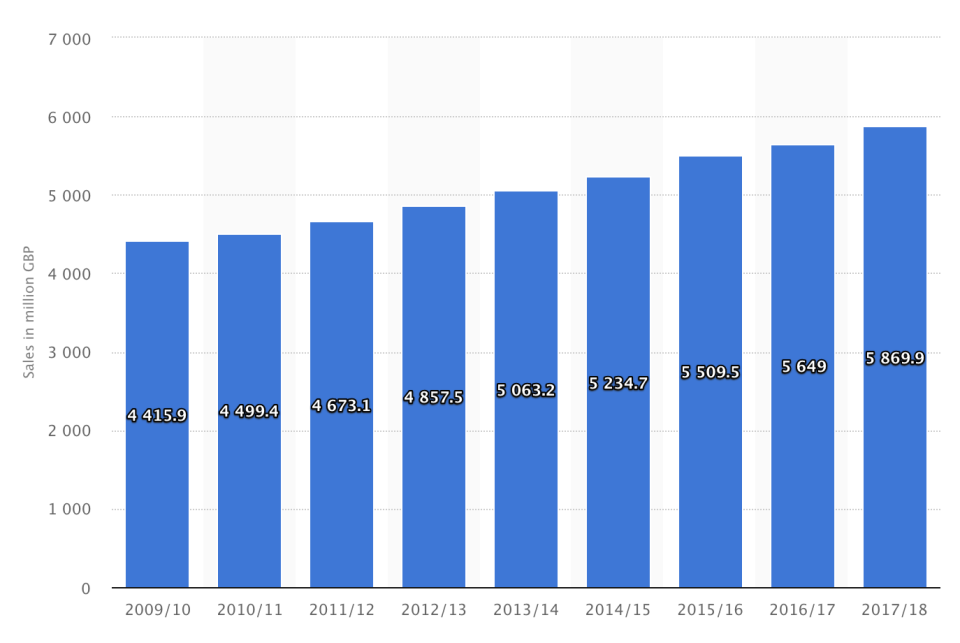

Combining this with a bricks-and-mortar strategy makes sense. When you look at M&S’s revenue in the UK from the financial year 2009/10 to 2017/18 (in million, sterling), the rate of growth has been consistent, whereas clothing has not:

M&S has just under two years until its Ocado partnership is set to go online. So in the meantime, it’s likely we’ll see some sped up changes to how it’s tackling its physical stores.

There are currently 1,043 M&S stores, of which 729 are Simply Food outlets, while the remainder sell a combination of clothing and food. However, if M&S wants to accommodate its full line of food products in its stores, it’ll have to expand those shops from 7,000 square feet to around 12,000 sq. ft.

Yahoo Finance

Yahoo Finance