NetApp Teams Up With Aruba for Enhanced Data Center Solutions

NetApp NTAP has inked a partnership with Aruba, a leading provider of cloud, data center, hosting and domain services in Europe, to bolster the potential data management and storage solutions nationwide. By integrating NTAP’s deep expertise in data infrastructure with Aruba’s advanced services, the collaboration is likely to aid businesses in managing, storing and securing their data.

Although Aruba has relied on NetApp’s solutions for over a decade, the recent announcement marks the formalization of their collaboration. NetApp is now designated as Aruba’s preferred data infrastructure provider. With the support of NetApp’s advanced data infrastructure, Aruba is well-positioned to design new flagship products that will be labeled “Powered by NetApp.” The tie-up is expected to fuel the development of cutting-edge solutions tailored to the specific needs of their enterprise customers.

NetApp’s solutions offer enhanced security and visibility into data management processes. By adopting NTAP’s technology as part of its core infrastructure, Aruba can pass on these benefits to its customers. In addition, the alliance will pursue joint innovation and strategic initiatives to expand its market presence and provide its customers with optimized data center solutions.

Healthy uptake of NetApp’s data infrastructure solution acts as a major growth driver for the company. Recently, a key provider of business planning and decision-making platforms – Anaplan – adopted NTAP’s unified data storage solution to strengthen the storage systems across its four global data centers. In August 2024, San Jose Sharks, a premier professional ice hockey team in Silicon Valley selected NTAP as the preferred data infrastructure provider for the team. By using NTAP’s modern technology, the Sharks are likely to efficiently manage their digital assets, especially in delivering immersive fan experiences through innovative media content.

Strength in All-flash Arrays to Power NTAP’s Top Line

NetApp is gaining from rising demand for its portfolio of modern all-flash arrays, especially the C-series capacity flash and ASA block-optimized flash. It is expecting the newly launched AFF A-series, along with its C-series and ASA products, to capture a significant chunk of the all-flash market. In the first quarter of fiscal 2025, the company’s All-Flash Array Business’ annualized net revenue run rate was $3.4 billion, up 21% year over year. Total billings rose 12% to $1.45 billion.

Also, steady momentum across flash, block, cloud storage and artificial intelligence (AI) solutions propels top-line expansion. Revenues increased 8% year over year to $1.54 billion in the fiscal first quarter. During the quarter, the company won more than 50 AI and data lake modernization deals. Owing to all these factors, it has raised its outlook for fiscal 2025. NetApp expects full-year revenues in the range of $6.48–$6.68 billion, up 5% year over year at the mid-point. Earlier it projected sales in the band of $6.45–$6.65 billion.

San Jose, CA-based NetApp is a global provider of intelligent data infrastructure. It is known for its cutting-edge solutions that integrate data storage and CloudOps to deliver seamless data management across various cloud environments. The company is focused on creating a unified, silo-free infrastructure by harnessing AI and observability to manage data efficiently, securely and resiliently.

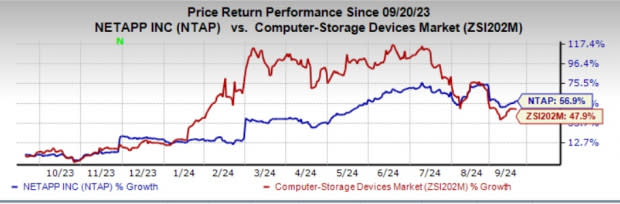

NTAP’S Zacks Rank & Stock Price Performance

Currently, NTAP carries a Zacks Rank #2 (Buy). Shares of the company have gained 56.9% in the past year compared with the sub-industry's growth of 47.9%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are Harmonic Inc. HLIT, Arista Networks, Inc. ANET and Ubiquiti Inc. UI. HLIT and UI sport a Zacks Rank #1 (Strong Buy), whereas ANET carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Harmonic enables media companies and service providers to deliver ultra-high-quality broadcast and OTT video services to consumers globally. HLIT delivered a trailing four-quarter average earnings surprise of 32.5%.

Ubiquiti company offers a comprehensive portfolio of networking products and solutions for service providers and enterprises. The company’s effective management of its strong global network of more than 100 distributors and master resellers improved its visibility for future demand and inventory management techniques.

Arista Networks supplies products to a prestigious set of customers, including Fortune 500 global companies in markets like cloud titans, enterprises, financials and specialty cloud service providers. It delivered a trailing four-quarter average earnings surprise of 15.02%. In the last reported quarter, ANET delivered an earnings surprise of 8.25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report