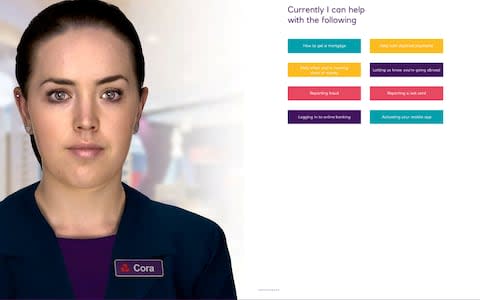

NatWest recruits AI bot Cora to answer customer questions

NatWest has begun testing an artificial intelligence-powered "digital human" to help customers with basic banking questions, raising the possibility of further job cuts at the state-controlled bank.

The assistant, named Cora, can answer over 200 basic banking queries, including "How do I log in to online banking?" and "How do I apply for a mortgage?".

Customers can have a two-way verbal conversation with Cora through a computer screen, tablet or mobile phone.

The programme has been developed with help from New Zealand-based tech company Soul Machines, which has previously provided facial technology to blockbuster films including King Kong and Avatar.

NatWest described the programme as “highly life-like” and said it drew on “advances in neuroscience, psychology, computing power and artificial intelligence”.

An earlier text-based version of Cora has interacted with over 400,000 NatWest customers, the bank said.

“We think it could create another way for our customers to bank with us and be used to help answer questions round the clock, whilst cutting queuing times for simple questions,” Kevin Hanley of NatWest said.

NatWest said the scheme would supplement branch services and would only be rolled out if the pilot was successful.

In December, Natwest’s owner RBS announced plans to axe a quarter of its branches – 259 of 1,003 in the UK.

It announced a partial reprieve earlier this month for 10 of the 62 RBS branch closures planned, but is ploughing ahead with shuttering 197 NatWests in England and Wales.

Yahoo Finance

Yahoo Finance