Nordstrom (JWN) Q4 Earnings Beat Estimates, Revenues Miss

Nordstrom, Inc. JWN posted fourth-quarter fiscal 2022 results, wherein earnings surpassed the Zacks Consensus Estimate and our estimate, while sales missed both. Moreover, the top and bottom lines fell year over year.

Results gained from strength in the core categories in the men's category during the quarter. However, the company has been witnessing decelerating demand trends since late June, inducing Nordstrom to right-size its inventory and expenses in response to the current macroeconomic environment. The company also announced plans to close its Canada business.

Nordstrom posted adjusted earnings of 74 cents per share, down from the year-ago fiscal quarter’s $1.23. However, earnings per share surpassed the Zacks Consensus Estimate of 65 cents and our estimate of 64 cents.

Total revenues of $4,319 million declined 4.1% year over year and missed the Zacks Consensus Estimate of $4,327 million and our estimate of $4,321 million. The dismal revenues were the result of soft holiday sales trends due to high promotions. Reduced consumer spending amid lower income groups, stemming from the tough macroeconomic environment, hurt revenues across both banners. Gross merchandise value (GMV) declined 4.2% in the quarter.

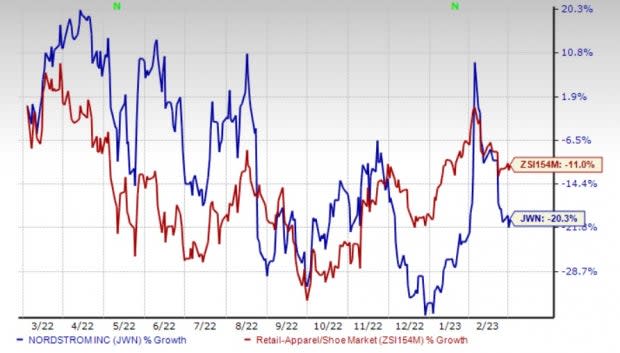

Shares of the Zacks Rank #5 (Strong Sell) company have lost 20.3% in the past year compared with the industry’s decline of 11%.

Image Source: Zacks Investment Research

Quarterly Highlights

Net sales fell 4.2% year over year to $4,200 million and lagged our estimate of $4,215.9 million. Credit Card net revenues grew 14.4% year over year to $119 million and beat our estimate of $105.3 million.

In fourth-quarter fiscal 2022, net sales for the Nordstrom banner decreased 2.4% from the year-ago quarter to $2,955 million but surpassed our estimate of $2,927.6 million. GMV declined 2.5% year over year for the Nordstrom banner in the fiscal fourth quarter.

Sales at the Nordstrom Rack banner declined 8.1% year over year to $1,245 million and lagged our estimate of $1,288.3 million. This was mainly due to muted demand, particularly from lower-income customers. The elimination of store fulfillment for Nordstrom Rack digital orders starting from the fiscal third quarter hurt the fiscal fourth-quarter Rack banner net sales by 500 basis points (bps).

Nordstrom, Inc. Price, Consensus and EPS Surprise

Nordstrom, Inc. price-consensus-eps-surprise-chart | Nordstrom, Inc. Quote

Digital sales plunged 13.1% year over year in the fiscal fourth quarter due to the elimination of store fulfillment for Nordstrom Rack digital orders in the fiscal third quarter and quitting of Trunk Club earlier in fiscal 2022. These actions hurt the fiscal fourth-quarter digital sales by 500 bps. In the fiscal fourth quarter, digital sales contributed 40% to net sales.

Nordstrom's gross profit margin contracted 525 bps year over year to 33.2% for the reported quarter mainly due to higher markdowns. The increased markdowns were the result of the company’s actions to right-size inventory levels in a higher promotional environment.

SG&A expenses, as a percentage of sales, declined 240 bps to 31.5% due to supply-chain initiatives that helped deliver expense efficiencies and lower per-unit costs.

Earnings before interest and taxes (EBIT) of $187 million declined 37.5% year over year in the fiscal fourth quarter. The decline mainly resulted from higher markdowns, partly negated by supply-chain expense efficiencies. The EBIT margin declined 235 bps in the fiscal fourth quarter to 4.5%.

Other Financials

Nordstrom ended fiscal 2022 with available liquidity of $1.5 billion, including $687 million of cash and cash equivalents, and $800 million available on its revolving credit facility. It had a leverage ratio of 3.1 times. The company had long-term debt (net of current liabilities) of $2,856 million and total shareholders’ equity of $739 million as of Jan 28, 2023.

As of Jan 28, 2023, JWN’s net cash provided for operating activities was $946 million. The company spent $473 million toward capital expenditure in fiscal 2022.

Nordstrom recently approved a dividend of 19 cents, payable Mar 14, to its shareholders of record as of Mar 29. In fiscal 2022, JWN bought back 2.8 million shares for $62 million as part of its $500-million share repurchase program. As of Jan 28, 2023, JWN has $438 million available under its share repurchase authorization.

Closure of Canada Operations

Nordstrom announced its intention to discontinue its Canada operations as part of its actions to drive long-term growth and enhance shareholder value. The company obtained an Initial Order from the Ontario Superior Court of Justice under the Companies' Creditors Arrangement Act ("CCAA") to facilitate the closure in an orderly fashion.

Nordstrom Canada plans to close its Nordstrom and Nordstrom Rack stores across Canada through a third-party liquidator. It also expects to wind down its Canada e-commerce platform. The e-commerce platform is expected to stop operations on Mar 2, 2023. The in-store closure is anticipated to be completed by late June 2023.

Nordstrom Canada operates six Nordstrom stores and seven Nordstrom Rack stores, as well as the Nordstrom.ca website. It currently employs nearly 2,500 people.

The company expects the Nordstrom Canada deconsolidation to reflect in its financial statements as of the date of the CCAA filing. It anticipates incurring $300-$350 million of pre-tax charges related to the wind-down in the first quarter of fiscal 2023 due to the write-down of the company's investment in Nordstrom Canada.

The closure of the Canada business is likely to result in a $400-million decline in the company’s total revenues and a $35-million improvement in its EBIT in fiscal 2023 from that reported in fiscal 2022. This reflects the exclusion of the aforementioned charges associated with the wind-down.

Outlook

Going forward, Nordstrom remains focused on enhancing customer experience, improving Nordstrom Rack performance, increasing inventory productivity and progressing on its supply-chain optimization initiatives. The company is confident of the strength of its brands, and its ability to drive profitable growth and deliver long-term value to shareholders.

Management provided its outlook for fiscal 2023, including the 53rd week and the expected impact of the wind-down of Canada operations. JWN expects total revenues to decline 4-6% year over year in fiscal 2023. Revenues are expected to include a 250-bps impact of the closing of the Canada operations and a nearly 130-bps gain from the 53rd week.

The EBIT margin is expected to be 1.2-2.1% of sales, including the impacts of the charges related to the closing of the Canada business. The adjusted EBIT margin is likely to be 3.7-4.2% of sales.

The company predicts an income tax rate of 32% for fiscal 2023, including a 500-bps impact of the one-time charges for the Canada business wind-down. Adjusted earnings are envisioned to be $$1.80-$2.20 per share, excluding the charges related to the Canada business wind-down. Earnings per share, including the wind-down-related charges, are expected to be 20-80 cents. The company’s earnings guidance excludes any potential share repurchase.

Stocks to Consider

Here are three better-ranked stocks to consider, namely American Eagle Outfitters AEO, Tapestry TPR and Urban Outfitters URBN.

American Eagle currently carries a Zacks Rank #2 (Buy). AEO has a long-term earnings growth rate of 11.6%. Shares of AEO have declined 20.9% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for American Eagle’s fiscal 2023 sales suggests growth of 1.7% from the year-ago period’s reported level, while earnings estimates indicate a year-over-year decline of 12.5%. AEO has a trailing four-quarter earnings surprise of 0.9%, on average.

Tapestry currently carries a Zacks Rank #2. TPR has an expected EPS growth rate of 12.5% for three to five years. Shares of TPR have rallied 20.4% in the past year.

The Zacks Consensus Estimate for Tapestry’s current financial-year revenues and EPS suggests growth of 0.5% and 17.7%, respectively, from the year-ago reported figures. TPR has a trailing four-quarter earnings surprise of 10.6%, on average.

Urban Outfitters currently carries a Zacks Rank of 2. URBN’s expected EPS growth rate for three to five years is 18%. Shares of URBN have improved 9.3% in the past year.

The Zacks Consensus Estimate for Urban Outfitters’ current financial-year revenues and EPS suggests growth of 1.7% and 6.1%, respectively, from the year-ago reported figures. URBN has a trailing four-quarter negative earnings surprise of 7.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Nordstrom, Inc. (JWN) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance