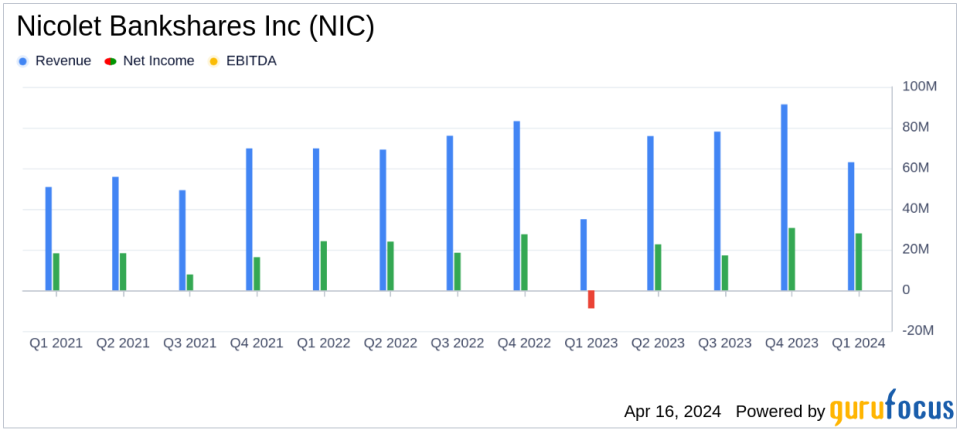

Nicolet Bankshares Inc (NIC) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

Net Income: Reported $28 million, surpassing the estimated $24.95 million.

Earnings Per Share (EPS): Achieved $1.82, higher than the analyst estimate of $1.64.

Revenue: Posted $71.74 million, aligning with analyst expectations.

Return on Average Assets: Recorded at 1.33%, showcasing efficient asset management.

Credit Quality: Maintained strong with nonperforming assets stable at 0.33% of total assets.

Nicolet Bankshares Inc (NYSE:NIC) released its 8-K filing on April 16, 2024, revealing a robust financial performance for the first quarter of 2024. The company reported a net income of $28 million, or $1.82 per diluted share, a significant recovery from a net loss of $9 million in the same quarter the previous year. This performance not only exceeded the analyst's net income estimate of $24.95 million but also surpassed the EPS forecast of $1.64.

Nicolet Bankshares Inc, headquartered in Green Bay, Wisconsin, operates as a bank holding company primarily engaged in providing a comprehensive range of banking services to businesses and individuals. The services include loans, deposits, and wealth management, primarily targeting small and medium-sized businesses and professional concerns.

The company's financial strength is further highlighted by its tangible common equity ratio, which saw an increase to 8.33% in Q1 2024. The return on average tangible common equity was impressive at 17.07%, reflecting strong core profitability and effective capital management.

Chairman, President, and CEO Mike Daniels commented on the results:

"Our first quarter results show our focus on execution as we move throughout the year. We continue to maintain our relationship-based pricing discipline paired with our credit culture as our team consistently shows the value that we bring. We are encouraged by the results, and we will continue to challenge ourselves to manage both growth and efficiency."

Daniels also noted the strategic positioning of Nicolet, highlighting the potential for future growth through organic means and mergers and acquisitions, despite a currently slow M&A market.

The balance sheet remains robust with total assets slightly decreasing to $8.4 billion as of March 31, 2024, from $8.47 billion at the end of 2023. The decrease was primarily due to lower cash balances, somewhat offset by growth in loans. The total loan portfolio saw a modest increase, indicating ongoing business expansion and customer trust.

Overall, Nicolet Bankshares Inc's performance in the first quarter of 2024 positions it well for sustained growth and operational efficiency, making it a notable entity in the banking sector for investors and stakeholders alike.

For detailed financial figures and further information, visit the official Nicolet Bankshares website or access their latest SEC filings.

Explore the complete 8-K earnings release (here) from Nicolet Bankshares Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance