Neogen (NEOG) Inks Genomics Deal to Aid in Food Tracing

Neogen Corporation NEOG recently announced that it has formed a genomics partnership with Performance Food Group PFGC to make it the official genomics provider for the food group’s PathProven technology.

Performance Food Group is an industry leader and one of the largest food and food service distribution companies in North America with more than 150 locations in North America.

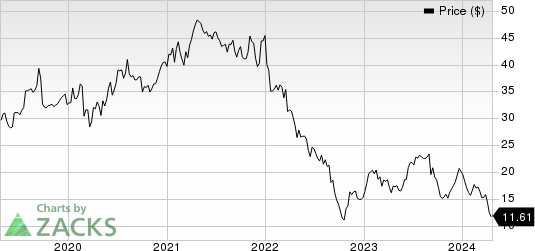

Price Performance

Over the past six months, NEOG’s shares have lost 22.8% against the industry’s rise of 13.9%. The S&P 500 increased 17.7% in the same time frame.

Image Source: Zacks Investment Research

More on the News

Performance Food Group's PathProven food trace technology, backed by Neogen genomics' industry-leading DNA testing capabilities, enables food products to be tracked back to their original farm, feedlot, or ocean. This allows for meticulous inspection and regulation of the entire production process, guaranteeing the products' origin and quality. Neogen now has a new chance to contribute to the sustainability and efficiency of the protein supply chain due to this partnership.

Neogen's portfolio — which covers everything from food security to discovery — will be implemented by Performance Food Group as a result of this partnership in its protein production process. Greater protein efficiency will be facilitated by this deeper integration of genomics technologies inside sourcing procedures.

Notable Developments

Neogen has recently launched Neogen Farm Fluid MAX in Great Britain and is likely to be available soon in other European markets, subject to global registrations and notifications. This dual-action disinfectant is designed for challenging farm conditions and is formulated for use as part of a Neogen Pathogen Programme.

Neogen has also recently launched the SureKill Gel Bait Pro Applicator. It is the newest product in the SureKill pest management line. Crafted with industrial-grade plastic and steel, the SureKill Gel Bait Pro Applicator is a durable, lightweight tool. It allows users to easily target inconvenient and challenging areas while minimizing bait waste and innovating baiting protocols.

In January, Neogen launched the Provecta Pro Flea & Tick Collar for dogs. It offers convenient and mess-free protection for dogs and puppies of 12 weeks and older. It contains two active ingredients, Deltamethrin and the IGR (S)-Methoprene and provides long-lasting, full-body protection against fleas, ticks, and mosquitoes for six months.

Neogen Corporation Price

Neogen Corporation price | Neogen Corporation Quote

Zacks Rank & Stocks to Consider

NEOG carries a Zacks Rank #4 (Sell) at present.

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA and Cardinal Health, Inc. CAH.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 58.3% compared with the industry’s 18.9% rise in the past year.

Cardinal Health, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 51.9% compared with the industry’s 3.2% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

Performance Food Group Company (PFGC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance