National insurance hike to be cancelled from November 6, says Kwarteng

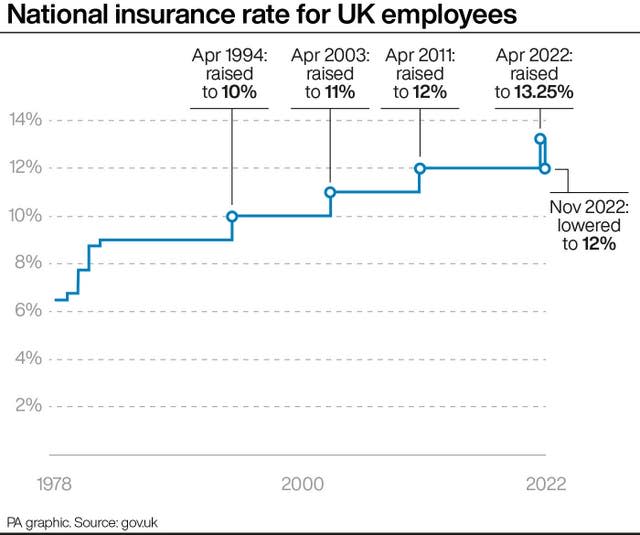

The national insurance hike introduced by Boris Johnson’s government will be reversed from November 6, Chancellor Kwasi Kwarteng has announced.

Ahead of his mini-budget on Friday, Mr Kwarteng confirmed that he was cancelling the 1.25 percentage point increase imposed by Rishi Sunak when he was chancellor to pay for social care and dealing with the NHS backlog.

Mr Kwarteng said he would also be scrapping the planned Health and Social Care Levy which was due to come into effect next April to replace the national insurance rise.

The Government tabled legislation in the Commons on Thursday to enact the tax changes.

Mr Kwarteng said: “Taxing our way to prosperity has never worked. To raise living standards for all, we need to be unapologetic about growing our economy.

“Cutting tax is crucial to this – and whether businesses reinvest freed-up cash into new machinery, lower prices on shop floors or increased staff wages, the reversal of the levy will help them grow, whilst also allowing the British public to keep more of what they earn.”

The Treasury said most employees will receive a cut to their national insurance contribution directly via their employer’s payroll in their November pay, although some may be delayed to December or January.

I can confirm that this year’s 1.25% point rise in National Insurance will be reversed on 6th November.

Its replacement – the Health and Social Care Levy planned for April 23 – will be cancelled.

A tax cut for workers. More cash for businesses to invest, employ and grow. pic.twitter.com/qssnBaNywK

— Kwasi Kwarteng (@KwasiKwarteng) September 22, 2022

The levy was expected to raise around £13 billion a year to fund social care and deal with the NHS backlog which has built up due to the Covid pandemic.

However Mr Kwarteng said funding for health and social care services will be maintained at the same level as if it was still in place.

The Chancellor and Prime Minister Liz Truss have argued that the lost revenues will be recovered through higher economic growth stimulated by the cuts in taxation.

But with Mr Kwarteng also preparing to scrap a planned rise in corporation tax, some economists have warned about the sharp rise in Government borrowing.

The Institute for Fiscal Studies said the plan to drive growth was “a gamble at best” and that ministers risked putting the public finances on an “unsustainable path”.

Yahoo Finance

Yahoo Finance