Nasdaq Composite Hits Record-High Level: 5 Top-Ranked Picks

On Jul 12, the tech-heavy Nasdaq Composite index scaled a fresh high at closing. The tech rally can be attributed to strong showing by several tech behemoths. This also highlights the gradual fading of investors’ apprehensions regarding a full-fledged global trade war and their confidence on strong fundamentals of the U.S. economy.

Moreover, investors are anticipating strong display by American corporates as second-quarter earnings season commences. Consequently, it will be a prudent move to invest in tech stocks with favorable Zacks Rank and are part of the Nasdaq Composite.

Large-Cap Tech Stocks Lead Market rally

On Jul 12, Nasdaq Composite gained 1.4% to end at 7,823.92, its highest closing since Jun 20. Tech giants namely Facebook Inc. FB, Amazon.com Inc. AMZN, Microsoft Corp. MSFT and Alphabet Inc. GOOGL were up 2.2%, 2.4%, 2.2% and 2.5%, respectively. All four stocks hit their 52-day high level. Moreover, Apple Inc. AAPL also gained 1.7%.

Market anticipates this sector to be least affected by the Trump administration’s intended second round of tariffs worth $200 billion on Chinese imports, consequently aiding the rally. On Jul 10, the U.S. government revealed the list of industries on which 10% duties will be imposed on imported goods from China.

U.S. Economy Remains Robust

On Jul 6, the Department of Labor reported that the U.S. economy added 213,000 non-farm jobs in June outpacing the consensus estimate of 196,000. June’s job market data reduces concerns that United States is in the late stage of economic expansion offering little sweetness for market participants.

Moreover, ISM manufacturing and services data for June and Commerce Department’s encouraging data on U.S. trade deficit in May as well as strong consumer credit data for May released by the Fed raised investors’ confidence.

Escalating Earnings Expectations

Investors have pinned high hopes on second-quarter 2018 earnings results. Total earnings of the S&P 500 index is expected to be up 19.1% from the same period last year backed by 8.2% year-over-year growth in revenues.

Notably, the technology sector earnings are anticipated to be up +23.8% on +10.7% higher revenues. A big driver of these positive revisions is obviously the direct impact of the tax cuts. (Read More: Start of Q2 Earnings Season)

Our Top Picks

Solid macro-economic fundamentals, government’s tax reform and deregulation proposals along with sustained strong earnings performance are major tailwinds for the U.S. economy. Such factors are unlikely to disappear in the near term. At this stage, investment in Nasdaq stocks with strong earnings momentum will be lucrative. However, picking winning stocks can be a difficult task.

This is where our VGM Score comes in handy. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

We have narrowed down our search to five stocks, each of which has a Zacks Rank #1 (Strong Buy) and a VGM Score A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

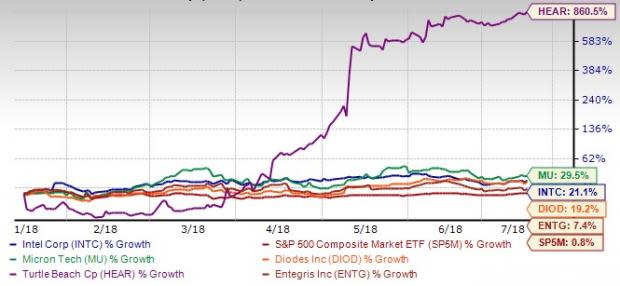

Intel Corp. INTC is one of the world's largest semiconductor chip maker. The company develops advanced integrated digital technology products, primarily integrated circuits, for industries such as computing and communications. Intel carries a VGM Score of A. The company has expected earnings growth of 16.2% for current year. The Zacks Consensus Estimate for the current year has improved by 4.4% over the last 30 days.

Micron Technology Inc. MU is one of the world's leading providers of advanced semiconductor solutions primarily DRAMs, NAND flash memory, CMOS image sensors and memory modules. Micron carries a VGM Score of A. The company has expected earnings growth of 136.3% for current year. The Zacks Consensus Estimate for the current year has improved by 1.6% over the last 30 days.

Diodes Inc. DIOD is a leading manufacturer and supplier of high-quality discrete and analog semiconductor products, primarily to the communications, computing, industrial, consumer electronics and automotive markets. Diodes carries a VGM Score of A. The company has expected earnings growth of 49.6% for current year. The Zacks Consensus Estimate for the current year has improved by 2.5% over the last 30 days.

Turtle Beach Corp. HEAR designs audio products for consumer, commercial and healthcare markets. It markets premium headsets for use with personal computers, mobile devices and video game consoles. Turtle Beach carries a VGM Score of A. The company has expected earnings growth of 520.8% for current year. The Zacks Consensus Estimate for the current year has improved by 4.1% over the last 30 days.

Entegris Inc. ENTG is a leading provider of materials management solutions to the microelectronics industry particularly, the semiconductor manufacturing and disk manufacturing markets. Entegris carries a VGM Score of B. The company has expected earnings growth of 29.2% for current year. The Zacks Consensus Estimate for the current year has improved by 1.1% over the last 30 days.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Entegris, Inc. (ENTG) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Turtle Beach Corporation (HEAR) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Diodes Incorporated (DIOD) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance