Myriad Genetics (MYGN) Adds New Test to Oncology Portfolio

Myriad Genetics MYGN recently announced the addition of Folate Receptor Alpha (FRα) to its Precise Oncology Solutions portfolio. The new biomarker adds another companion diagnostic option for providers to help guide treatment decisions for patients with ovarian cancer.

The latest development is likely to provide oncologists with comprehensive, data-driven genetic insights that can better treatment decisions for their patients.

Significance

FRα is a newly recommended biomarker test included in the National Comprehensive Cancer Network treatment guidelines for ovarian cancer. The test establishes patient eligibility for ELAHERE (“mirvetuximab soravtansine-gynx”). Presently, this is the only FDA-approved drug indicated for patients who are FRα-positive and resistant to platinum-based chemotherapy.

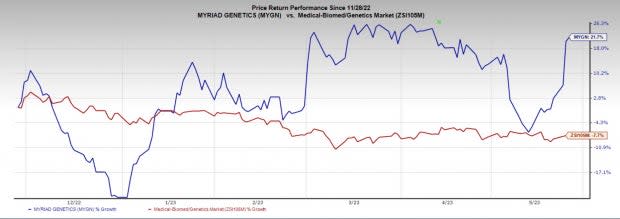

Image Source: Zacks Investment Research

The company also stated results from the SORAYA study, which demonstrated that 36% of the screened patients were found to have high tumor FRα expression. This represents a significant proportion of patients with ovarian cancer who could potentially benefit from MIRV-based therapy. Alongside germline and homologous recombination deficiency status, FRα can potentially be a powerful biomarker for patients with ovarian cancer to create a comprehensive treatment plan.

FRα is currently available and can be ordered alongside other companion diagnostic test offerings through the Myriad ordering portal. For a streamlined workflow, oncologists can receive germline, HRD, FRα biomarker and tumor testing results from a single laboratory.

Industry Prospects

Per a Research report, the global cancer biomarkers market size was valued at $12.4 billion in 2021 and is expected to witness a CAGR of 16.6% up to 2027.

Recent Developments

In April 2023, Myriad Genetics and Intermountain Precision Genomics, a service of Intermountain Health, received certification to offer solid tumor testing to patients in all 50 U.S. states after receiving the New York State Clinical Laboratory Permit. The NYS certification strengthens the advancement of precision medicine by increasing access to genetic testing, which can help patients with cancer and their providers determine more targeted treatment decisions.

In the same month, Myriad Genetics launched a new hereditary cancer assessment program in collaboration with an independent outpatient medical imaging provider, SimonMed Imaging. It combines diagnostic imaging and genetic risk assessment using MyRisk with RiskScore and patient education. The program, which leverages a custom-built Myriad tool developed in collaboration with SimonMed, will increase access to affordable genetic testing while helping identify and elevate high-risk patient care.

Price Performance

In the past six months, MYGN shares have increased 21.7% against the industry’s fall of 7.7%.

Zacks Rank and Key Picks

Myriad Genetics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector are Penumbra PEN, Lantheus LNTH and Neuronetics STIM. While Penumbra and Lantheus each sport a Zacks Rank #1 (Strong Buy), Neuronetics carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Penumbra’s stock has risen 116.7% in the past year. The Zacks Consensus Estimate for Penumbra’s earnings per share (EPS) increased from $1.47 to $1.56 for 2023 and from $2.51 to $2.56 for 2024 in the past seven days.

PEN’s earnings beat estimates in each of the trailing four quarters, the average surprise being 109.42%. In the last reported quarter, the company registered an earnings surprise of 109.09%.

The Zacks Consensus Estimate for Lantheus’ 2023 EPS has increased from $4.95 to $5.60 in the past 30 days. Shares of the company have improved by 45.6% in the past year against the industry’s 31.2% decline.

LNTH’s earnings beat estimates in each of the trailing four quarters, the average surprise being 25.77%. In the last reported quarter, the company recorded an earnings surprise of 13.95%.

Estimates for Neuronetics’ loss per share have narrowed from $1.32 to $1.29 for 2023 in the past seven days. Shares of the company have risen 8.1% in the past year compared with the industry’s 1.1% growth.

STIM’s earnings beat estimates in each of the trailing four quarters, the average surprise being 19.61%. In the last reported quarter, Neuronetics delivered an earnings surprise of 2.56%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Neuronetics, Inc. (STIM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance