Newell (NWL) Looks Well-Placed on Strong Demand & Innovation

Newell Brands NWL has been gaining from solid demand, product innovation and robust core sales growth. This, along with a solid e-commerce business, remains a key growth driver.

The company has been on track to leverage its robust e-commerce capabilities, which have remained strong for some time now. It continues to strengthen its e-commerce business via increased investments and better customer engagement. Newell’s earlier launched “buy online and pick up in stores” and “ship from store” services in its Yankee Candle retail stores have been doing well. Going forward, management expects further digital penetration, driven by expanded omni-channel capabilities.

Continued improvements in the Writing business, driven by product innovation and strength in the Sharpie and Paper Mate brands, bode well. Newell witnessed improvements in the Writing business in first-quarter 2022, driven by some accelerated back-to-school orders. Consequently, the Writing business looks well-positioned for growth in 2022. Management remains optimistic about the next back-to-school season on the back of robust merchandising plans to meet demand. The company also remains focused on product innovations in this category, with a number of products to be launched later this year.

Driven by these factors, this Zacks Rank #3 (Hold) stock posted impressive first-quarter 2022 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate and grew year over year. Net sales grew 4.4% year over year, driven by core sales growth of 6.9%, as five of the seven business units witnessed higher core sales. This marked the seventh successive quarter of core sales growth. Also, the bottom line beat earnings estimates for the 11th straight quarter.

Management issued an upbeat view for the second quarter and 2022. The company anticipates net sales of $9.93-$10.13 billion for 2022, with core sales of flat to up 2%. The normalized operating margin is expected to be 11.5-11.8%. Normalized earnings per share are forecast to be $1.85-$1.93 for 2022.

For second-quarter 2022, net sales are envisioned to be $2.52-$2.57 billion, with core sales growth in the low-single digits. For the quarter, the company expects a normalized operating margin of 11.7-12.1% and normalized earnings of 45-48 cents per share.

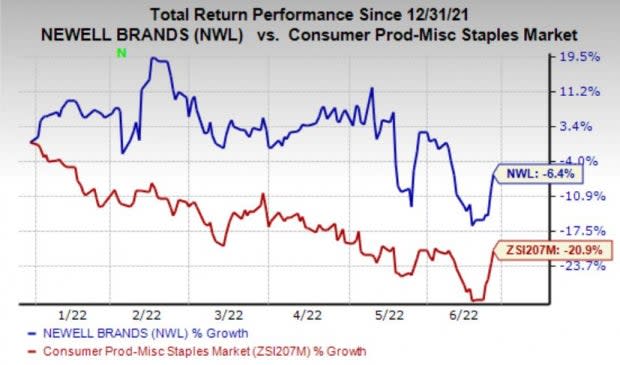

Image Source: Zacks Investment Research

We note that shares of NWL have lost 6.4% year to date compared with the industry’s decline of 20.9%.

Despite these upsides, the company has been witnessing elevated advertising and promotional expenses related to product launches and omni-channel investments. Ongoing inflationary pressures, mainly related to resin, sourced finished goods, transportation and labor costs, remain concerning. The company also remains exposed to industry-wide supply-chain disruptions, including port congestion, limited container availability, and shortage of labor and truck drivers.

Wrapping Up

Newell Brands appears to be a solid bet, backed by tailwinds, including product innovation, robust demand and a solid online show. Earnings estimates for the current financial year have increased 1.1% to $1.92 over the past 60 days.

Stocks to Consider

Here are three better-ranked stocks to consider — Dillard’s DDS, Boot Barn Holdings BOOT and Canada Goose GOOS.

Dillard’s operates as a departmental store chain, featuring fashion apparel and home furnishings. It presently sports a Zacks Rank #1 (Strong Buy). DDS has a trailing four-quarter earnings surprise of 224.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dillard’s current financial-year sales suggests growth of 6.1%, while the same for EPS indicates a decline of 33.9% from the year-ago period’s reported numbers. DDS has an expected EPS growth rate of 12.6% for three-five years.

Boot Barn, which provides western and work-related footwear, apparel and accessories, currently has a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 25.2%, on average.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales and EPS suggests growth of 17% and 4.4%, respectively, from the year-ago period’s reported figures. BOOT has an expected EPS growth rate of 20% for three-five years.

Canada Goose is the designer, manufacturer, distributor and retailer of premium outerwear for men, women and children. It currently carries a Zacks Rank #2. GOOS has a trailing four-quarter earnings surprise of 65.9%, on average.

The Zacks Consensus Estimate for Canada Goose’s current financial year’s EPS suggests growth of 64.4% from the year-ago period’s reported figures. GOOS has an expected EPS growth rate of 27.4% for three-five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newell Brands Inc. (NWL) : Free Stock Analysis Report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance