No-deal Brexit: European car industry at risk of losing £100bn and 14.6 million jobs

UK car production has fallen by 44.6% year-on-year in August due to the coronavirus pandemic and the country is set contribute to the total European loss of billions of pounds and put millions of jobs at risk if Britain slips into a no-deal Brexit.

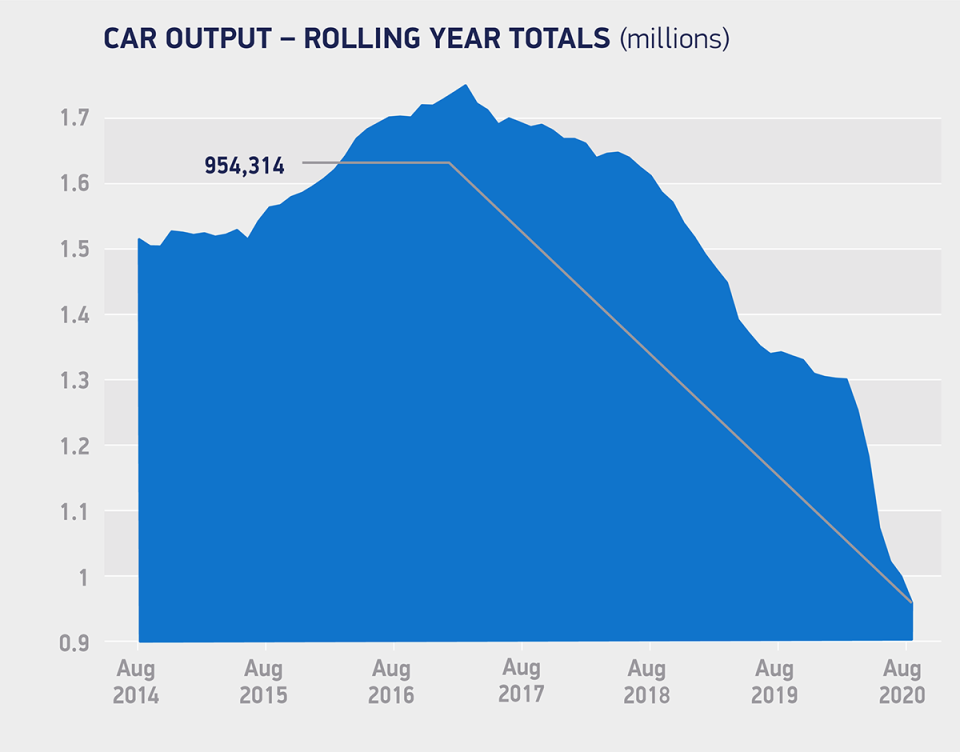

“The crisis of a second wave of coronavirus comes with the prospect of a ‘no-deal’ Brexit now mere months away and with the UK on course to produce just below 885,000 cars this year, down 34% on 2019,” said the Society of Motor Manufacturers and Traders (SMMT)

“The potential for this performance to rebound exists, but needs an ambitious, tariff-free FTA which could help car output return to pre-crisis levels of 1.2 million units by 2025.

“However, a ‘no-deal’ scenario would be disastrous, with car volumes potentially falling below 750,000 by 2025, hampering sector efforts to drive investment into the new skills, facilities and technologies that will be integral to delivering a zero-carbon future for the UK.

“Furthermore, calculations released last week revealed that ‘no-deal’ would cost the pan-European automotive industry some £100bn ($128bn) in lost trade over the next five years, putting jobs at risk in a sector that supports 14.6 million livelihoods, representing one in 15 of EU and UK jobs.”

READ MORE: UK firms not ready for Brexit transition as border chaos grows

According to data from the SMMT, just 51,039 units rolled off factory lines with production falling by 40.2% overall this year, as the ongoing impact from the spread of COVID-19 stalls demand from both domestic and overseas buyers.

It pointed out that production for UK buyers fell -58.3% in the month to just 7,795 units, while exports declined by -41.1% with 43,244 vehicles produced for overseas markets. It said that since 85% of all cars built in Britain in August were destined for countries around the world, it shows the “underlining the importance of this trade to the sector and UK economy.”

“These are increasingly disturbing times for UK car makers and suppliers with the coronavirus crisis weighing heavily on the sector,” said Mike Hawes, CEO SMMT.

“Companies are bracing for a second wave with tighter social and business restrictions making the industry’s attempts to restart even more challenging. The UK industry is fundamentally strong and agile, and the measures announced yesterday by the Chancellor are welcome and essential, although we await more details of how they will work for all businesses and crucially large manufacturers.

“Companies need to retain skilled jobs and maintain cashflow and we may need more support to boost business and consumer confidence later this year. Moreover, with fewer than 100 days until the Brexit transition period ends, we need urgent agreement of an ambitious free trade deal with our largest market to avoid the second shock of crippling tariffs.”

Yahoo Finance

Yahoo Finance