Negative Rates: Four Real World Experiences

Negative interest rates are controversial. As we discover the extensive damage done to the global economy from the pandemic of 2020, there will likely be calls from some quarters for more central banks, including the US Federal Reserve (Fed), to cut short-term rates below zero. And, there could be considerable dissent.

We want to explore the empirical evidence in terms of market reactions to better appreciate the pros and cons for negative rates. For this study, we turn to the foreign exchange (FX) markets. In both the academic and practitioner literature, FX markets are a respected bellwether for the relative prospects of currency pairs, evaluating the differences in monetary policy, growth prospects, trade flows, and inflation. The question we are posing is: What have the FX markets told us about negative rates?

We will delve into why the FX markets are an especially good empirical guide as to how negative rates worked, examine the reasons for the implementation of negative rates, and then study four central banks that have experimented with negative rates. To anticipate our conclusions:

FX markets have typically (not every time) responded to a move into negative rates with a strengthening of the currency or a reduced pace of depreciation. While the quick response was appreciation, in some cases it did not last as other factors came into play.

We interpret currency appreciation as the market’s evaluation that the monetary policy has been tightened, not loosened as was intended.

The principal reason that negative rates are not stimulatory appears to be that they act as a tax on the banking system and actually restrict the provision of credit.

FX Theory & Relative Monetary Policy

FX markets determine the relative price of one currency versus another. As such, there is an abundance of literature studying exchange rates in terms of how monetary policy, economic growth, inflation, and trade flows impact currencies. David Hume (1741, 1758)1 was an early writer on the flow of money and its impact on exchange rates, arguing that increasing the money supply artificially would lead to inflation and a weaker currency. Hume made the point that such policies would not work to increase economic growth, since money (water, in his analogy) would flow among nations to find a level appropriate to the “art and industry” of each country.

The modern treatment of the relationship of monetary policy to exchange rates is anchored in the work of Nobel Prize winner Robert Mundell (1960, 1961, 1968),2 and carried through in the studies of Jacob Frenkel and Harry G. Johnson (1976),3 as well as Art Laffer (1969);4 summarized in a study by Stephen McGee (1976)5 and explored further in a collection of essays by Blu Putnam and Sykes Wilford (1986).6 This line of research, known as the monetary approach to the balance of payments, began in the 1960s when exchange rates were fixed to the US dollar, and the dollar to gold. The emphasis was on understanding why the central banks of some countries were losing their foreign reserves while others were gaining foreign reserves. Once FX rates were delinked from the US dollar and began to float independently in the early 1970s, there was intense interest in exchange rate movements. The Chicago Mercantile Exchange launched its currency futures products in the early 1970s, the first successful financial futures product. The monetary approach research shifted gears with the markets to focus on exchange rate determination.

The main theoretical concepts were that reserve flows under fixed exchange rates and exchange rate movements in a floating regime were balancing the relative attractions of different countries in terms of their economic growth prospects (i.e., faster growing countries can attract capital) and monetary policy (i.e., restrictive monetary policy with higher interest rates can attract capital). What was controversial back in the 1970s and 1980s was the role of the trade balance. The monetary approach argued that capital flows overwhelmed trade flows, and one had to focus, as David Hume did, on the relative attractiveness of the different economies taken as whole. Later research noted that when a country’s dependence on exports in its economy was relatively high, then trade flows increased in importance in exchange rate determination through their heightened relationship to economic growth (i.e., more exports led to faster growth and currency appreciation, everything else being equal).

The empirical evidence supporting the monetary approach seemed to work well in the 1970s and early 1980s when the money supply was easier to define and measure. The statistical relationship with the money supply broke down later in the 1980s and 1990s, as interest was paid on checking accounts, as money moved freely between investment, savings, and checking accounts, as credit cards gained market share over cash, etc. All of these developments in the structure of how payments were made eliminated the relationship between money supply and inflation, economic growth, and exchange rates. The empirical research then shifted to assessing the relative accommodation or restrictiveness of monetary policy using the shape of the yield curve. [See Erik Norland’s December 2019 research on “Which Yield Curve Foretells Growth Best?7 here] When short-term interest rates were below long-term yields - a positively sloped yield curve - then monetary policy was deemed accommodative. When short-term interest rates were equal to or above long-term yields, a flat or inverted yield curve indicated a restrictive monetary policy.

The main idea for exchange rates held that, other things being equal, a policy shift toward a more accommodative monetary policy would be expected to lead to currency depreciation or less appreciation if it were on a rising trend. And vice versa, a policy shift toward a more restrictive monetary policy would be expected to lead to currency appreciation or less depression if the currency were already on a downward trend.

Thus, our research into negative rates sets up the following question. When central banks announced and implemented negative rate policies, what happened to the exchange rate?

A fall in the exchange rate (or slower pace of appreciation) would indicate negative rates were an accommodative policy, as was anticipated by the central banks pushing rates below zero.

A rise in the exchange rate (or slower pace of depreciation) would indicate negative rates were a restrictive policy.

Four Real World Experiments

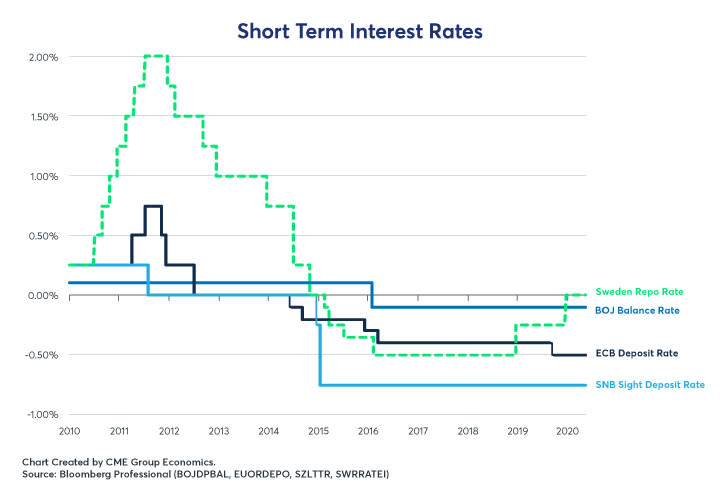

The European Central Bank (ECB), the Bank of Japan (BoJ), the Swiss National Bank (SNB) and Sweden’s Riksbank have experimented with negative interest rates from the mid-2010s (Figure 1), charging depositors as much as 0.75%. The decisions by these central banks to experiment with sub-zero interest rates was born of a common source of dissatisfaction. All four central banks were dissatisfied with the pace of economic recovery and with inflation rates that were persistently below target. Each one hoped that charging commercial banks to deposit funds with the central bank would result in greater extension of credit by the banking system, accelerate their respective economic recoveries, and raise inflation rates toward target levels.

There are two means by which proponents of negative rates hoped that sub-zero interest on deposits would achieve the objective of stronger real growth and higher inflation:

By charging depositors to park money in banks, the owners of those funds would instead spend or invest those monies, boosting aggregate demand, GDP growth and, eventually inflation.

Negative deposit rates would deter foreigners from holding their currency and that a weaker currency would boost exports, insulate domestic producers from competition and increase prices of imported goods. By the same token, it might also encourage domestic investors to invest abroad, selling their own currency and buying foreign currency in the process.

Figure 1: Since Late 2014, Four Central Banks Experimented with Negative Rates.

This second point is important because it is easier to achieve faster economic growth and higher inflation with a weak currency than with a strong one. That said, the hope that negative interest rates would bring about a weaker currency is rarely stated out loud. Other governments might frown on a beggar-thy-neighbor policy of intentionally weakening one’s currency into order to deal with domestic economic problems or to gain competitive advantage.

Even if the central banks that pursued negative rates had stated explicitly that they hoped to weaken the currencies by setting deposit rates below zero, their trading partners need not have worried. One might imagine that negative interest rates would hurt the value of a currency. Afterall, who would want to hold deposits in a currency where they must pay borrowers for the privilege of lending money? Yet, despite blurring the distinction between assets and liabilities, more often than not, currencies have strengthened rather than weakened in response to negative interest rates.

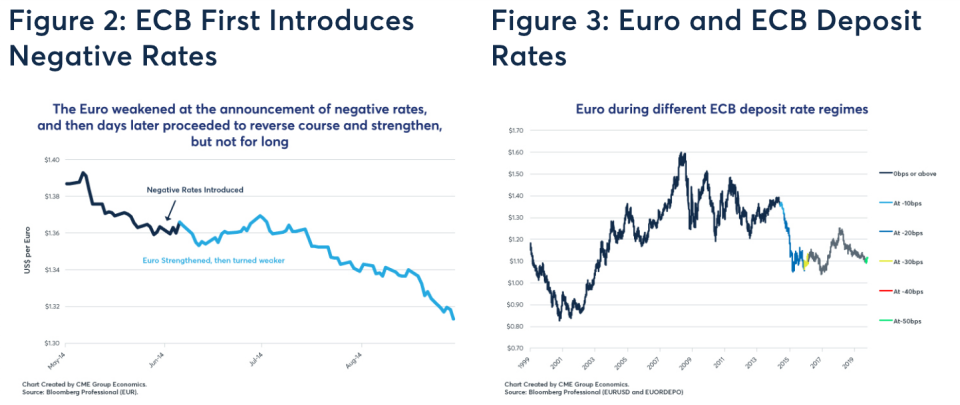

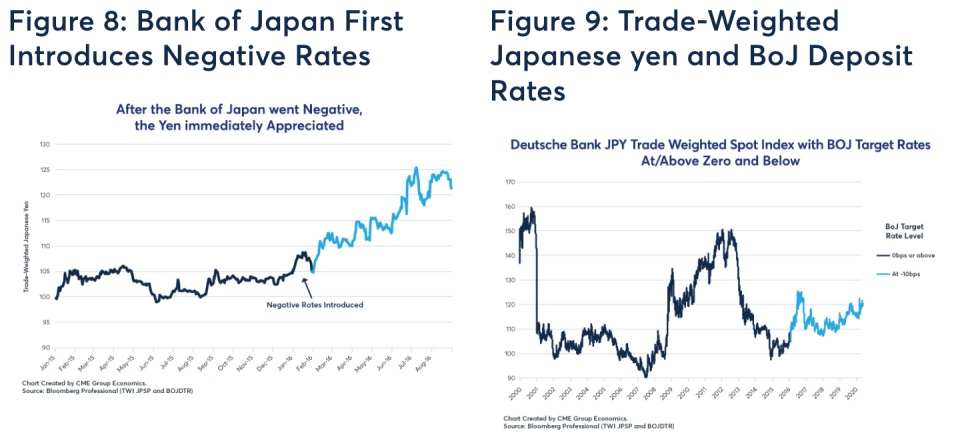

In the days and weeks immediately after the introduction of negative rates by each of the four central banks, all of the currencies appreciated – some more than others. (See Figures 2, 4, 6, and 8.) Longer-term, the picture is much more complicated, as one might expect since many more factors come into play besides negative interest rates.

Of the four central banks that set rates negative, two of them, Japan and Switzerland, quickly wound up with stronger currencies (Figures 5 and 9). Meanwhile, while the euro appreciated in the weeks after the initial move into negative rates with a -0.10% level, it quickly reversed and depreciated in no small part due to uncertainties surrounding bank stress tests and then the announcement and implementation of the ECB’s aggressive move into asset purchases. The euro did have a period of appreciation in 2017 extending into early 2018, which, interestingly, occurred a few months after the ECB had put the deposit rate at ever more deeply negative levels, at -0.40%. (Figure 3).

Figure 2: ECB First Introduces Negative Rates; Figure 3: Euro and ECB Deposit Rates

Figure 4: Swiss National Bank First Introduces Negative Rates; Figure 5: Trade-Weighted Swiss franc and SNB Deposit Rates

Figure 6: Swedish Riksbank First Introduces Negative Rates; Figure 7: Trade-Weighted Swedish krona and Riksbank Deposit Rates

Figure 8: Bank of Japan First Introduces Negative Rates; Figure 9: Trade-Weighted Japanese yen and BoJ Deposit Rates

The Swedish krona, like the euro, had a short-lived appreciation immediately after the Riksbank went negative. Soon though, the Swedish krona (SEK) started to weaken significantly under the negative interest rate regime. We note though, that SEK was falling much more quickly before the Riksbank went to negative rates. After they went to negative rates, SEK continued to fall but at a more jagged pace (Figure 7). On December 16, 2019, the Riksbank became the first and, so far, only central bank to raise rates back to zero. Ending the negative interest rate policy did not send SEK soaring. Rather in the five months following the end of negative rates in Sweden, SEK fell 2% versus the Euro (EUR), 5% versus the US dollar (USD) and 6% versus the Swiss franc (CHF).

Sweden’s case is special. First off, roughly half of Sweden’s trade is done with the Eurozone, Switzerland and Denmark, with Denmark setting its currency versus the euro. Sweden’s trade surplus, which once totaled 7% of GDP, has slowly but surely shrunk to around 2% of GDP even as Eurozone moved into a trade surplus. This factor alone probably explains why SEK weakened so much on a trade-weighted basis despite negative interest rates. What we observed, however, was that SEK was falling rapidly before negative rates came into effect but then fell less consistently as they eventually went to -50bps, only to resume a more rapid decline as the Riksbank raised rates to -25bps and then eventually put rates back at zero. As such, Sweden may be the counter-example that proves the point: all else being equal, negative interest rates tend to strengthen rather than weaken currencies. [See Erik Norland, “Sweden’s Experiment with Negative Rates”, CME Group, May 2020, https://www.cmegroup.com/education/featured-reports/swedens-experiment-with-negative-rates.html]8

Why would Negative Rates be a Tightening of Monetary Policy?

The answer may lie in how negative interest rates impact credit expansion, capital formation, money markets, and the banking system. For example, in 2019 in the Eurozone, banks paid € 7.6 billion to park money with the ECB. Moreover, since negative rates came into effect, the amount of money on deposit with the ECB has actually risen rather than fallen.

As many analysts, including ourselves9 (see article here) argued, when negative rates were first instituted, negative deposit rates act as a tax on the banking system. Banks were unlikely to be able to pass on the full costs of negative rates to their clients and depositors, so bank profits would be diminished, which would lead to greater caution in the expansion of credit.

There was also the signaling effect from the central bank. A move into negative rate territory was indicative that the central bank had a pessimistic view for the outlook for economic growth. This pessimistic signaling effect may have led investors and banks to prefer to pay a modest fee (i.e., the tax on deposits) to store their money rather than take the risk of spending or investing their money in an economy with little growth prospects.

Interestingly, despite the evidence that negative rates do not work as anticipated, as the world enters a deep recession stemming from the pandemic, we expect the idea to continue to be vigorously debated. There is a contentious division in the ECB’s council on this issue. In the US, many Fed governors and regional bank Presidents have indicated they do not think negative rates are appropriate for the US. "I continue to think, and my colleagues on the Federal Open Market Committee continue to think, that negative interest rates are probably not an appropriate or useful policy for us here in the United States," said Fed Chari Jerome Powell on May 2020.10

For example, when asked about negative interest rates, Charles Evans, President of the Federal Reserve Bank of Chicago, was dismissive: “I don’t anticipate it being a tool that we would be using in the U.S.” James Bullard, President of the St. Louis Federal Reserve Bank, noted using negative rates would be “problematic. ... It is not at all clear that they’ve been successful there [in Europe and Japan] ... we can use other tools to handle the situation.” Atlanta Federal Reserve Bank President Raphael Bostic commented that negative rates are “among the weaker tools in the toolkit."11 We also note that the former President of the Minneapolis Fed has come out in favor of negative rates. And, the Fed, as is the case with most central banks, wants to keep all its options open in these trying times, even if they do not think they would effort want to use negative rates.

This debate is on-going in the futures and options markets as well. On the CME, there have been trades in US federal funds futures at a price just above 100, indicating negative rates. And, there are strike prices on Eurodollar deposit rate call options above 100 (indicating negative rates), with open interest, indicating that some market participants have risk exposures that make them willing to buy call options that would only payoff in a negative rate environment.

To learn more about futures and options, go to Benzinga’s futures and options education resource.

Endnotes

David Hume, “Of the Balance of Trade” in Part II, Essay 5, in Essays: Moral, Political, and Literary (1758). Published in association with Scottish bookseller Alexander Kincaid. “Of the Balance of trade” was first published in 1741 and later corrected and then included in this volume of essays.

Robert Mundell is arguably the father of modern theories of exchange rate dynamics and balance of payments, for which he won the Nobel Prize in 1999. Among others, see: “The Monetary Dynamics of International Adjustment under Fixed and Flexible Exchange Rates”, Quarterly Journal of Economics, May 1960, pp 227-257; "The international disequilibrium system." Kyklos 14.2 (1961): 153-172; and International Economics, New York, 1968.

acob Frenkel and Harry G. Johnson, The Monetary Approach to the Balance of Payments, University of Toronto Press, 1976.

Arthur B. Laffer, “The U.S. Balance of Payments – A Financial Center View”, Journal of Law and Contemporary, 1969, Volume 34, pp. 33-46.

Stephen P. Magee, "The Empirical Evidence on the Monetary Approach to the Balance of Payments and Exchange Rates." The American Economic Review, 66.2 (May 1976): 163-170.

Bluford H. Putnam, and D. Sykes Wilford. The Monetary Approach to International Adjustment. Praeger Publishers, 1986.

Erik Norland, “Which Yield Curve Foretells Growth Best?”, CME Group, December 2019, URL: https://www.cmegroup.com/education/featured-reports/which-yield-curve-foretells-growth-the-best.html

Erik Norland, “Sweden’s Experiment with Negative Rates”, CME Group, May 2020, URL: https://www.cmegroup.com/education/featured-reports/swedens-experiment-with-negative-rates.html

See the video in Market Watch from November 12, 2019, “Economist Perspective: Negative Rates—An Option in the Fed’s Playbook?”, https://sponsor.marketwatch.com/cme-group/economist-perspective-negative-rates-an-option-in-the-feds-playbook/. Also, read the research, “Negative Rates Not Needed, Not Helpful” from CME Group at URL https://www.cmegroup.com/education/files/negative-rates-not-needed-not-helpful.pdf

Fed Chair Jerome Powell interview on CBS “60 Minutes” TV show aired on May 18, 2020, with correspondent Scott Pelley. https://www.cbsnews.com/news/jerome-powell-negative-interest-rates-federal-reserve/.

All of the quotes from the Presidents of Federal Reserve Banks were cited in a Reuters new story by Ann Safer on May 11, 2020: https://www.reuters.com/article/us-usa-fed-negative-rates-idUSKBN22N2SN

See more from Benzinga

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance