NeoGenomics (NASDAQ:NEO) Shareholders Have Enjoyed A Whopping 335% Share Price Gain

It hasn't been the best quarter for NeoGenomics, Inc. (NASDAQ:NEO) shareholders, since the share price has fallen 28% in that time. But that does not change the realty that the stock's performance has been terrific, over five years. In fact, during that period, the share price climbed 335%. Impressive! So we don't think the recent decline in the share price means its story is a sad one. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

See our latest analysis for NeoGenomics

Because NeoGenomics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, NeoGenomics can boast revenue growth at a rate of 20% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 34%(per year) over the same period. Despite the strong run, top performers like NeoGenomics have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

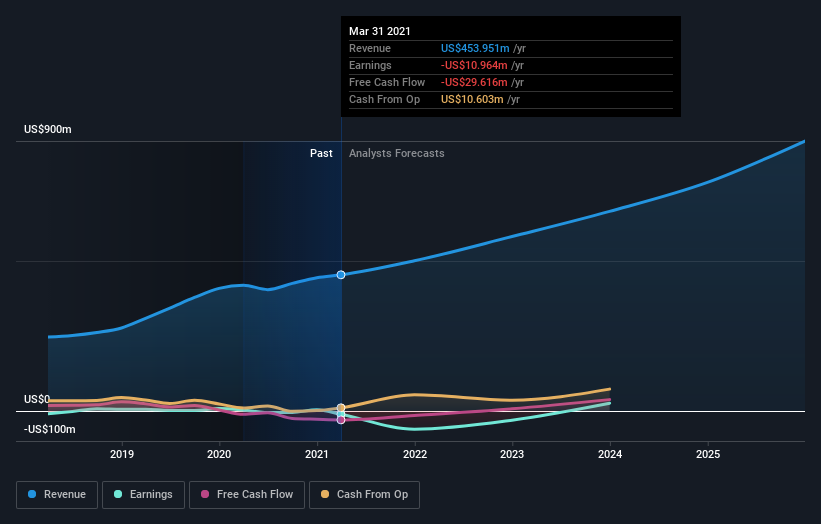

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

NeoGenomics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling NeoGenomics stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

NeoGenomics shareholders are up 43% for the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 34% per year over five year. It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand NeoGenomics better, we need to consider many other factors. For instance, we've identified 3 warning signs for NeoGenomics that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance