Nelnet Inc (NNI) Significantly Outperforms Analyst EPS Estimates in Q1 2024

GAAP Net Income: Reported at $73.2 million for Q1 2024, significantly exceeding the estimated $46.00 million.

Earnings Per Share (EPS): Achieved $1.97, surpassing the estimate of $1.14.

Revenue from Loan Servicing and Systems: Totaled $127.2 million, falling short of the previous year's $139.2 million.

Education Technology Services and Payments Revenue: Increased to $143.5 million from $133.6 million year-over-year, indicating growth in this segment.

Net Income from Asset Generation and Management: Turned to a profit of $25.6 million from a loss of $0.2 million in the previous year.

Share Repurchases: Acquired 817,826 shares year-to-date for $75.3 million, reflecting confidence in stock value.

Dividend: Declared a Q2 cash dividend of $0.28 per share, payable on June 14, 2024.

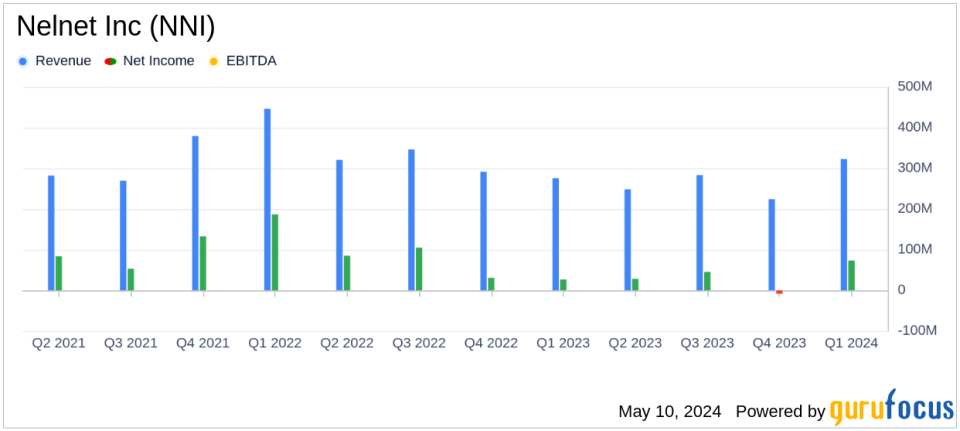

Nelnet Inc (NYSE:NNI) disclosed its financial results for the first quarter of 2024 on May 9, 2024, revealing a substantial increase in earnings per share and net income. The company reported a GAAP net income of $73.2 million, or $1.97 per share, significantly surpassing the analyst's EPS estimate of $1.14. This performance marks a notable improvement from the $26.5 million, or $0.71 per share, recorded in the same period last year. For a detailed view of the financials, refer to Nelnet Inc's 8-K filing.

Nelnet operates across four segments, with its Loan Servicing and Systems segment being a significant revenue contributor. This segment, along with the Education Technology, Services, and Payment Processing segment, forms the core of Nelnet's operations, providing diversified educational and financial services.

Financial Performance and Segment Highlights

The Asset Generation and Management (AGM) segment experienced a decrease in net interest income from loans and investments, dropping to $40.6 million from $45.5 million in the previous year, largely due to a reduced loan portfolio. However, AGM's net income after tax showed a remarkable recovery, posting $25.6 million compared to a negligible loss last year, bolstered by favorable changes in the fair value of derivative instruments.

Nelnet Bank, a relatively new segment, demonstrated modest growth with a net income after tax of $0.9 million, an improvement over a slight net loss in the prior year. This segment's total deposits reached $960.6 million as of March 31, 2024.

The Loan Servicing and Systems segment, however, saw a decrease in revenue to $127.2 million from $139.2 million year-over-year, with a corresponding decline in net income after tax to $12.2 million from $19.2 million. This was attributed to a decrease in the volume of loans serviced.

Conversely, the Education Technology Services and Payments segment reported a revenue increase to $143.5 million from $133.6 million in the previous year, with net income after tax rising to $36.2 million from $28.7 million, reflecting robust operational performance and strategic positioning.

Strategic Initiatives and Market Positioning

CEO Jeff Noordhoek expressed satisfaction with the quarter's results, highlighting the strength of Nelnet's core businesses despite market uncertainties. The company's strategic initiatives, including significant share repurchases and investments in loan acquisitions and capital management, underscore its proactive approach to leveraging its strong liquidity position for growth and shareholder value enhancement.

Year to date, Nelnet has repurchased 817,826 shares, reflecting confidence in the company's valuation and future prospects. Additionally, the Board of Directors declared a quarterly cash dividend of $0.28 per share, payable on June 14, 2024, further affirming the company's commitment to delivering shareholder returns.

Challenges and Forward Outlook

Despite the positive financial outcomes, Nelnet faces challenges including the management of loan portfolio runoffs and servicing volume reductions. The competitive environment and regulatory landscape also pose ongoing challenges that could impact future performance. However, the company's diversified business model and strategic investments position it well to navigate these complexities and capitalize on emerging opportunities.

In conclusion, Nelnet's Q1 2024 results not only exceeded analyst expectations but also demonstrated the effectiveness of its strategic initiatives and the resilience of its business model. As the company continues to execute its growth strategies and navigate market challenges, it remains well-positioned for sustained financial and operational success.

Explore the complete 8-K earnings release (here) from Nelnet Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance