How Much Is Vicinity Centres' (ASX:VCX) CEO Getting Paid?

This article will reflect on the compensation paid to Grant Lewis Kelley who has served as CEO of Vicinity Centres (ASX:VCX) since 2018. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the funds from operations and shareholder returns of the company.

Check out our latest analysis for Vicinity Centres

Comparing Vicinity Centres' CEO Compensation With the industry

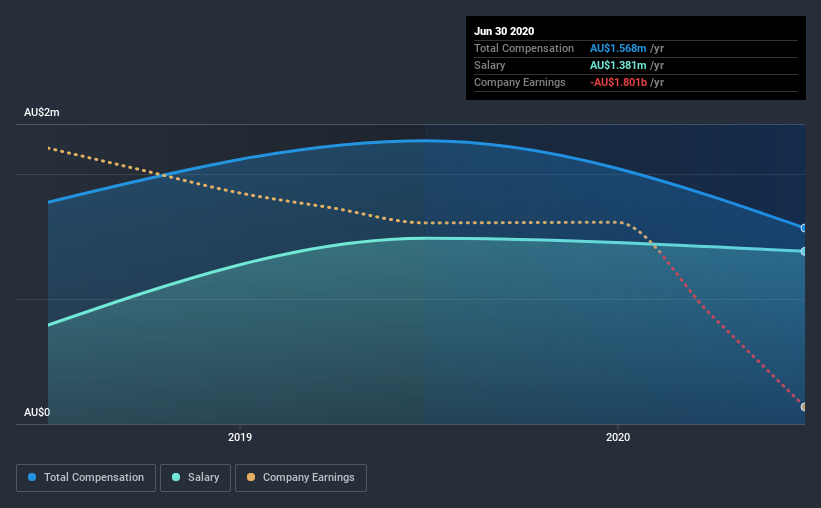

According to our data, Vicinity Centres has a market capitalization of AU$7.1b, and paid its CEO total annual compensation worth AU$1.6m over the year to June 2020. We note that's a decrease of 31% compared to last year. We note that the salary portion, which stands at AU$1.38m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between AU$5.1b and AU$15b, we discovered that the median CEO total compensation of that group was AU$3.8m. Accordingly, Vicinity Centres pays its CEO under the industry median. What's more, Grant Lewis Kelley holds AU$521k worth of shares in the company in their own name.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$1.4m | AU$1.5m | 88% |

Other | AU$187k | AU$781k | 12% |

Total Compensation | AU$1.6m | AU$2.3m | 100% |

On an industry level, around 54% of total compensation represents salary and 46% is other remuneration. Vicinity Centres pays out 88% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Vicinity Centres' Growth

Vicinity Centres has reduced its funds from operations (FFO) by 10.0% per year over the last three years. In the last year, its revenue is down 16%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Vicinity Centres Been A Good Investment?

With a three year total loss of 32% for the shareholders, Vicinity Centres would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we touched on above, Vicinity Centres is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. FFO growth has failed to impress us, and the same can be said about shareholder returns. It's tough to say that Grant Lewis is earning a very high compensation, but shareholders will likely want to see healthier investor returns before agreeing that a raise is in order.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Vicinity Centres that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance