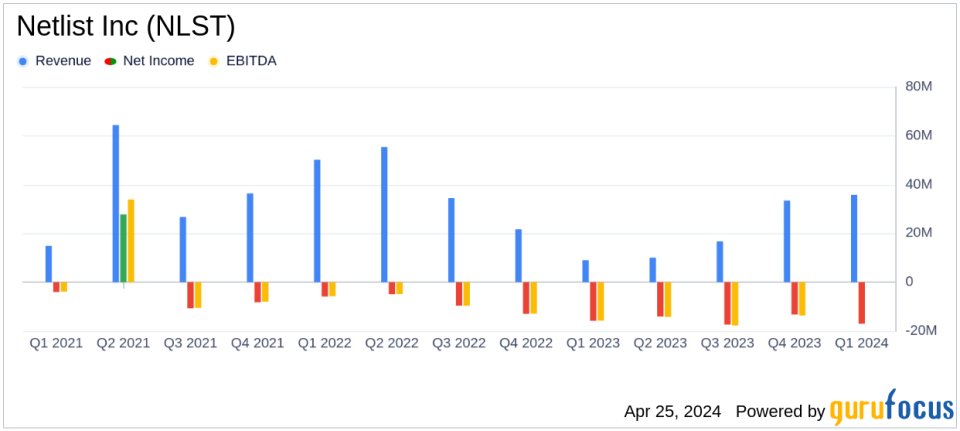

Netlist Inc (NLST) Q1 2024 Earnings: Misses Analyst Forecasts Amid Patent Challenges

Revenue: Reached $35.8 million, a substantial increase from $9.0 million in the same quarter last year, exceeding estimates of $35.0 million.

Net Loss: Widened to $17.0 million from $15.8 million year-over-year, falling short of the estimated loss of $12.0 million.

Earnings Per Share (EPS): Reported at -$0.07, below the estimated -$0.05.

Gross Profit: Marginally increased to $0.7 million from $0.6 million in the prior year's quarter.

Cash Position: Ended the quarter with $41.1 million in cash, cash equivalents, and restricted cash.

Stockholders' Equity: Stood at $10.4 million as of March 30, 2024.

Total Assets: Recorded at $64.6 million, with a noted decrease from the previous quarter's $72.8 million.

On April 25, 2024, Netlist Inc (NLST) disclosed its financial outcomes for the first quarter, ending March 30, 2024, through an 8-K filing. The company, a pioneer in memory and storage solutions, reported a significant increase in revenue but also a deepening of its net loss, diverging from analyst expectations.

Financial Performance Overview

Netlist Inc's revenue for Q1 2024 reached $35.8 million, up from $9.0 million in the same quarter the previous year, marking a nearly fourfold increase. This performance slightly exceeded the estimated revenue of $35.0 million. However, the company's net loss widened to $17.0 million, or $0.07 per share, compared to a net loss of $15.8 million, or $0.07 per share, year-over-year. This result did not align with the anticipated net loss of $12.0 million, or $0.05 per share.

Gross profit marginally increased to $0.7 million from $0.6 million in the prior year's quarter. Despite the revenue surge, the gross profit remains relatively flat due to the cost of sales which stood at $35.1 million.

Challenges and Strategic Focus

Netlist's CEO, C.K. Hong, highlighted the company's robust revenue growth but also expressed concerns over recent unfavorable Patent Trial Board (PTAB) decisions regarding Netlist's '912 patent. These legal setbacks pose significant challenges as the company strives to protect and monetize its intellectual property. Hong reaffirmed the commitment to defending Netlists patents and exploring all options to address these legal adversities.

Operational and Financial Metrics

As of March 30, 2024, Netlist reported cash and cash equivalents of $28.7 million, a decrease from $40.4 million at the end of 2023. Total assets stood at $64.6 million, down from $72.8 million at the previous year-end. The company's working capital was reported at $9.0 million, indicating some liquidity to manage short-term obligations.

The balance sheet shows an increase in total liabilities to $54.3 million from $49.0 million, reflecting a rise in accounts payable and other financial commitments. Stockholders equity decreased to $10.4 million, down from $23.8 million, primarily due to the widened net loss.

Looking Ahead

Despite the challenging quarter, Netlist's management remains focused on navigating the intellectual property landscape and leveraging its technological innovations to improve financial health. The company's ability to continue innovating in the memory and storage sector is crucial for its long-term success amid competitive and legal pressures.

Investors and stakeholders are encouraged to follow the upcoming investor conference call hosted by CEO C.K. Hong and CFO Gail Sasaki for deeper insights into the quarter's results and strategic initiatives moving forward.

For more detailed information and future updates, visit Netlists website or consult their latest SEC filings.

Explore the complete 8-K earnings release (here) from Netlist Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance