Nokia (NOK) to Boost Chunghwa Telecom's 5G Network in Taiwan

Nokia NOK has been selected by Chunghwa Telecom (“CHT”) to augment its 5G network across Taiwan’s central and southern regions.

Per this two-year deal, Nokia will provide equipment from its energy-efficient AirScale portfolio across 4,000 new sites to improve the overall performance.

Also, it will help CHT to maintain its market leadership by unlocking the full potential of 5G while achieving a lower carbon footprint.

Nokia will provide CHT with a range of solutions from its AirScale Single RAN equipment portfolio. This includes macro base stations, small cells, 5G Massive MIMO antennas and passive RRH supporting different spectrum bands.

These advanced solutions will expand CHT’s 5G coverage and ensure the best user experience for indoor and outdoor enterprise use cases.

The deal also includes network implementation and optimization services. It will see Nokia continue its long-term vendor partnership with CHT, which began from the deployment of 2G networks.

Nokia’s industry-leading solutions will support CHT’s competitive advantages to seize new business opportunities in the 5G era across key industries.

This deal will help CHT maintain its position as the leading mobile operator in Taiwan’s highly competitive market by delivering innovative services to customers.

Nokia’s energy-efficient AirScale portfolio will support CHT’s sustainability efforts by reducing energy consumption and carbon emissions.

NOK is likely to benefit from the increasing demand for next-generation connectivity. The company aims to accelerate product roadmaps and cost competitiveness through additional 5G investments.

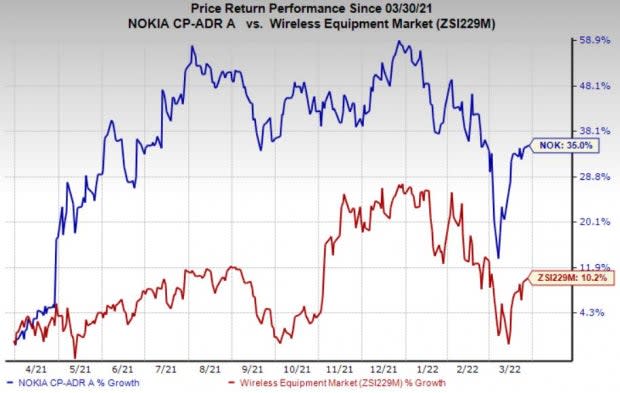

The stock has gained 35% in the past year compared with the industry’s growth of 10.2%.

Image Source: Zacks Investment Research

NOK currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearfield, Inc. CLFD is a better-ranked stock in the broader Zacks Computer and Technology sector, sporting a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised upward by 20.5% over the past 60 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.7%, on average. It has gained 127.7% in the past year.

Qualcomm, Inc. QCOM, carrying a Zacks Rank #2 (Buy), is another solid pick for investors. The consensus estimate for current-year earnings has been revised upward by 12.2% over the past 60 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 12.2%, on average. It has appreciated 21.8% in the past year.

Sierra Wireless, Inc. SWIR carries a Zacks Rank #2. The consensus mark for current-year earnings has been revised upward by 237.5% over the past 60 days.

Sierra Wireless pulled off a trailing four-quarter earnings surprise of 58%, on average. The stock has returned 21.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance