MSC Industrial (NYSE:MSM) Posts Q2 Sales In Line With Estimates

Industrial supplies company MSC Industrial Direct (NYSE:MSM) reported results in line with analysts' expectations in Q2 CY2024, with revenue down 7.1% year on year to $979.4 million. It made a non-GAAP profit of $1.33 per share, down from its profit of $1.74 per share in the same quarter last year.

Is now the time to buy MSC Industrial? Find out in our full research report.

MSC Industrial (MSM) Q2 CY2024 Highlights:

Revenue: $979.4 million vs analyst estimates of $979.3 million (small beat)

EPS (non-GAAP): $1.33 vs analyst expectations of $1.33 (in line)

2024 Guidance lowered for sales and operating margin

Gross Margin (GAAP): 40.9%, in line with the same quarter last year

Market Capitalization: $4.40 billion

Erik Gershwind, President and Chief Executive Officer, said, "As announced on June 13th, we began the second half of our fiscal year with unexpected gross margin pressure and a slower than expected recovery in average daily sales, particularly within our Core customer base. As a result, our third quarter performance was below expectations and led to a revised full year outlook. We responded with swift corrective actions to improve gross margin trending and accelerate progress on the rollout of our web enhancements."

Founded in NYC’s Little Italy, MSC Industrial Direct (NYSE:MSM) provides industrial supplies and equipment, offering vast and reliable selection for customers such as contractors

Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

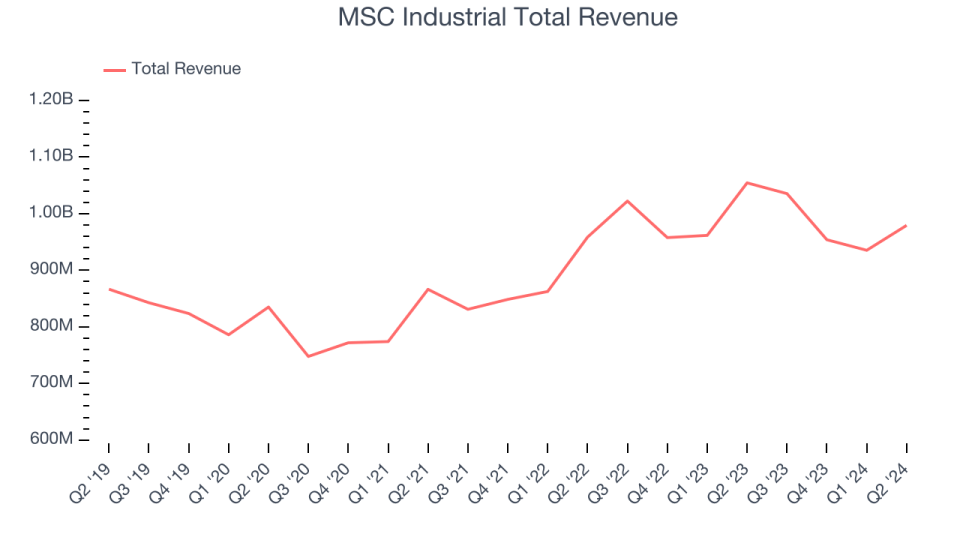

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Over the last five years, MSC Industrial grew its sales at a weak 3.1% compounded annual growth rate. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. MSC Industrial's annualized revenue growth of 5.6% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, MSC Industrial reported a rather uninspiring 7.1% year-on-year revenue decline to $979.4 million of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to decline 1.1% over the next 12 months.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

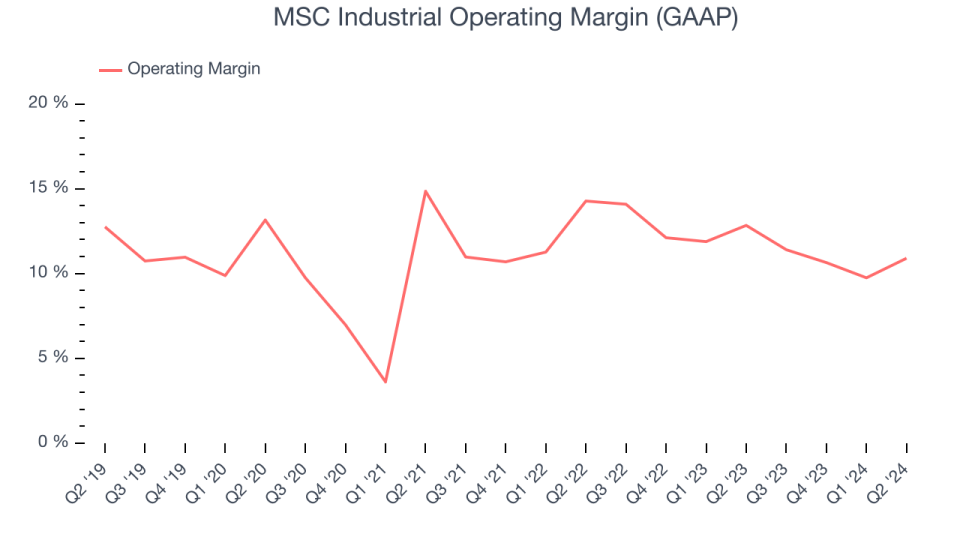

Operating Margin

MSC Industrial has managed its expenses well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.2%. This isn't surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, MSC Industrial's annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, MSC Industrial generated an operating profit margin of 10.9%, down 1.9 percentage points year on year. Conversely, the company's gross margin actually rose, so we can assume its recent inefficiencies were driven by increased general expenses like sales, marketing, and administrative overhead.

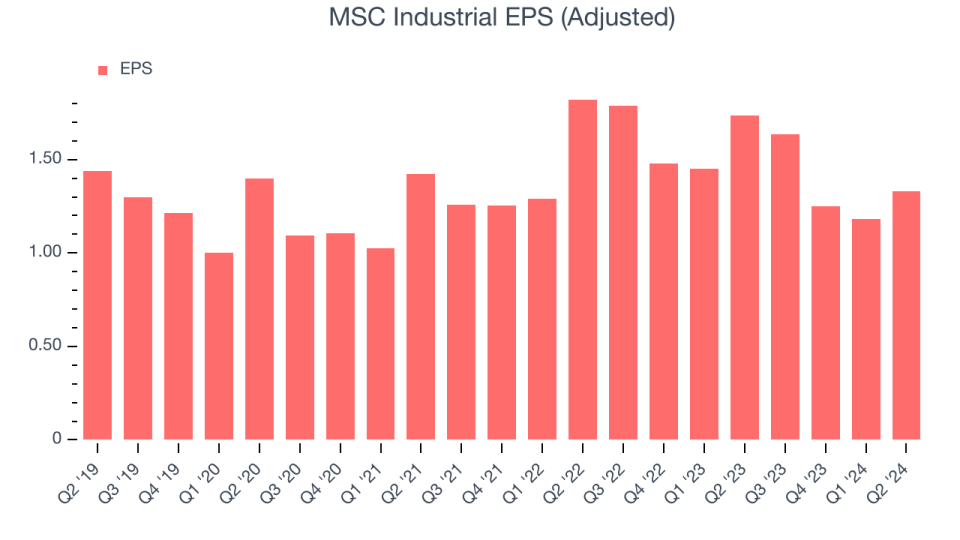

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

MSC Industrial's flat EPS over the last five years was below its 3.1% annualized revenue growth. However, its operating margin didn't change during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

We can take a deeper look into MSC Industrial's earnings to better understand the drivers of its performance. A five-year view shows MSC Industrial has diluted its shareholders, growing its share count by 1.7%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For MSC Industrial, its two-year annual EPS declines of 2% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q2, MSC Industrial reported EPS at $1.33, down from $1.74 in the same quarter last year. This print was close to analysts' estimates. Over the next 12 months, Wall Street expects MSC Industrial to perform poorly. Analysts are projecting its EPS of $5.40 in the last year to shrink by 10.7% to $4.82.

Key Takeaways from MSC Industrial's Q2 Results

We struggled to find many strong positives in these results. While revenue was roughly in line, its operating margin missed. Full year guidance was also lowered. Overall, this quarter could have been better. The stock remained flat at $78.55 immediately following the results.

So should you invest in MSC Industrial right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance