This nimble wholesaler can hold its own against large rivals

It is easy to jump to the conclusion most IPOs on the UK stock market have been duds in recent years. For example, fast food group Deliveroo is down 70pc on its listing price, e-commerce platform THG has fallen 78pc since its IPO and sofa seller Made.com went into administration less than 18 months after floating.

Yet one success story has flown under the radar. Kitwave priced its IPO at 150p per share in May 2021 and has subsequently doubled in value thanks to a string of good news.

The £215m distribution company has said six times since joining the stock market that results will be ahead of expectations. That is impressive and proof that the London Stock Exchange is still capable of attracting well-run, profitable businesses to the UK stock market – it is not simply about luring in tech entrepreneurs.

Kitwave is an unsung hero. If you are partial to buying a can of Coke or a Kit-Kat when you are out and about, or you often nip to the corner shop to buy a box of fish fingers for the kids’ tea, there is a high chance that Kitwave is responsible for making sure those products are available on the shelves.

It has more than 42,000 customers – three-quarters are independent convenience stores and the rest are foodservice outlets such as cafes, restaurants, care homes and schools. The company specialises in impulse products alongside alcohol and chilled, frozen and fresh food.

There has not been a shift in consumer buying behaviour during the cost of living crisis for impulse products, according to chief executive Paul Young.

He says as long as people are moving around, the products Kitwave supplies to shops will be in demand. He also says the products are not price-sensitive, commenting that if someone wants a Mars bar or a Magnum ice cream, they will buy it whatever the cost.

Kitwave can hold its own against large wholesalers because it is prepared to make “little and often” deliveries. Its larger rivals typically have a £2,000 minimum order size and they do not want to go to small shops multiple times in a week.

In contrast, Kitwave has a £200 minimum order size and can do next-day or even same-day delivery for clients.

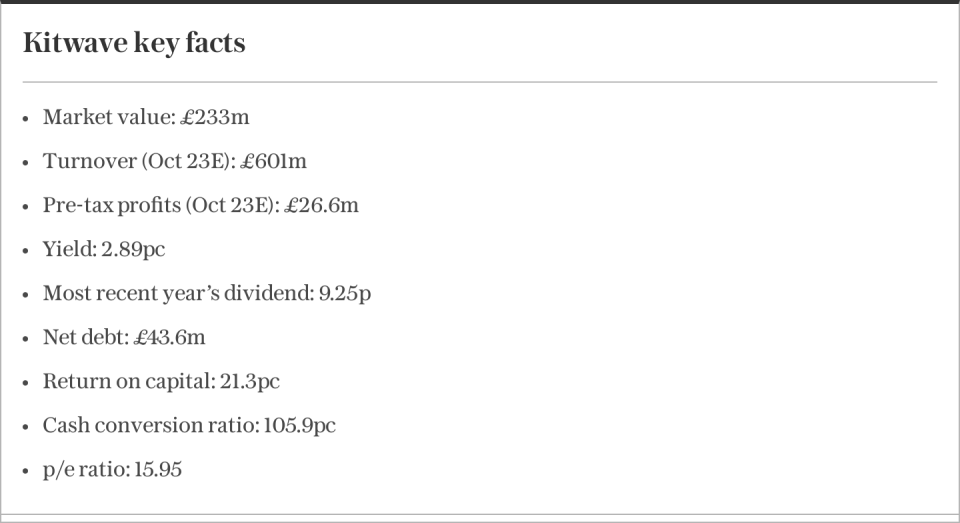

The consensus analyst forecast is for Kitwave to make £26.6m adjusted pre-tax profit in 2023 versus £18.9m in 2022. Part of those additional earnings come from WestCountry, a fresh produce wholesaler acquired in December 2022.

Kitwave buys established family-run businesses rather than broken entities that need fixing. It typically pays four to six times enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA). The money to pay for the deals comes from a mixture of debt and cash generated by the business.

Additional profit growth comes from operational enhancements such as better picking and improved route planning, as well as simply selling more products to existing customers as there are minimal additional costs for making a larger-sized delivery.

Do not expect Kitwave to be a rapid growth story every year. It is more of a steady-as-she-goes type business.

The company has invested in its e-commerce systems in recent years to help clients make their orders online. However, there is a need to maintain personal relationships, which is why it still has telesales staff and people on the road discussing new products.

Distributors typically have skinny operating margins unless they are supplying niche products. In Kitwave’s case, its margins are in the region of 3pc to 4pc. Net debt of £64.4m at the half-year stage (30 April 2023) equated to a 1.9 times net debt/EBITDA ratio, which most businesses would consider to be in the comfort zone.

The shares trade on 11 times forecast earnings for the year to October 2023 and offer a 3.6pc prospective dividend yield.

It is never a good look when directors sell shares in their employer, particularly not in unison. Five senior staff offloading a combined £3.3m worth of stock immediately after half-year results on July 4 raised a few eyebrows.

A two-year post-IPO lock-up period for director share dealing expired in May 2023 and the company told Questor that the five directors sold part of their holdings for personal and tax reasons.

Investors need to decide if that is perfectly reasonable or a red flag for the stock.

Questor says: buy

Ticker: KITW

Share price at close: 319p

Dan Coatsworth is a stock market analyst at AJ Bell

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance