Near a 52-week low, McDonald’s shares look like unbelievable value

UK shares offer terrific value at the moment. But investors shouldn’t be afraid to look across the Atlantic in search of stocks trading at bargain prices.

After a 16% decline this year, the McDonald’s (NYSE:MCD) share price is near a 52-week low. I think the company’s shares now offer the same exceptional value as its burgers.

A durable business

McDonald’s offers its customers great value. And that resonates with consumers in pretty much any economic environment.

In general, the biggest threat with this type of business is inflation. Whether it’s energy, staff, or raw materials, higher costs make it difficult to maintain low prices for consumers.

This is a genuine challenge for McDonald’s and a risk with the stock. But the company has some advantages over its competitors when it comes to dealing with the threat of inflation.

Unlike other restaurant franchises, the company owns its properties outright and leases them to tenants. This gives it a revenue stream that doesn’t depend on food sales.

As a result, McDonald’s can hold down food prices as costs rise in ways its rivals can’t. This is a big advantage and a key reason the business has proved durable.

Outlook

Stock market wisdom says that what teenagers are buying today is a good indication of what will be popular 10 or 20 years from now. If that’s right, things look good for McDonald’s.

According to data from Piper Sandler, the company is the second-most popular food outlet for US teenagers. That’s a very positive sign looking forward – and it’s not the only one.

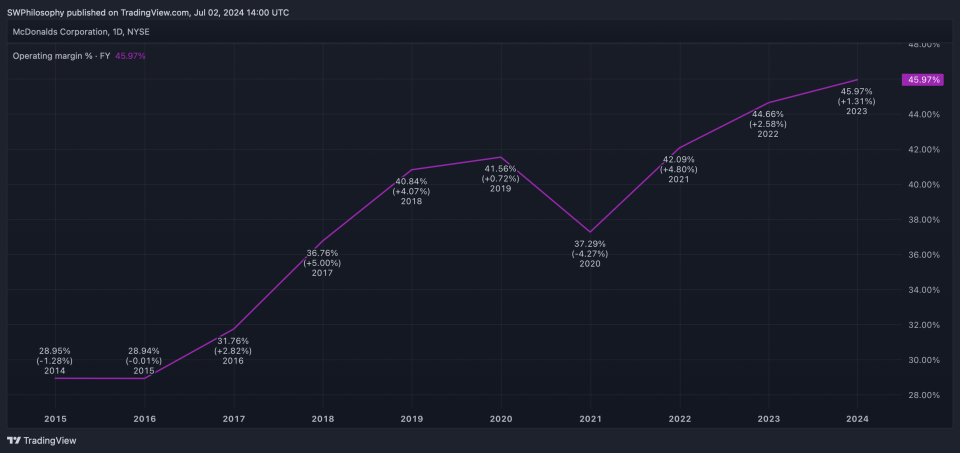

McDonald’s operating margin 2014-24

Created at TradingView

Over the last decade, McDonald’s has improved its operating margins and reduced its share count. This has been a powerful combination for growing earnings per share.

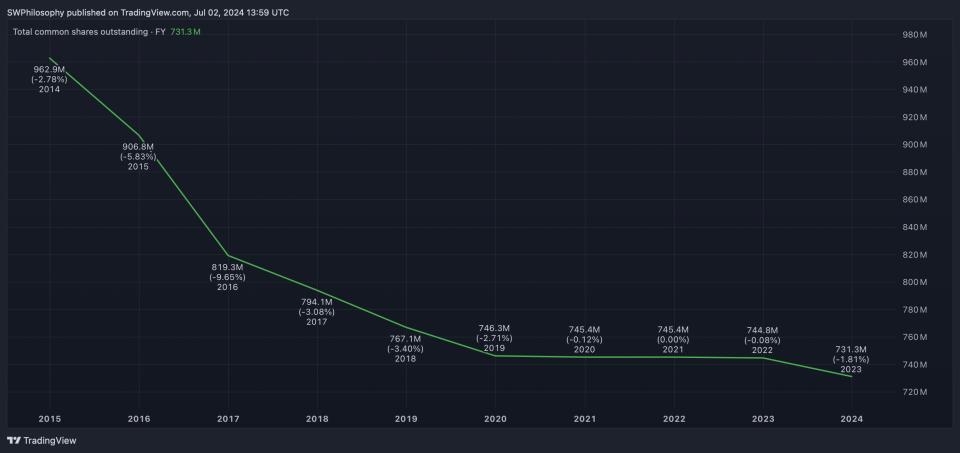

McDonald’s shares outstanding 2014-24

Created at TradingView

I expect the company to keep repurchasing shares with the cash it generates. And the ability to do this consistently should help growth in future.

Valuation

Despite all this, McDonald’s shares are cheap on a price-to-earnings (P/E) basis. The stock typically trades at a (P/E) ratio of 25, but the current multiple is closer to 21.

McDonald’s P/E ratio 2014-24

Created at TradingView

That’s unusually low for the company and I think it makes the case for buying the stock today quite a compelling one. It dramatically reduces the risk for investors.

For the McDonald’s share price to go down from here, one of two things needs to happen. The first is the stock trading at a lower P/E multiple and the second is earnings going down.

Either is possible, but I don’t think either is likely. The fact the stock already at an unusually low P/E ratio means it would be historically surprising if it fell further from here.

Equally, the strength in the underlying business means it would be surprising if earnings per share declined. The share buyback programme also reduces the chance of this.

US value

The likes of Microsoft and Nvidia have been pulling the S&P 500 higher recently. But investors should be careful not to overlook US stocks that are unusually cheap right now.

I think the case for buying McDonald’s shares at today’s prices is very strong. It’s impossible to eliminate risk entirely, but an unusually low P/E ratio goes a long way towards helping.

The post Near a 52-week low, McDonald’s shares look like unbelievable value appeared first on The Motley Fool UK.

More reading

Stephen Wright has no position in any of the shares mentioned. The Motley Fool UK has recommended Microsoft and Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance