Netflix (NFLX) Q1 Earnings Beat, User Growth Misses Estimates

Netflix NFLX reported first-quarter 2021 earnings of $3.75 per share, beating the Zacks Consensus Estimate by 25.8% and the company’s guidance of $2.97. Moreover, the figure surged 138.9% year over year.

Revenues of $7.16 billion increased 24.2% year over year and also beat the consensus mark by 0.4%. Average revenue per membership increased 6% year over year on a reported basis (5% on foreign-exchange neutral basis).

The streaming giant added 3.98 million paid subscribers globally against addition of 15.77 million in the year-ago quarter and beat its guidance of 6 million paid-subscriber addition.

At the end of the first quarter, Netflix had 207.64 million paid subscribers globally, up 13.6% year over year, missing management’s expectation of 209.66 million paid subscribers.

The miss reflects growing competition from services launched by Apple AAPL, Disney DIS, ViacomCBS, AT&T T, Discovery and Comcast. However, the year-over-year growth benefited from solid content portfolio.

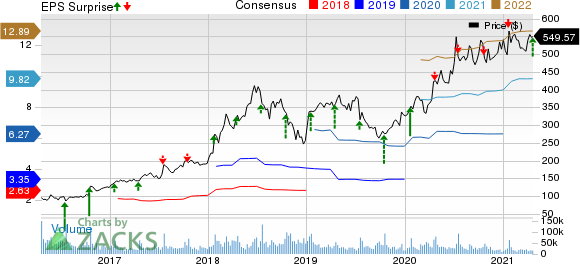

Netflix, Inc. Price, Consensus and EPS Surprise

Netflix, Inc. price-consensus-eps-surprise-chart | Netflix, Inc. Quote

Notably, this Zacks Rank #3 (Hold) company now expects paid net additions to be 1 million compared with the year-ago quarter’s 10.09 million, reflecting stiff competition. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Netflix were down almost 8.5% in pre-market trading following the results.

Segmental Revenue Details

United States and Canada (UCAN) reported revenues of $3.17 billion, which rose 17.3% year over year and accounted for 44.3% of total revenues. ARPU grew 9% from the year-ago quarter on a foreign-exchange neutral basis.

Paid-subscriber base increased 6.3% from the year-ago quarter to 74.38 million. The company added 0.45 million paid subscribers, down 80.5% year over year.

Europe, Middle East & Africa (EMEA) reported revenues of $2.34 billion, which surged 36% year over year and accounted for 32.7% of total revenues. ARPU grew 4% from the year-ago quarter on a foreign-exchange neutral basis.

Paid-subscriber base increased 16.7% from the year-ago quarter to 68.51 million. The company added 1.81 million paid subscribers, down 74% year over year.

Latin America’s (LATAM) revenues of $837 million increased 5.5% year over year, contributing 11.7% of total revenues. ARPU grew 4% from the year-ago quarter on a foreign-exchange neutral basis.

Paid-subscriber base rose 10.4% from the year-ago quarter to 37.89 million. The company added 0.36 million paid subscribers, down87.6% year over year.

Asia Pacific’s (APAC) revenues of $762 million soared 57.4% year over year and accounted for 10.6% of total revenues. ARPU increased 3% year over year on a foreign-exchange neutral basis.

Paid-subscriber base jumped 35.3% from the year-ago quarter to 26.85 million. The company added 1.36 million paid subscribers, down 62.2% year over year.

Content Details

Netflix’s first-quarter content slate included Firefly Lane, Lupin, Fate: The Winx Saga, Ginny & Georgia, season 3 of Cobra Kai, Below Zero, Space Sweepers, Squared Love and Who Killed Sara?.

Movies included I Care ALot, YES DAY, Outside the Wire, and the last installment of To All the Boys I’ve Loved Before.

Markedly, Netflix plans to spend more than $17 billion in cash on content this year. The company also plans to launch more originals compared to 2020.

Netflix has a strong content portfolio for the second half of 2021 that includes Sex Education, The Witcher, La Casa de Papel (aka Money Heist) and You. Original movies include The Kissing Booth finale, Red Notice, Don’t Look Up and Too Hot to Handle.

Operating Details

Marketing expenses declined 13.2% year over year to $762.6 million. As a percentage of revenues, marketing expenses decreased 460 basis points (bps) to 11.5%.

Moreover, consolidated operating income surged 108.1% year over year to $954.3 million, driven by higher-than-expected revenue and subscriber growth. Consolidated operating margin expanded 600 bps on a year-over-year basis to 14.4%.

Balance Sheet & Free Cash Flow

Netflix had $8.40 billion of cash and cash equivalents as of Mar 31, 2021, compared with $8.21 billion as of Dec 31, 2020.

Long-term debt was $14.86 billion as of Mar 31, 2021, up from $15.8 billion as of Dec 31, 2020. Streaming content obligations were $20.73 billion compared with $19.22 billion as of Dec 31, 2020.

Netflix reported free cash flow of $691.7 million against free cash outflow of $284 million in the year-ago quarter.

Guidance

For the second quarter of 2021, Netflix forecasts earnings of $3.16 per share. The Zacks Consensus Estimate is pegged at $2.61 per share, lower than the company’s expectation, indicating growth of 64.2% from the figure reported in the year-ago quarter.

Netflix expects to end the second quarter of 2021 with 208.64 million paid subscribers globally, indicating growth of 8.1% from the year-ago quarter.

Total revenues are anticipated to be $7.30 billion, suggesting growth of 18.8% year over year. The Zacks Consensus Estimate for revenues stands at $7.37 billion, higher than the company’s expectation.

Operating margin is projected at 25.5% compared with 22.1% in the year-ago quarter.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AT&T Inc. (T) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance