Here’s How Much You’ll Pay in Taxes Over a Lifetime in Every State

Taxes may be the bane of most working people’s existence, but they’re impossible to dodge. But wait, there’s more: Not only must you pay federal income taxes, but you must, in the vast majority of states, also pay individual income taxes. In fact, 43 states and Washington, D.C., levy individual income taxes and 41 tax wage and salary income, according to the Tax Foundation.

Learn More: Trump Wants To Eliminate Income Taxes: Here’s What That Would Mean for the Economy and Your Wallet

Find Out: 6 Money Moves You Must Make if You Want to Be Like the Wealthy

Over a lifetime of earnings, taxes can add up to a tremendous amount of money spent. Research from Self, a financial technology company, provided a state-by-state breakdown of the average lifetime earnings compared with estimated lifetime taxes and the percentage of earnings that will go toward tax payments.

Here’s how much you’ll pay in taxes over a lifetime in every state, with states ranked in order of highest to lowest percentage of earnings spent.

New Jersey

Lifetime earnings: $1,818,191

Lifetime taxes: $987,117

Percentage of earnings: 54.3%

Trending Now: Trump Wants To Eliminate Income Taxes: 4 Reasons You Might Want To Change Your Retirement Plans

Read Next: 7 Reasons You Must Speak To a Financial Advisor To Boost Your Savings in 2024

Earning passive income doesn't need to be difficult. You can start this week.

Connecticut

Lifetime earnings: $1,731,261

Lifetime taxes: $855,307

Percentage of earnings: 49.4%

Explore More: I’m an Economist: Here’s What a Trump Win in November Would Mean for the Tax Burden on the Poor

Vermont

Lifetime earnings: $1,442,094

Lifetime taxes: $651,434

Percentage of earnings: 45.2%

New York

Lifetime earnings: $1,658,872

Lifetime taxes: $748,199

Percentage of earnings: 45.1%

Massachusetts

Lifetime earnings: $1,857,438

Lifetime taxes: $816,700

Percentage of earnings: 44.0%

New Hampshire

Lifetime earnings: $1,674,402

Lifetime taxes: $722,610

Percentage of earnings: 43.2%

Check Out: Trump Wants To Eliminate Income Taxes: 3 Items That Will Instantly Get More Expensive

Rhode Island

Lifetime earnings: $1,600,495

Lifetime taxes: $684,828

Percentage of earnings: 42.8%

Illinois

Lifetime earnings: $1,580,130

Lifetime taxes: $665,286

Percentage of earnings: 42.1%

California

Lifetime earnings: $1,589,377

Lifetime taxes: $659,224

Percentage of earnings: 41.5%

Maine

Lifetime earnings: $1,420,847

Lifetime taxes: $581,750

Percentage of earnings: 40.9%

Be Aware: Should Trump Eliminate Income Taxes? Here’s What Tax Experts Say

Mississippi

Lifetime earnings: $1,212,292

Lifetime taxes: $481,017

Percentage of earnings: 39.7%

Nebraska

Lifetime earnings: $1,441,423

Lifetime taxes: $546,354

Percentage of earnings: 37.9%

Wisconsin

Lifetime earnings: $1,497,577

Lifetime taxes: $562,204

Percentage of earnings: 37.5%

Kansas

Lifetime earnings: $1,405,670

Lifetime taxes: $525,482

Percentage of earnings: 37.4%

Read More: Trump-Era Tax Cuts Are Expiring — How Changes Will Impact Retirees

Texas

Lifetime earnings: $1,437,047

Lifetime taxes: $531,438

Percentage of earnings: 37.0%

Washington

Lifetime earnings: $1,729,531

Lifetime taxes: $631,249

Percentage of earnings: 36.5%

Iowa

Lifetime earnings: $1,443,717

Lifetime taxes: $524,580

Percentage of earnings: 36.3%

Minnesota

Lifetime earnings: $1,645,072

Lifetime taxes: $589,066

Percentage of earnings: 35.8%

Discover More: These Are America’s Wealthiest Suburbs

Oregon

Lifetime earnings: $1,461,612

Lifetime taxes: $521,500

Percentage of earnings: 35.7%

Utah

Lifetime earnings: $1,397,411

Lifetime taxes: $493,368

Percentage of earnings: 35.3%

Pennsylvania

Lifetime earnings: $1,508,483

Lifetime taxes: $532,077

Percentage of earnings: 35.3%

Virginia

Lifetime earnings: $1,652,307

Lifetime taxes: $581,874

Percentage of earnings: 35.2%

Try This: I’m an Economist: Here’s My Prediction for the Working Class If JD Vance Is Vice President

Michigan

Lifetime earnings: $1,386,964

Lifetime taxes: $487,842

Percentage of earnings: 35.2%

Maryland

Lifetime earnings: $1,871,450

Lifetime taxes: $655,454

Percentage of earnings: 35.0%

Idaho

Lifetime earnings: $1,254,081

Lifetime taxes: $420,886

Percentage of earnings: 33.6%

Washington, D.C.

Lifetime earnings: $2,652,904

Lifetime taxes: $884,820

Percentage of earnings: 33.4%

For You: What the Upper Middle Class Make in Different US Cities

Missouri

Lifetime earnings: $1,392,011

Lifetime taxes: $463,997

Percentage of earnings: 33.3%

Hawaii

Lifetime earnings: $1,581,119

Lifetime taxes: $521,966

Percentage of earnings: 33.0%

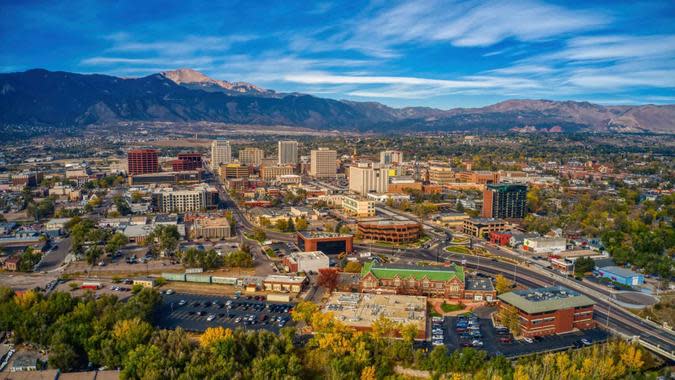

Colorado

Lifetime earnings: $1,648,566

Lifetime taxes: $540,680

Percentage of earnings: 32.8%

Arizona

Lifetime earnings: $1,443,082

Lifetime taxes: $470,554

Percentage of earnings: 32.6%

Check Out: Here’s the Salary Needed to Actually Take Home $100K in Every State

North Carolina

Lifetime earnings: $1,381,529

Lifetime taxes: $450,446

Percentage of earnings: 32.6%

Ohio

Lifetime earnings: $1,425,470

Lifetime taxes: $453,333

Percentage of earnings: 31.8%

Montana

Lifetime earnings: $1,279,987

Lifetime taxes: $406,829

Percentage of earnings: 31.8%

Indiana

Lifetime earnings: $1,405,776

Lifetime taxes: $443,271

Percentage of earnings: 31.5%

Read Next: Here’s the Income Needed To Be in the Top 1% in All 50 States

Kentucky

Lifetime earnings: $1,307,340

Lifetime taxes: $411,333

Percentage of earnings: 31.5%

South Carolina

Lifetime earnings: $1,326,469

Lifetime taxes: $416,183

Percentage of earnings: 31.4%

Nevada

Lifetime earnings: $1,415,800

Lifetime taxes: $440,737

Percentage of earnings: 31.1%

New Mexico

Lifetime earnings: $1,224,927

Lifetime taxes: $379,638

Percentage of earnings: 31.0%

Learn More: How I Went From Middle Class to Upper Middle Class

Arkansas

Lifetime earnings: $1,264,951

Lifetime taxes: $381,758

Percentage of earnings: 30.2%

Georgia

Lifetime earnings: $1,422,823

Lifetime taxes: $426,896

Percentage of earnings: 30.0%

Tennessee

Lifetime earnings: $1,359,081

Lifetime taxes: $390,663

Percentage of earnings: 28.7%

Oklahoma

Lifetime earnings: $1,306,352

Lifetime taxes: $371,432

Percentage of earnings: 28.4%

Find Out: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

West Virginia

Lifetime earnings: $1,263,434

Lifetime taxes: $358,407

Percentage of earnings: 28.4%

Florida

Lifetime earnings: $1,335,046

Lifetime taxes: $377,379

Percentage of earnings: 28.3%

Wyoming

Lifetime earnings: $1,401,788

Lifetime taxes: $394,772

Percentage of earnings: 28.2%

Alabama

Lifetime earnings: $1,296,399

Lifetime taxes: $360,053

Percentage of earnings: 27.8%

Try This: I’m an Investor: I’m Making These Money Moves Immediately If Trump Wins

North Dakota

Lifetime earnings: $1,523,518

Lifetime taxes: $422,314

Percentage of earnings: 27.7%

South Dakota

Lifetime earnings: $1,390,105

Lifetime taxes: $380,130

Percentage of earnings: 27.3%

Louisiana

Lifetime earnings: $1,318,458

Lifetime taxes: $358,611

Percentage of earnings: 27.2%

Delaware

Lifetime earnings: $1,526,730

Lifetime taxes: $392,091

Percentage of earnings: 25.7%

Find Out: In 5 Years, These 2 Stocks Will Be More Valuable Than Apple

Alaska

Lifetime earnings: $1,632,895

Lifetime taxes: $400,742

Percentage of earnings: 24.5%

More From GOBankingRates

What Is the Median Income for the Upper Middle Class in 2024?

If You Shop Online, Make Sure You Do This -- It Could Put an Extra $200 in Your Wallet

This article originally appeared on GOBankingRates.com: Here’s How Much You’ll Pay in Taxes Over a Lifetime in Every State