The Netflix (NASDAQ:NFLX) Share Price Has Soared 534%, Delighting Many Shareholders

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. For example, the Netflix, Inc. (NASDAQ:NFLX) share price is up a whopping 534% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. It's down 4.1% in the last seven days.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for Netflix

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

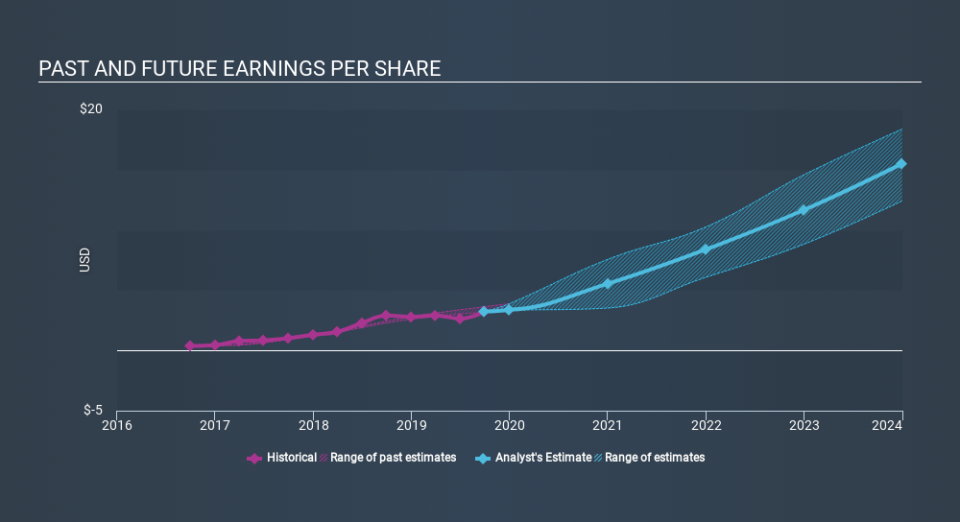

During five years of share price growth, Netflix achieved compound earnings per share (EPS) growth of 42% per year. This EPS growth is reasonably close to the 45% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. In fact, the share price seems to largely reflect the EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Netflix has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Netflix shareholders are up 7.1% for the year. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 45% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Is Netflix cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Netflix better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance