In the News: The Race to AI Dominance, Powell's Pump, & Blood Bath & Beyond

AI Competition Heats Up

Shares of Chinese internet juggernaut Baidu BIDU have been on a hot streak recently after news broke that the company joined the global race for AI dominance. On Tuesday, shares vaulted higher by more than 10% on massive volume as Baidu announced that its ChatGPT competitor would launch in the coming days.

Image Source: Zacks Investment Research

Though the race for AI supremacy is in its infancy, the early leader and first mover is Microsoft MSFT. The world’s most dominant player has been pouring billions of dollars into OpenAI’s ChatGPT. AI chatbot ChatGPT has had such a successful debut that it is the fastest consumer app to reach 100 million active users, and it is on its way to monetization (customers can pay $42 a month to avoid delays during high traffic periods). Tuesday, shares rose strongly on heavy volume after Microsoft held a special ChatGPT-focused event. At the event, Microsoft management explained to investors how AI integrate with the company’s vast suite of products - including the unveiling of a new AI-powered Edge browser and Bing search engine

Image Source: Zacks Investment Research

While Microsoft and OpenAI’s ChatGPT is the first AI platform to get widespread usage and adoption, Google parent Alphabet GOOGL has been working on AI behind the scenes for years. In fact, a Google engineer made headlines last year when he divulged that he believed Google’s AI was sentient; in other words, it was conscious. On Monday, Google announced that it would unveil its AI offering called “Bard” in the coming days. Google has been dominating the search and internet content space for years. However, ChatGPT is becoming a formidable competitor – or at least garnering management’s attention.

The Powell Pump

Federal Reserve Chairman Jerome Powell boosted markets through his comments on Tuesday. Powell praised the current job market by saying, “demand for U.S. workers is 5 million greater than the available supply”. He also downplayed inflation by saying, “a big part of inflation is related to the pandemic itself.”

Beyond Petroleum? Not so Fast

Despite missing earnings expectations for the first time in two years, shares of British Petroleum BP shot to new 52-week highs in Tuesday’s session.

Image Source: Zacks Investment Research

Though the oil exploration giant missed expectations, the company delivered record annual profits of nearly $28 billion. Like Chevron (CVX), BP announced that it would seek to return money to shareholders in the form of an increased dividend payout (10% increase) and a $2.75 billion buyback. The main headline that emerged from the earnings call was the reversal in course of the company’s bold climate goals. In earlier earnings calls, BP’s CEO said the company aimed to reduce its carbon footprint by 35-40% by 2030 through green initiatives. During last night’s earnings call, BP lowered its target to between 20-30%, citing existing investments in production. After lagging in the market in recent days, energy stocks such as BP and Exxon Mobil XOM outperformed.

Blood Bath & Beyond

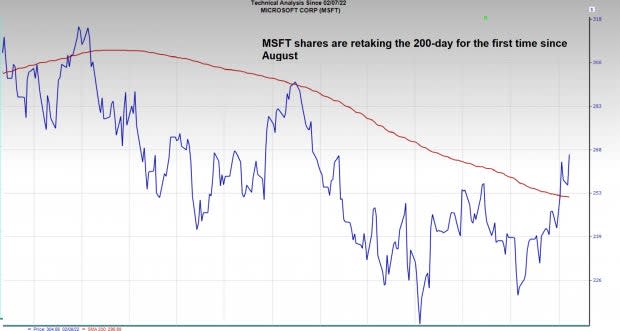

After rising more than 100% intraday on Monday, struggling retailer Bed Bath & Beyond BBBY roundtripped nearly all of its gains on Tuesday. Earlier in the week, the stock rose on hopes of a rumored leveraged buyout offer. Monday after the close, management announced that it would issue more than 95 million shares of common stock for sale – a move that would drastically dilute current shareholders. The 200-day has been an excellent tool to use when trading the highly volatile stock. Over the past year, BBBY has encountered resistance at the level several times.

Image Source: Zacks Investment Research

Other “meme” stocks such as GameStop GME and AMC Entertainment AMC fell in sympathy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

GameStop Corp. (GME) : Free Stock Analysis Report

Bed Bath & Beyond Inc. (BBBY) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance