UK small business recovery continues in September

The recovery among UK small businesses continued to grow in September amid a boost in consumer spending and active housing market, according to the NatWest UK Small Business PMI.

The data also showed a significant shortfall in output compared with pre-coronavirus levels and a subsequent need to cut costs. This saw job losses continue to rise for the seventh-month in a row as the performance gap between small firms and large companies remains.

NatWest’s monthly survey reveals that some small companies showed a desire to retain skilled staff where possible as the pace of job cuts eased. In comparison, larger firms reported a higher rate of job cuts.

While respondents noted an uptick in business and consumer spending from the record downturn in spring due to COVID-19, small firms in the leisure and hospitality sectors saw a slowdown in activity. This was due to tighter restrictions in trading as part localised lockdown rules, such as 10pm curfews and the end of the Eat Out to Help Out scheme in August.

READ MORE: One in four UK firms stockpiling for Brexit disruption

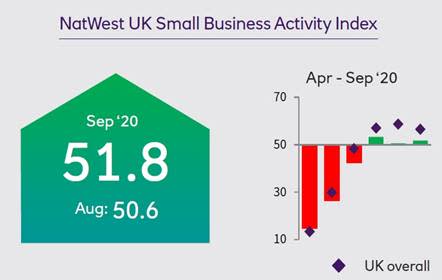

The headline All-Sector Small Business Activity index climbed from 50.6 in August to 51.8 in September. The latest expansion was still softer than the recent 53.3 peak of activity seen in July.

Any figure above 50.0 indicates an overall increase in business activity among UK private sector firms who employee between 1 and 49 employees.

Head of business banking at NatWest, Andrew Harrison, said: “September’s PMI data shows early signs of a steady recovery for the UK’s small businesses with an uptick in growth, demonstrating adaptability and resilience among this key segment of our economy.

“It’s encouraging to see that business outlook remains positive for the next year despite further restrictions coming down the track that we’ll continue to support businesses through.”

READ MORE: UK economy faces 'perfect storm' as winter looms

Service sector firms with less than 50 employees signalled a modest business activity expansion overall. Central to the growth was the first increase inflows of new business since February.

While business expectations for the next 12 months moderated slightly from August, many respondents cited concerns about re-introduced lockdown measures, and some noted worries about Brexit uncertainty.

Meanwhile, small UK manufacturers recorded a further increase in output during September, although the rate of growth softened slightly on the month.

A return to growth in order book volumes, the reopening of manufacturing supply chains and stock replenishment were all factors contributing to the steady rise in output levels in the sector.

Construction companies have continued a sustained recovery in output levels as September saw a third straight monthly improvement in activity following the record downturn during the second quarter.

After slowing in August, the rate of growth recovered slightly and faster than those recorded by similar-sized firm operating in the manufacturing and service sectors. Small building companies reported a boost to activity from house building and general property development.

NatWest principal economist. Stephen Blackman, said: “September was a decent, if unspectacular, month for small businesses with a PMI reading of 51.8 – one most firms would have taken in the current situation.

“That said, conditions are tough and while most small firms have seen steady and stable revenues last month, this was before the restriction screw turned tighter.

“The extent of the impact that localised lockdowns, plus the corresponding shift in attitudes and behaviour, will have on small firms and the business landscape, remains uncertain.

“September has the potential to be a pivotal moment in the battle against COVID-19 — it could be one of the last months before another dangerous lurch downwards, or it could quietly blend in with months of slow, but strengthening economic recovery.”

Watch: What is a no-deal Brexit and what are the potential consequences?

Yahoo Finance

Yahoo Finance