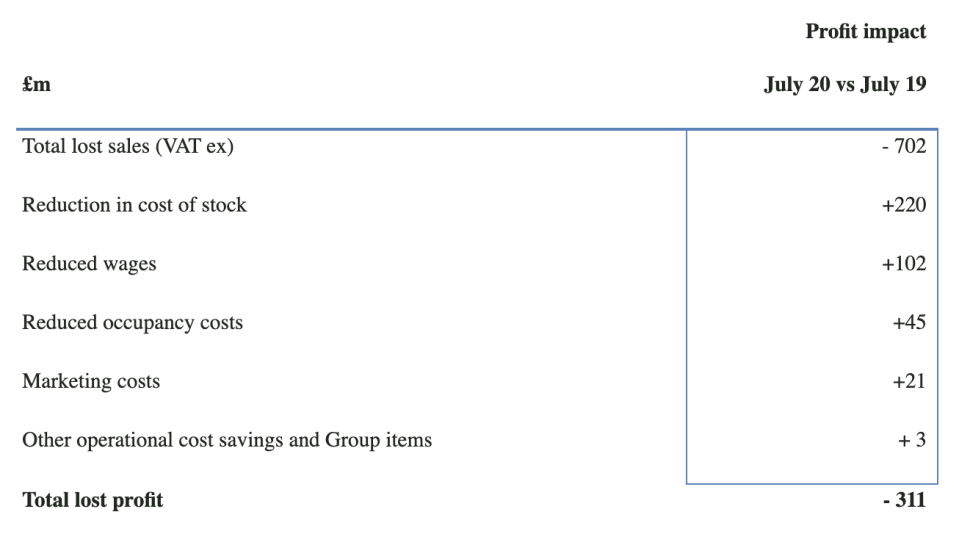

Next posts £311m in lost profit amid cuts in wages, stock, marketing

UK clothing retailer Next (NXT.L) is upbeat and raised its profit outlook for the second time in two months, despite posting £311m ($396m) in lost profit.

The group showed in its results statement for the half-year ending July 2020 how lost sales have flowed through to reduce profit—and why it had to take steps in cutting wages, suspending marketing programmes, slashing cost of stock, and making savings on occupancy costs to mitigate those losses.

“Without remedial action, the £702m of lost sales would have reduced profit by nearly the same amount; this is because we had already bought the stock to achieve those sales” said Next.

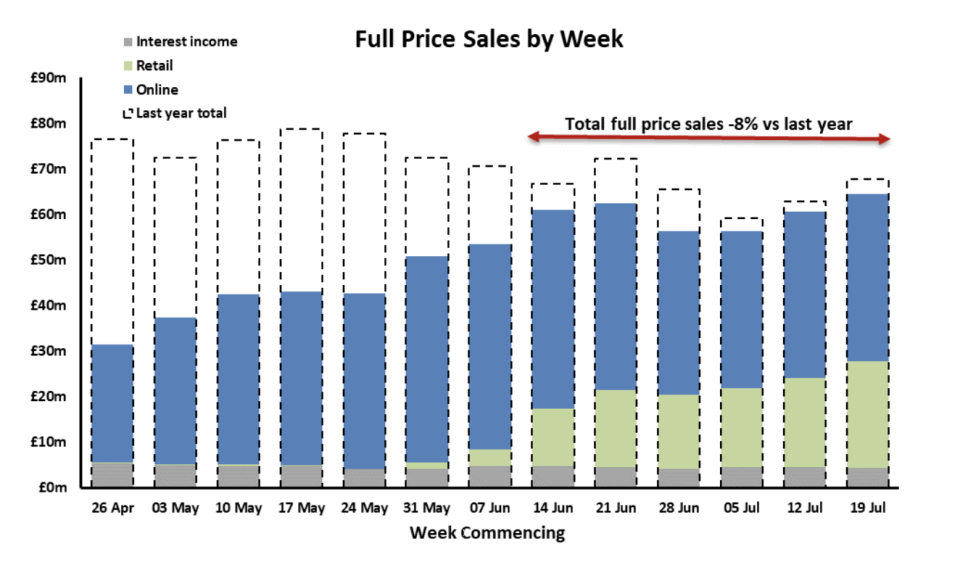

However, the group made it clear that it sees a full-year 2020-21 pretax profit of £300m, up from its previous forecast of £195m in July, due to strong recent trading (full-price sales in the last seven weeks were up 4% on last year) and its position online.

The announcement boosted the company’s share price, up 1.1% in early trading in London on Thursday.

“Next was fortunate that its online sales accounted for more than half of its turnover going into the pandemic, so we had the scale online to make up for some of the business we lost, and continue to lose, from our stores,” the group said in a statement.

“Interestingly, sales online have been significantly stronger since our stores reopened than they were before the pandemic struck. It appears that some lockdown habits have stuck, and we have been able to take advantage of this shift to online.

“It was a stroke of good fortune that the product areas that did well, also had much lower rates of return. So every item dispatched was less likely to come back and more likely to convert into a sale. This meant that limited picking and packing capacity was used to best effect.”

However this amount is still sharply down from the £729m made in 2019-20.

“The pandemic has been expensive and miserable. But some good has come from the upheaval,” said the group in its statement.

“It is remarkable what can be learnt from shutting down your entire operation and slowly, department by department, store by store, warehouse by warehouse, bringing it back to life.

“All the more challenging and informative with much of the endeavour managed by hundreds of our colleagues sitting in their spare bedrooms, kitchens and conservatories! We have learnt how we can work more effectively. Lessons which, if we are careful to preserve them, will stand us in good stead for years to come.”

Yahoo Finance

Yahoo Finance