Newell (NWL) to Sell Rawlings as Part of Transformation Plan

Newell Brands Inc. NWL has agreed to sell its sporting goods subsidiary, Rawlings Sporting Goods Company, Inc., to a fund managed by Seidler Equity Partners (“SEP”). The private investment firm has partnered with Major League Baseball (“MLB”) for the transaction. The sale will include the Rawlings, Miken and Worth brands of the St. Louis, MO-based subsidiary.

Newell Brands will receive gross proceeds of nearly $395 million from the transaction. Further, after-tax proceeds from the sale are expected to be about $340 million. The company plans to use these proceeds for deleveraging and share repurchases. Rawlings generated net sales of about $330 million in 2017.

The company’s agreement to sell Rawlings is in sync with its Accelerated Transformation Plan. The plan is expected to create value and transform the company into a simpler, stronger and faster one to leverage its abilities with respect to innovation, design and e-commerce. It aims at restructuring Newell’s portfolio in to seven core consumer segments that can generate above $9 billion sales; offloading non-core businesses; utilizing proceeds from divestitures along with free cash flow to lower debt and make share repurchase; and retaining investment grade rating with annual dividend of 92 cents per share through 2019, targeting 30-35% payout ratio.

Further, the execution of the plan will lead to simplification of the company’s operations, which is likely to reduce the company’s number of manufacturing facilities by 66%, distribution centers by 55%, brands by 45% and employees by 39%. It will also reduce above 30 ERP systems to two by the end of 2019. Moreover, management will focus on right-sizing the cost structure for anticipated smaller net sales, remove stranded corporate expenses and recover synergies lost through divestitures. These efforts will help improve operational performance and enhance shareholder value amid a rapidly changing retail backdrop.

Coming back to Rawlings, this iconic sports brand is likely to gain from its association with Seidler Equity Partners and Major League Baseball. These firms will recognize new opportunities for Rawlings and its employees. The companies expect to complete the transaction in 30-45 days, depending upon the satisfaction of customary closing conditions and regulatory approvals.

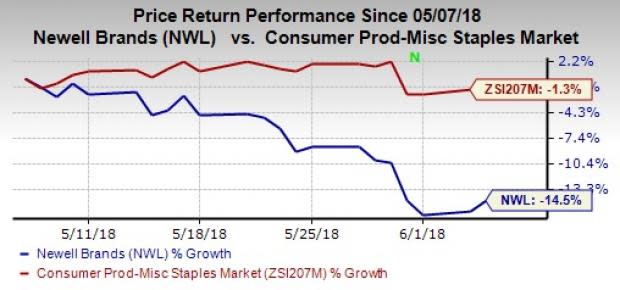

Following the news, shares of Newell Brands rose 1.6%. However, this Zacks Rank #3 (Hold) stock has decreased 14.5% in the past month, wider than the industry’s decline of 1.3%.

3 Top-Ranked Consumer Staples Stocks

The Boston Beer Company, Inc. SAM has delivered an average positive earnings surprise of 41.8% in the trailing four quarters. It has long-term earnings growth rate of 9.5% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inter Parfums Inc. IPAR has delivered an average positive earnings surprise of 11.8% in the last four quarters and has long-term earnings growth rate of 12.3%. Further, the stock currently flaunts a Zacks Rank #1.

MEDIFAST INC. MED is a Zacks #1 Ranked stock and it has pulled off an average positive earnings surprise of 16.8% in the trailing four quarters. It also has long-term earnings growth rate of 15%.

Today's Stocks From Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6% and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newell Brands Inc. (NWL) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance